Introduction to European Fundamentals | Episode 2: Factors Moving the Market/Timely Economic Indicators [Miko Matsuzaki]

Miko Matsuzaki Profile

Matsuzaki Yoshiko. She began her trader career at UBS Tokyo Branch. She moved to the UK in 1988, and in 1989 she joined Barclays Bank London Main Office Dealing Room. She gave birth in 1991. In 1997 she transferred to the American Merrill Lynch Investment Bank in London’s City, and left in 2000. Currently, in addition to FX trading, she shares information directly from Europe to Japanese individual investors through blogs, seminars, and YouTube. Her books include “Matsuzaki Yoshiko’s London FX” and “Always Profitable London FX” (both published by Jiyu Kokuminsha). Since 2018, she has operated the “Fundamentals College.” She also started an online salon on DMM called “FX Style.”

Blog:http://londonfx.blog102.fc2.com/

Fundamentals College:https://fundamentals-college.com/

Online Salon:https://lounge.dmm.com/detail/1215/

*This article is a reprint/edited version from FX攻略.com September 2019 issue. Please note that the market information in the main text may differ from current market conditions.

Shifts in Market Focus

Prices of currencies, stocks, bonds, and other assets traded in the market are shaped by demand and supply, fundamentals, and technical factors, forming short- to medium- and long-term trends. In particular, when people hear “fundamentals,” some react with “difficult!” However, even those who struggle with fundamentals subconsciously analyze figures such as GDP and inflation at the time of economic indicator releases, and use them to form positions, so preconceptions play a large role.

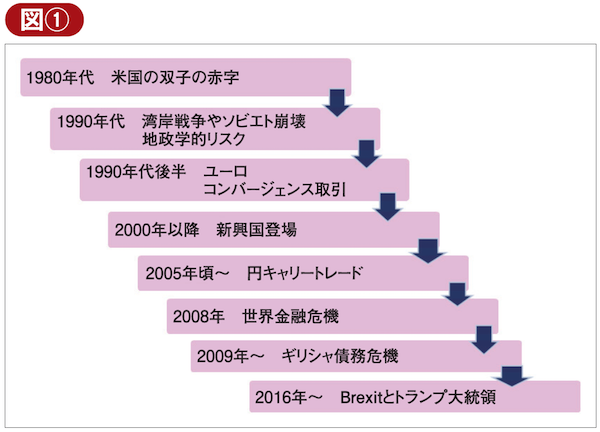

In recent years, the economic indicator that market participants have paid most attention to has been the U.S. employment statistics. However, looking back, it’s clear that the materials that move markets and timely indicators change with the times. In this column, I will discuss the “shifts in the materials that move markets” and the “current timely indicators.”

First, let us look back at events that shook the markets (Figure 1). The Plaza Accord of September 1985 had the greatest impact on the history of exchange rates. At that time, President Reagan proclaimed the revival of a strong United States and announced economic policies known as Reaganomics, which included a policy of a “strong dollar.” However, a strong dollar led to an expanding U.S. trade deficit and worsened fiscal balance, becoming the worst outcome. To correct the excessive surge of the dollar and eliminate the twin deficits, the Plaza Accord was decided in 1985. Therefore, at that time, the U.S. trade balance was the most closely watched economic indicator.