Understanding "RSI" by Iwamoto Max: Part 3 [Max Iwamoto]

Makkusu Iwamoto Profile

Keisuke Iwamoto. As the nickname “Mid-level dropout CERTIFIED Technical Analyst” suggests, he is a rare no-education analyst in the industry. Even in an era where academic background still heavily matters, he is daily fighting in the FX market where such factors apparently do not matter. With the feeling of “now that anyone can start FX easily, I want you to acquire the skills to keep winning steadily,” he serves as a serial author and seminar lecturer.

*This article is a reprint/edit of an FX Strategy.com October 2018 issue. Please note that the market information written in the main text is not the same as the current market.

Is Divergence a Useful Trading Signal?

This time we will discuss “divergence,” which is often used as a buying/selling signal. Divergence is not limited to RSI; it can also occur in oscillator-type indicators displayed in a separate sub-window from the chart, such as Stochastic, MACD, or the Psychologic Line, but the meaning indicated by each indicator differs completely.

This is because RSI is calculated based on “price range” over a certain period, while Stochastic is based on things like the “close price,” so the values targeted and calculation methods differ. You can lump them together as divergence, but you must not forget to distinguish these points.

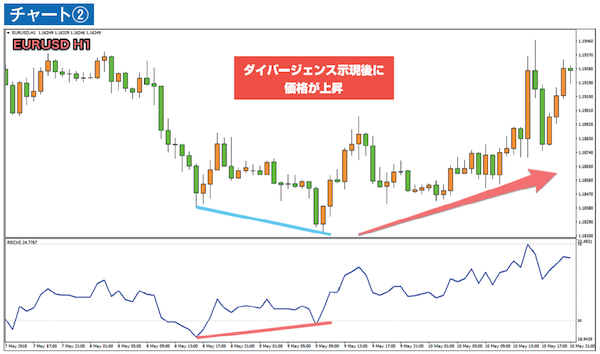

In RSI divergence, during an uptrend the price is rising while RSI begins to drop from the top region, signaling the end of the uptrend (see Chart ①). Conversely, in a downtrend, the price falls while RSI begins to rise from the bottom region, signaling the end of the downtrend (see Chart ②).

Divergence that signals such potential trend reversals is commonly used as a trading signal. Of course that’s fine, but in fact that alone is not at all enough to understand RSI divergence.

Divergence is a counter-trend phenomenon; rather than a simple idea like “when it appears, the trend will reverse dramatically,” it is wiser to think of it as a flashing signal indicating that the momentum of the rise or fall is weakening. You’ll understand why as you read on.