Monthly strategy of AUD/USD (Australian Dollar vs. US Dollar) - Relaxed Forex

This article is a reprint and re-edited version of FX攻略.com’s December 2018 issue. Please note that the market information described herein may differ from the current market.

Yuttari Currency Person Profile

Yuttari Kase. Individual investor. A “Yuttari Trade” advocate with very few trading sessions. Everyday studying with the goal of achieving great success in FX. Holds accounts with various FX companies and is familiar with a variety of services within the industry.

Official blog:FX Yuttari Trade派

Official blog:FX Real Trade Dojo

When trading using a monthly chart, it is easier to trade on the side where swap points are positive. This is because from the start of the trade to its settlement may take several months to more than a year.

- Exchange rate: uncertain whether it will move as expected

- Swap points: accrue every day reliably

In a state where you don’t know how the exchange rate will move, daily swap point losses can be stressful. As a result, you may end up with more yen-selling foreign currency buying trades. If you sell yen, except for EURJPY etc., swap points are likely to be positive in many cases.

With that premise in mind, this article discusses long-term trading in a currency pair that does not include the yen: AUDUSD (Australian dollar / US dollar). Is AUDUSD a suitable long-term trading pair?

Looking at Swap Points from Trend of Policy Rates

First, let’s examine the swap points for AUDUSD. Achieving long-term swap points for AUDUSD is challenging. Also, the numbers differ among FX brokers. Therefore, we will analyze swap points based on policy rates of Australia and the United States.

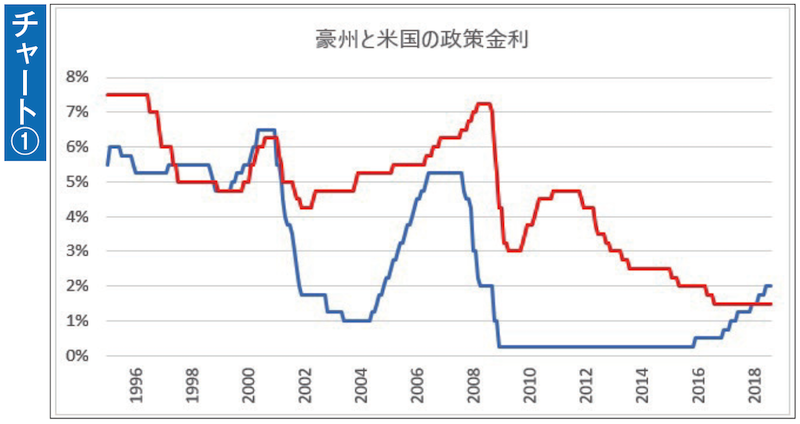

Swap points are calculated using the interest rate differential between the two countries. Policy rates greatly influence short-term rates. By using policy rates, we can infer the general tendency of swap points. Chart ① shows the policy rate trends for Australia (red line) and the United States (blue line) since 1995. Looking over more than 20 years, both countries appear to have relatively high interest rates, and several trends become apparent.

- Generally, Australia’s policy rate is higher

- Policy rates gradually decline

- Recently, the United States has been higher

From around 1998 to 2001, it is evident that the United States policy rate was slightly higher. Also, in 2018, the United States rate was higher. It seems high for the US policy rate to be higher—that would be a rare case.