【No.7 Trader Kaibe】A professional trader's real image ~ The amount in trades is just a number; having the confidence that profits will remain is important

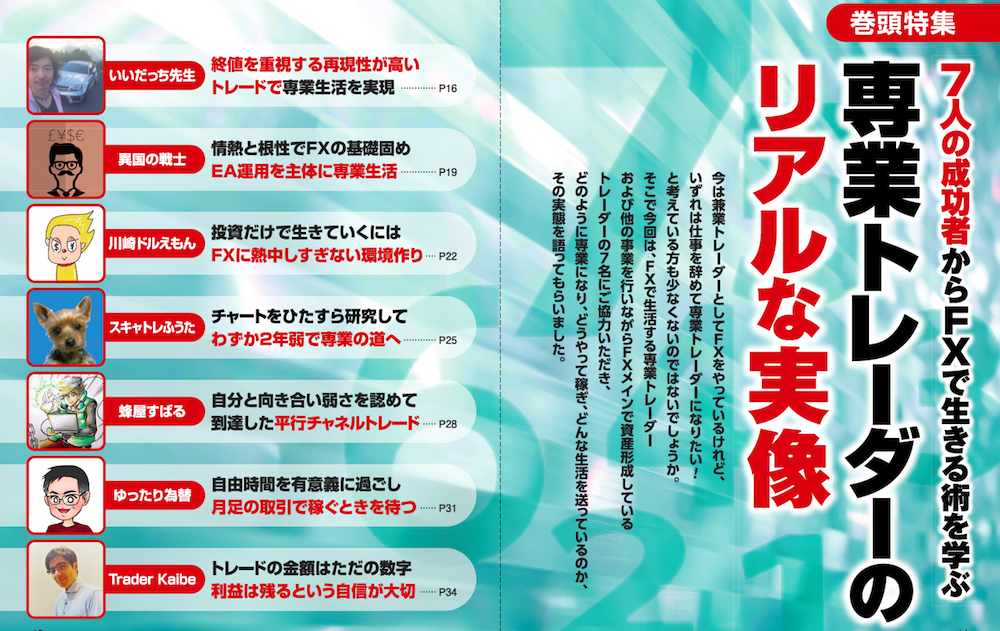

Learn How to Live on FX from 7 Successful People

Many people who are currently working as part-time traders wonder if they can quit their jobs someday to become full-time traders. In this article, we asked seven traders who live off FX as their main income or who mainly trade FX while pursuing other businesses how they became full-time, how they earn, and what kind of lifestyle they lead, to share their real-life experiences.

*This article is a reprint/edit of an article from FX攻略.com August 2019 issue. Please note that the market information described in the text may differ from the current market conditions.

Trader Kaibe Profile

Formerly worked in chemical research and development at a major manufacturer. He has 13 years of FX experience, with a maximum historical return of 6300% over nine months. He self-taught the programming language for automated trading and achieved a strong result, becoming the runner-up in the 2017 "Robins Cup" with automated trading alone.

Blog:https://www.traderkaibe.com/

Twitter:https://twitter.com/k_flashes

Trading Style is Automated Trading Only

Trader Kaibe, a skilled trader who earned runner-up in the 2017 Robins Cup with a single EA he developed, is featured.

The EA he developed, "Flashes," is sold on platforms like GogoJungle and is widely used by many traders.

Kaibe originally worked as a chemical R&D staff at a major manufacturer while also developing and operating EAs as a part-time trader. What prompted him to become a full-time trader?

“Although I call myself full-time, I do FX-related work such as lectures, selling EAs, and contributions to magazines. I also started a business unrelated to FX. After combining those earnings and the profits from trading, it became a sufficient living, so I became a full-time trader from May this year.”

He currently earns his profits mainly through managing his own EAs.

“There are times I trade with discretion, but I don’t do it extensively. It’s mainly for research to create new EAs. Discretionary trading has the potential for higher returns, but you have to watch the charts for long periods. It takes time and mental energy, so I predominantly trade with EAs.”

He currently operates a total of five EAs, including his own creations. We asked about his recent profits and losses.

“In 2017, the profit rate was 50% with a drawdown (DD) of 10%. In 2018, profits exceeded 100% with a 10% DD. In 2019, volatility was unusually small, so the profit rate was around 10% with about a 5% DD. I generally aim for an annual return of 50–100%.”

Pause EA Operation Depending on Market Conditions

Next, we asked about the basic strategy for his EA operation.

“When I sense a volatile market, I stop the EA. I also pause during major indicators such as the U.S. Nonfarm Payrolls or important statements from Federal Reserve Chairmen. The reason is that EAs cannot adapt to future fundamentals. Therefore, I do not recommend running EAs in markets heavily influenced by fundamentals.”

Everyone wants to keep their EAs running to earn money, but suppressing that urge and operating according to market conditions is a crucial point for achieving profits.