Foreign Exchange Online - Masakazu Sato's Practical Trading Techniques | Technical & Fundamental Analysis Predicting the Futures of the 3 Major Currencies [This Month's Theme | Short-term Trading Ahead of Year-end Market. Trend-following Techniques]

2018's exchange market was a year buffeted by President Trump, but it is just over two months away from finishing. Based on past anomalies (price movement habits), year-end markets tend to continue trends that emerged in autumn relatively calmly, making them favorable for trend-following. Depending on the results of the U.S. midterm elections on November 6, there is a factor to consider, but let's think about a method that goes long in the current dollar strength environment.

※This article is a reprint and edit of an article from FX攻略.com December 2018 issue. Please note that the market information described in the text may not reflect the current market.

Profile of Masakazu Sato

Sato, Masakazu. After working at a domestic bank, joined the French Parisbas Bank (now BNP Paribas). Served as interbank chief dealer, head of treasury, senior manager, etc. Subsequently became a senior analyst at FX-Online, which boasts the highest annual trading volume. Has been involved in the currency market for over 20 years. Appears on Radio NIKKEI's "Stock Live Commentary! Stock Channel," Stock Voice's "Market Wide - Foreign Exchange Information," and regularly distributes market information on Yahoo! Finance.

Dollar-yen with strong stagnation, but could be a buying signal after the midterms?

The currency market is approaching year-end. For overseas institutional investors who play the leading role in FX, November ends is hedge fund fiscal year-end, and December ends is the fiscal year-end for major financial institutions, marking the season for the year's wrap-up.

Perhaps because their own livelihoods are on the line with the fiscal year-end looming, experience suggests that November–December often sees the trends formed from summer to autumn continuing as they are. Assuming the clear trend that emerged in August–September continues, let's consider what short-term trading strategies would be effective, based on each currency’s price movements this year.

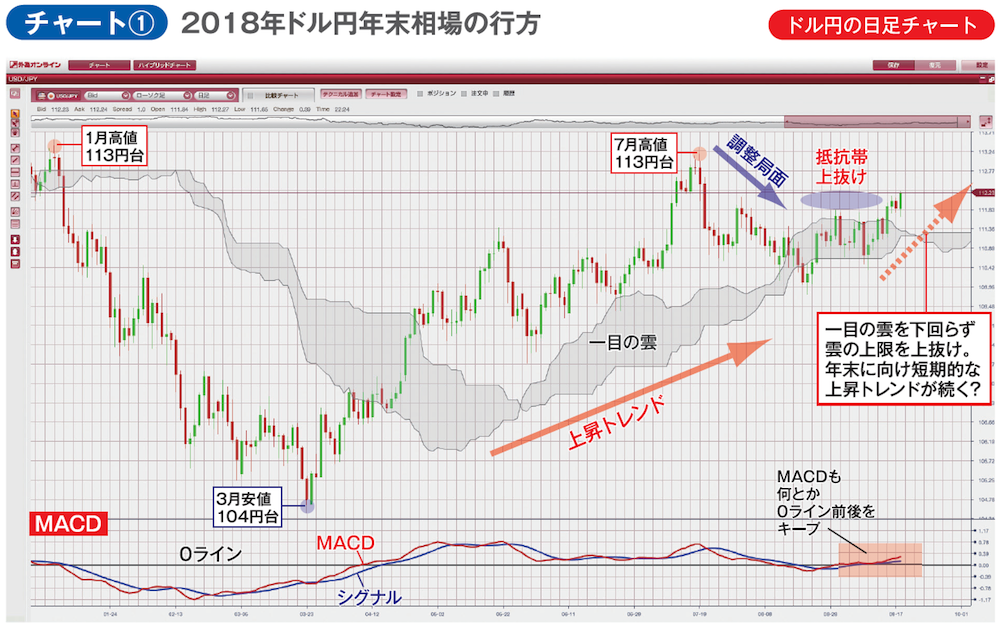

Chart ① is a daily chart of USD/JPY since the start of 2018, with Ichimoku Kinko Hyo and MACD displayed. After hitting a high in the 113 yen range per dollar in January, USD/JPY fell to the 104 yen range by March due to rising U.S. long-term interest rates causing stock market adjustments and Trump’s protectionist policies. At one point the movement suggested breaking below 100 yen, but subsequently it turned upward, and is still in the uptrend that has continued since April.

The driving force behind the dollar’s strength is the thriving U.S. economy boosted by Trump’s tax cuts. The widening US-Japan interest rate differential to 2.25% due to successive Fed rate hikes has become a very attractive factor.

Recently, USD/JPY rose above the upper boundary of the Ichimoku cloud, which had been in the 111 yen range, after several attempts in mid-September. Going forward, breaking through the high seen in November 2017 in the upper 114s is a target, and by year-end it wouldn’t be surprising if it rose to the 115 range.

Of course, with President Trump’s pressure on not only China but also Japan intensifying, simply hoping for a dollar rise based on solid U.S. economy may not be easy. However, looking at recent currency markets, there are signs of a move toward “de-Trump” and “post-Trump.” Even from Chart ①, Trump’s extreme statements seem already priced in, and USD/JPY is in an uptrend, testing higher levels.

What to watch is the U.S. congressional midterm elections approaching on November 6. Currently, all seats in the House of Representatives are up for election, with Democrats reportedly ahead. However, if there is no outright defeat for the Republicans and no turmoil such as Trump’s impeachment following the election due to the Russian probe, there may be a temporary rapid rise to the 118 yen range, the highest since Trump took office.