Motty's FX Consultation — Episode 2: Can't Cut Losses

A stop-loss is a chance given to traders to get out. It's not that you can't earn without being able to stop-loss, but if you can't stop-loss, the likelihood of being forced to quit rises significantly, so let's be able to stop-loss with solid reasoning.

※This article is a reprint/edit of an article from FX攻略.com November 2018 issue. Please note that the market information written in the main text differs from the current market.

Actual failure stories - when I got carried away and increased the lot size, the market moved against me! The return to the days when I wanted to go back (breakeven)

This is a story from another trader. That person mainly trades the pound-related pairs and does a lot of scalping on GBP/JPY (I’ve been feeling the same lately lol), and one day the scalping was going well, earning about 500,000 yen, and perhaps out of temptation, they increased the lot size and made a mistake on the last entry, resulting in an unrealized loss of 300,000 to 400,000 yen in an instant… When that happens, I guess they’re too scared to wipe out the profits they've accumulated, so they can’t cut losses. They ultimately locked in around 900,000 yen in loss!!

GBP/JPY is scary, but the fear of going against you after raising the lot size is painful just to imagine.

MottiIt's a common thing that after you enter, if you end up with a bigger-than-expected unrealized loss, you can't cut losses, right?

Editorial team: That's right... When you have an unrealized loss, you end up doing “prayer trades” about ten times a month, blowing away your profits (cry).

MottiYou’re lying! You actually do prayer trades about a hundred times! Even God would be surprised.

Editorial team: Actually… how do you become good at cutting losses and get out safely? (sweat)

MottiFirst, before you enter, grasp the market situation and determine the stop-loss point in advance.

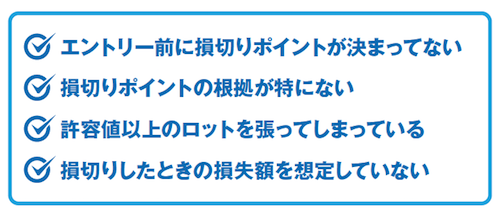

The exact cause why you can’t cut losses is!!

Did any of the above apply to you? There are various explanations for why you can’t cut losses, including things like the “prospect theory,” but for now, the big issue is that you’re trading without solid rationale. Also, do you calculate how much you would lose if you cut losses at a pre-determined, evidence-backed point before entering? I believe the basic approach is to enter with a lot size that won’t hurt too much even if you cut losses. If you’re aiming for a quick fortune in a short period, you can risk larger lot sizes, but first you need to consistently increase even with small lots!