Iidatchi Sensei's "Yūyū" End-of-Day Trade | Episode 3 Perfect Pattern ③ The Crowd Psychology of the Market (Part 1) [Iidatchi Sensei]

Profile of Dr. Iidatchi

Former teacher at a cram school for advancement. He loves hot springs and holds a certified hot spring sommelier qualification. He is a professional FX trader who develops many excellent traders using the "closing price trading method," and his online study sessions attract participants from all over the country, from the elderly to the young. The chart analysis method that emphasizes the “closing price” is popular among part-time traders as a trading method that doesn’t require 24-hour market focus.

Blog:The Great Comeback from 100,000 yen! FX Trader Iidatchi BLOG

*This article is a republished and edited version of an article from FX攻略.com, January 2019 issue. Please note that the market information written in the body does not reflect current market conditions.

Why does the Donpisha pattern occur?

Hello, this is Dr. Iidatchi. Last time I wrote about a trading methodology that doesn’t turn trading into gambling, and the recommendation of pattern trading. Instead of making futile guesses about whether prices will go up or down, what’s more important is to “continue to make profits.” Guessing whether prices go up or down can be right or wrong. In other words, you can have both positive and negative balances. To keep profiting, you need to build a risk-reward (small loss, large gain) framework. Predicting correctly all the time is impossible unless you are a psychic or prophet.

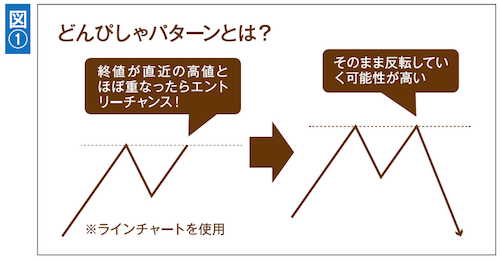

Rather than making difficult forecasts, it reduces the mental burden in trading to decide whether to sell or buy based on chart patterns, so the pattern Dr. Iidatchi repeatedly recommends is the Donpisha pattern shown in Diagram ①.

Dr. Iidatchi and many of his students continue to profit from the indispensable Donpisha pattern, but why does it frequently appear on charts?