Foreign Exchange Online: Masakazu Sato's Practical Trading Techniques|Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [This Month's Theme|Dollar Federal Reserve rate cut imminent! Central bank policy changes and trend re

With the US-China trade war intensifying, the Federal Reserve Board (FRB) is increasingly likely to start cutting rates. A shift in monetary policy by central banks in Japan, the United States, and Europe has already had a significant impact on the foreign exchange markets. We will examine how past policy changes after the Lehman Shock affected USD/JPY and EUR/USD, and prepare for the coming “era of U.S. rate cuts.”

※This article is a reprint and revised edition of an article from FX攻略.com, September 2019. Please note that the market information written in the main text may differ from current market conditions.

Profile of Masakazu Sato

Sato Masakazu. After working at a domestic bank, he joined BNP Paribas (now BNP Paribas Bank) in Paris. He has served as Interbank Chief Dealer, Head of Funds, Senior Manager, and other positions. He later became Senior Analyst at FX Online, which boasts the largest trading volume annually. He has over 20 years of experience in the world of foreign exchange. He has appeared on Radio NIKKEI’s “Complete Live Stock Commentary! Stock Channel↑”, and on Stock Voice’s “Market Wide – Foreign Exchange Information,” and regularly provides market information for Yahoo! Finance.

Is a July FOMC rate cut almost certain? Impacts of rate cuts on USD/JPY

President Trump has repeatedly stated that he will “decide at the G20 Osaka Summit at the end of June” whether to impose additional tariffs on China. By the time this article is published, the US-China trade war should be either intensifying or improving, with some results already becoming visible.

On July 30–31, the Federal Open Market Committee (FOMC) will meet, and market attention is focused on whether Fed Chair Jerome Powell will move to cut rates. The May U.S. employment report released in June showed nonfarm payrolls rising only 75,000 against expectations of 185,000, a surprise. March and April figures were also greatly revised downward, suggesting the U.S. labor market may have already entered a slowdown phase since early spring this year.

In the market, worsening U.S. employment conditions have raised the probability of a rate cut by the FRB within the year to 97.9%. The view that a rate cut in the July FOMC is imminent has become strong, and the probability of two rate cuts within the year has risen to about 34%.

President Trump has openly demanded a 1% rate cut from the FRB. A rapid yen appreciation has already progressed, and a shift in the FRB’s stance would have a very large impact on the forex market, potentially leading to a major trend reversal.

Therefore, in this issue we will examine how monetary policy by the central banks of Japan, the United States, and Europe has influenced exchange rates since the Lehman Shock, and look ahead to the potential impacts of a turning point toward US rate cuts.

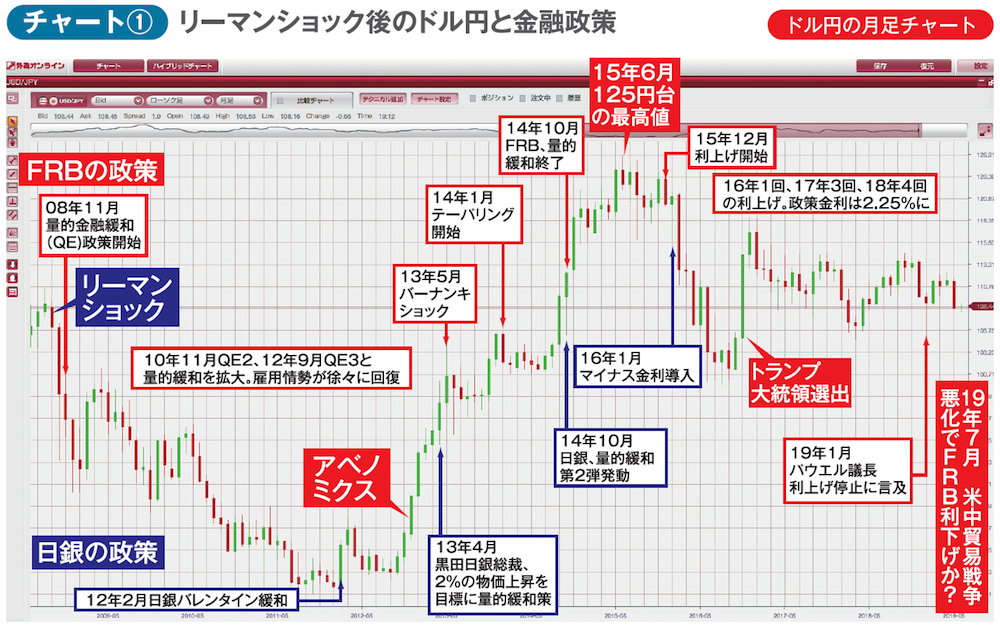

Chart ① shows the monthly chart of USD/JPY from right after the Lehman Shock, with annotations of monetary policy changes by the U.S. Federal Reserve (in red) and the Bank of Japan (in blue) during that period.

In September 2008, in response to the unprecedented financial crisis triggered by Lehman Brothers’ collapse, the United States, together with the European Central Bank (ECB), took coordinated rate cuts in October (the Bank of Japan did not participate). In November, the U.S. began large-scale liquidity provision by purchasing government agency securities such as U.S. Treasuries and mortgage-backed securities (MBS) as part of the “quantitative easing policy” (QE). In December, a zero-interest-rate policy was also implemented. Looking back, this swift and precise response was a driving force for the U.S. economy to recover quickly from the Lehman Shock.

In May 2013, buoyed by improving employment conditions, then-Federal Reserve Chair Ben Bernanke mentioned “tapering” of quantitative easing. The market reacted with a stock market plunge and sell-off in emerging market currencies, known as the “Bernanke Shock.” However, the U.S. economic recovery continued rapidly, and from January 2014 the Fed began tapering by gradually reducing purchases of Treasuries and MBS, ending QE in October of the same year.

Then, after Bernanke, Janet Yellen became Chair and in December 2015 finally began the long-awaited rate hikes. Subsequently, in 2016 there was one rate hike, in 2017 there were three, and in 2018 under Chair Powell there were four rate hikes.

Looking at Chart ①, the driving force behind USD/JPY appreciation over the past 11 years has largely been the BOJ’s quantitative easing under Governor Kuroda since April 2013. However, the widening interest rate differentials caused by the U.S. FRB’s tapering and rate hikes have clearly acted as a support, keeping USD/JPY at relatively high levels above 100 yen in recent years.