The major central banks have entered a rate-cut cycle, strengthening the yen’s appreciation trend [Jiro Ota]

Jiro Ota Profile

Ota Jiro. FX strategist. Began FX trading in 1979 at The First National Bank of Boston Tokyo Branch. Later worked in corporate foreign exchange at Manufacturers Hanover Trust Bank, BHF Bank, National Westminster Bank, and ING Bank, then moved into retail FX, conducted sales at GFT Tokyo, later gaining experience as a market strategist, and is currently active as an individual investor.

*This article is a reprint/edit of an article from FX攻略.com, September 2019 issue. Please note that the market information written in the main text differs from the current market.

How far will the yen strengthen?

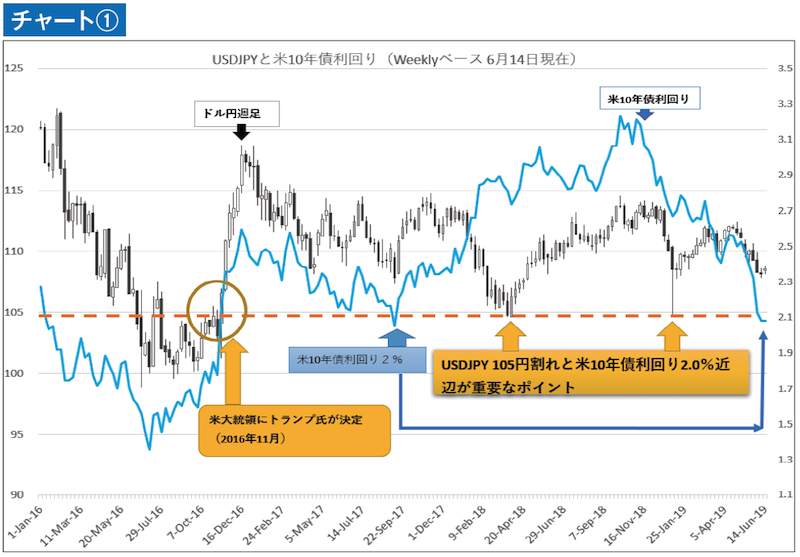

When comparing the latest policy rates with the yields on 10-year government bonds of major countries, the Bank of Japan is expected to keep its 10-year yield in a target range around zero percent (−0.1 to +0.1%), continuing to hold it for a long period, while the U.S. 10-year yield has fallen below 2.0%.

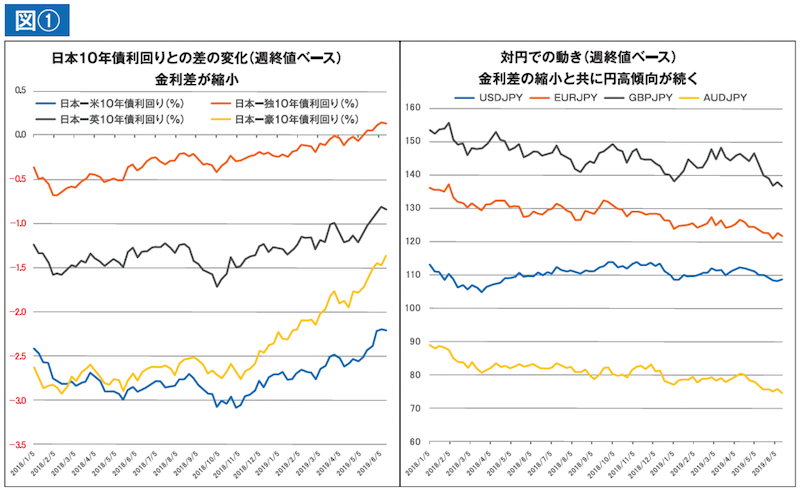

A WSJ survey conducted in January reported that not a single economist out of 69 expected the U.S. 10-year yield to fall below 2.5% by June this year. Other major central banks are generally moving toward monetary easing and bond yields are falling, leading to a reevaluation of the yen (see Figure 1).

So, how far do we think this yen appreciation trend will go? Until the Federal Reserve (Fed) and the European Central Bank (ECB) strengthen their bias toward rate cuts, we thought this year's USD/JPY range would be between 107 and 113. However, with the ongoing tariff and retaliatory tariff exchanges between the U.S. and China continuing for over a year, the point “U.S. 10-year yield below 2.0% = USD/JPY below 105” has become very important (see Chart 1).