Virtual Currency Communication | For those starting cryptocurrency investment from now ~ Investment advice ~ [Oohira]

Mr./Ms. Ohira's Profile

FX experience since 2009, cryptocurrency experience since 2015. Leveraging cryptocurrency investment and past experiences, delivering cryptocurrency information on major newsletter sites and investment sites. Participates in numerous individual investor networks and shares knowledge gained from many investors. Running a cryptocurrency investment information site for beginners since 2016.

Blog:The Future Potential of Cryptocurrencies – Investment Methods for Beginners to Earn

*This article is a reproduction and editing of articles from FX攻略.com, September 2019 issue. Please note that the market information written in the text may differ from the current market.

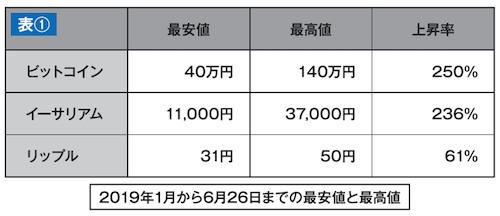

Attention on the Cryptocurrency Market from 2019

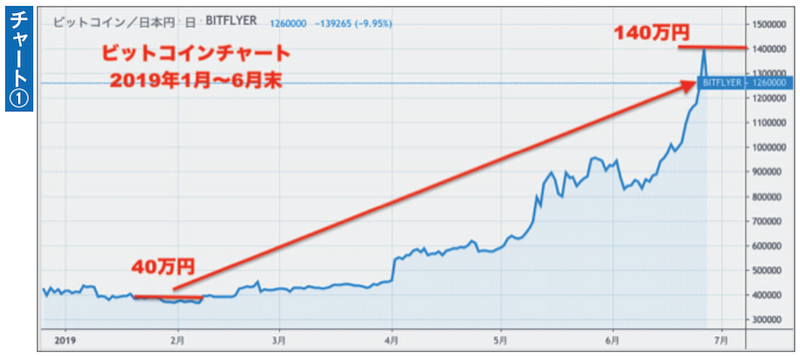

The 2018 cryptocurrency (crypto asset) market overall was in a downtrend. After Bitcoin reached a peak price of 2,000,000 yen at the end of 2017, the price fell to 400,000 yen by February 2019 (Chart ①). The 2,000,000 yen price for Bitcoin at that time was clearly caused by a short-term bubble and was not a fair price.

In a previous article, I wrote that the fair price for 2018 was around 700,000 yen, but by the end of June 2019 Bitcoin recorded 1,400,000 yen (Chart ①). Factors include global economic instability from US-China trade frictions and Brexit. This situation precisely indicates that Bitcoin has begun to hold significant asset value as a safe haven.

Focus on Cryptocurrencies with High Market Capitalization

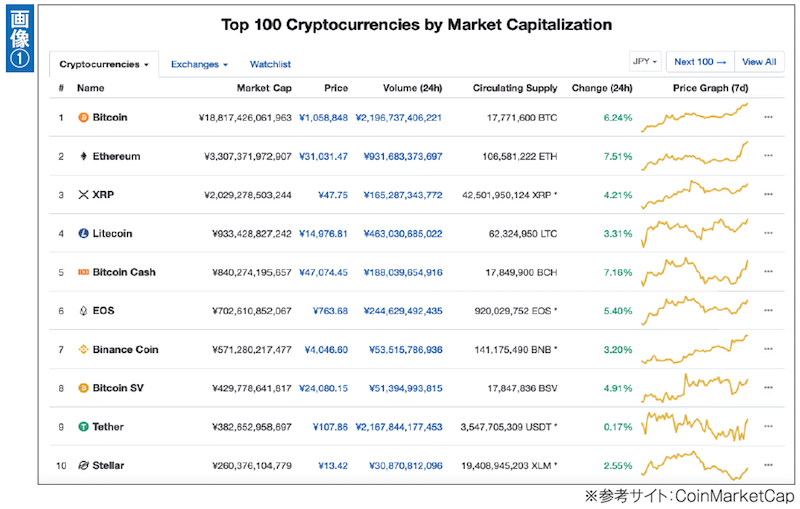

If you want to make solid investments in cryptocurrency, it is important to first focus on market capitalization. Market capitalization represents the total trading volume of cryptocurrencies worldwide and serves as a criterion for choosing relatively more stable currencies. Bitcoin has held the number one market capitalization for its entire 10-year history, and as of June 2019 it is just under 20 trillion yen. It is followed by Ethereum, Ripple, and others.

Therefore, with cryptocurrencies, it would be best to hold the largest amount of Bitcoin by market capitalization, followed by Ethereum, Ripple, and so on. Start by focusing on the top 10 in cryptocurrency market capitalization. Most domestic exchanges offer currencies with high market capitalization (Image ①).