Crude oil, trading range continues at high levels [Ryuji Sato]

Ryuuji Sato Profile

Sato Ryuuji. Born in 1968. After graduating from a U.S. university in 1993, he joined Genesis Co., Ltd. (later Oval Next Co., Ltd.), a financial and investment information vendor, after working at a marketing company. He writes analyst reports on macroeconomic analysis, currency, commodities, and stock markets, and is involved in trading. Since 2010, he founded “H-Square Co., Ltd.”, writes analyst reports, plans and publishes works such as “FOREX NOTE Currency Notebook,” and serves as a radio host for investment-related programs. Personal trader. Certified Technical Analyst by the International Federation of Technical Analysts. Main host of Radio NIKKEI’s “The Money Doisat’s Market Forecast” (Mondays 15:00–).

Official site:Ryuuji Sato Blog

※This article is a reprint/edit of an article from FX攻略.com December 2018 issue. Please note that the market information written in the main text may differ from the current market.

Rising Geopolitical Risks

Crude oil prices remain range-bound at high levels. U.S. President Trump has repeatedly urged OPEC to raise production to lower prices, but at the Joint Ministerial Monitoring Committee (JMMC) held in Algeria on September 23, oil production increases were postponed. The NY crude near-month price (henceforth NY crude) hit a year-to-date high of $75.27 on July 3, but may test $80 as well. This time, I would like to consider the future direction of the crude oil market.

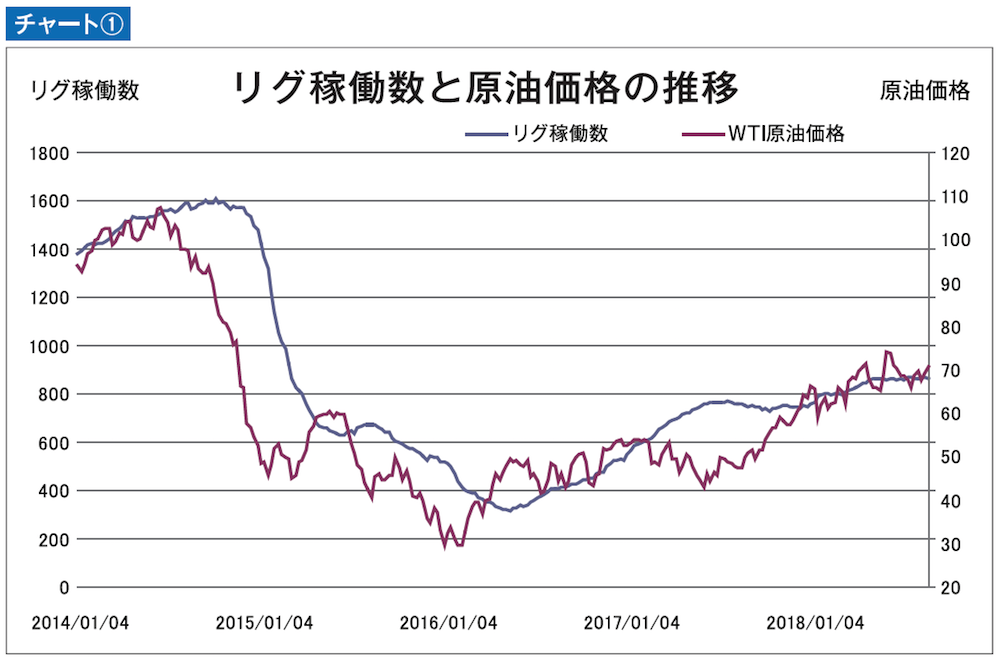

Looking at this year’s NY crude price movements, from roughly January to April it traded in a strong range around $60–70, but from May onward the range rose to around $65–75 (Chart 1). From the chart, it is clear that market sentiment tightened after April, aided by the U.S., U.K., and France’s attacks on chemical weapon facilities in Syria. In May, the U.S. indicated withdrawal from the nuclear agreement reached with six Western countries and Iran. Following this, NY crude rose to $72.83 on May 22.

Subsequently, in June it softened to $63.59, but supported by supply concerns, on July 3 it rose to $75.27, the highest since November 2014. The subsequent pullback found support around $65, and the market did not collapse sharply, with time spent around the $70s in September as well.

One factor contributing to the sustained high-range trading of crude prices is that oil-producing nation Venezuela, due to mismanagement under the pre-Chavez regime, faces shortages of funds, personnel, technology, and equipment, reducing crude production. According to the International Energy Agency (IEA), Venezuela’s crude exports declined to half of previous levels to about 1 million barrels per day by mid-2018. IEA’s Birol (Executive Director) expects further declines in the country’s oil production.

Currently, in addition to the OPEC/non-OPEC-led coordinated production cuts agreed in December 2016 (the first in 15 years) and other factors such as expectations surrounding U.S. sanctions on Iran and declines in Venezuela’s oil production, the market is being supported.