Copper plunges sharply; is this a long-term downtrend scene? [Ryuji Sato]

Ryuuji Sato Profile

Sato Ryuuji. Born 1968. After graduating from a U.S. university in 1993, he joined Genesis Corporation (later Oval Next Co., Ltd.) after a stint at a marketing company, working as an information vendor covering finance and investments. He has written analyst reports on macroeconomic analysis, foreign exchange, commodities, and stock markets, and has been involved in trading. Since 2010, he founded H Square Co., Ltd., writing analyst reports and planning/publishing works such as the “FOREX NOTE Forex Notebook,” while also serving as a radio program caster in investment-related topics. Individual trader. International Federation of Technical Analysts – Certified Technical Analyst. Main caster on Radio Nikkei’s “The Money Doisato’s Market Forecast” (Mondays 15:00–).

Official Site:Sato Ryuuji Blog

※This article is a republication/edit of an article from FX攻略.com, November 2018 issue. Please note that the market information written in the main text may differ from current market conditions.

Economic Barometer

Copper prices, widely regarded as an economic barometer, have fallen sharply. Looking at copper’s past price movements, when prices rise, it often signals a favorable economy, and when prices fall, it tends to indicate a peak in the economy. Here we consider the background of this sharp drop and the outlook going forward.

This is the first time in a year that we are discussing copper, so here is a brief explanation of why copper is called an “economic barometer.” Copper is excellent in corrosion resistance, electrical conductivity, heat conduction, antibacterial properties, and processability, making it widely used in electrical wires and electronics parts, and it underpins many industries. Therefore, copper demand reflects the realities of housing, public infrastructure, and manufacturing.

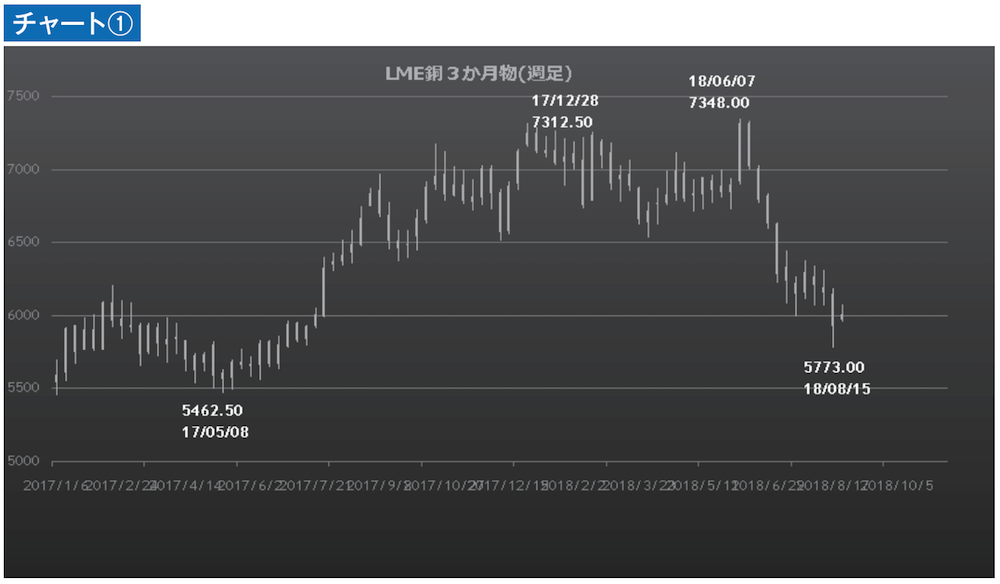

On the other hand, because supply is stable, changes in demand reflect in copper prices relatively straightforwardly. This is why copper is regarded as an “economic barometer.” The international benchmark price for copper is the three-month copper contract listed on the London Metal Exchange (LME) (see Chart 1).