Foreign Exchange Online: Masakazu Sato’s Practical Trading Techniques — Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [This Month’s Theme: With Trade War Risks, Also Sharpen the Skills to Profit from Selling]

The 2018 exchange rates moved with a stronger dollar against the backdrop of interest rate differentials and a robust U.S. economy, but the risk of a trade war sparked by President Trump remains “alive.” The short-term selling trades that exploit the forex rule of “rises slowly, falls sharply” are worth keeping in mind as one of FX investment options. We will introduce selling methods that can be used on breaks of standard support lines and under breaks of the lower end of ranges.

*This article is a reprint and revision of an article from FX攻略.com October 2018 issue. Please note that the market information in the body of the text may differ from current market conditions.

Masakazu Satoh Profile

Satoh Masakazu. After working at a domestic bank, he joined the French bank Paribas (now BNP Paribas) and held roles such as Interbank Chief Dealer, Head of Funds, and Senior Manager. Later, he became Senior Analyst at Gaika Online, which boasted the No.1 trading volume annually. He has over 20 years of experience in the world of foreign exchange. He appears on Radio NIKKEI’s “Stock Live: Full Commentary on Stocks!” and on Stock Voice’s “Market Wide: Foreign Exchange Information,” and regularly provides market information on Yahoo! Finance.

Trade War Risk Sends Yen Higher. Know the Price Movement Habit of USD/JPY That Can Drop Sharply

The summer forex market showed a clear dollar-buying trend. The driving force included the effects of Trump’s tax cuts and the U.S. economy being able to claim a “one-man show” in its strength, as well as expectations that the policy rate would rise two more times within the year, bringing the advanced nations’ rate to the 2.5% level, a standout figure to watch.

In the market, there are various “after-the-fact” explanations, such as a dollar shortage from supply and demand dynamics, or that dollar buying could occur if trade war does not worsen further, and conversely, if trade issues deepen, Japan’s trade surplus could shrink, reducing dollar-selling pressure. None of these have provided a decisive explanation, however.

On the other hand, a key risk factor for a shift to dollar strength and a rapid yen appreciation is that there is no sign of a resolution to the U.S.-China trade war. The U.S. announced tariffs on up to $200 billion (about 22 trillion yen) in imports, but hearings and public feedback are required, so implementation could be as early as September. After that, a policy to impose up to 25% tariffs on imports of automobiles and auto parts to the U.S. looms as a protective measure.

The U.S. Auto Industry Association is opposing this, so it may not be easy, but if protectionist targets shift from steel and aluminum to automobiles, Japan cannot stay silent. The Japanese government has suggested it might take countermeasures if the U.S. imposes restrictions on imported cars from Japan. If that happens, the trade war that had been a “battle across the ocean” with the U.S. and Europe may flare up in Japan as well, potentially pushing the yen higher toward the 1 USD = 100 JPY level.

Come to think of it, USD/JPY traded in the mid-104 range as recently as five months ago. By the end of July, the dollar had strengthened about 9 yen, creating a scenario where a sudden drop would not be surprising. In this issue, we focus on the recent three major currencies’ declining phases to examine how to respond to sharp drops and crashes.

FX price movements are said to be “rises slowly over time, falls sharply in a short period,” meaning the downward momentum tends to be more rapid and larger.

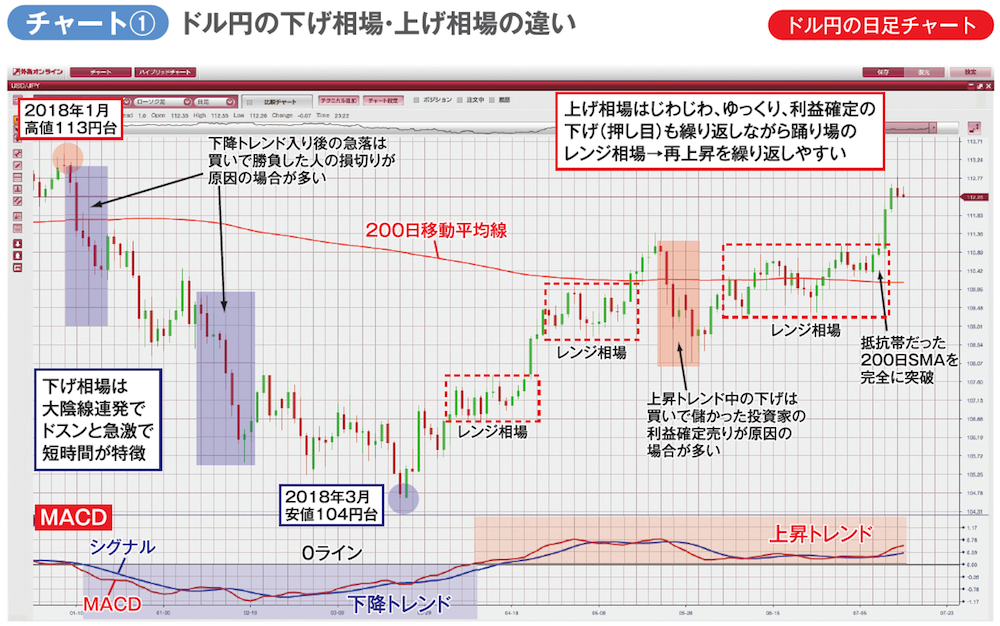

Chart ① shows the daily bars for USD/JPY up to the end of July this year. After the March low around 104 yen per dollar, the first half of 2018 was a decline, while the second half rose, presenting a contrasting market trend. In terms of speed, the decline featured three or more consecutive long bearish candles, creating a one-way slide multiple times. Conversely, the rise after April tended to be more gradual, forming a hovering range as if on a landing, and continuing to climb step by step.

The idea that USD/JPY “rises gradually and drops sharply” is not limited to this year; it is a common price action across markets. Behind this behavior is the fact that the primary players buying and selling USD/JPY are Japanese investors seeking U.S. interest rate differentials or foreign investments in the United States. When they buy USD/JPY, it is still an investment, so they are less inclined to chase new highs and more inclined to want to buy on dips when the dollar becomes cheaper. If expectations play out and USD/JPY continues to rise, partial profit-taking by some investors often follows, leading to a gradual rise with a pattern of “one step back, two steps forward.”

On the other hand, when declines are rapid and short, it is often because the selling of dollars and buying of yen is driven by market orders to cut losses “whatever it takes.” Selling USD/JPY is less about investment and more about converting funds invested in foreign currencies back into Japanese yen. Since both dollars and yen are money, buying USD/JPY is investment, while selling USD/JPY is conversion or cashing-in. It is reasonable to think that the driving force behind the “gradual rise and sharp fall” price pattern in currency pairs involving the yen is Japanese foreign investment.