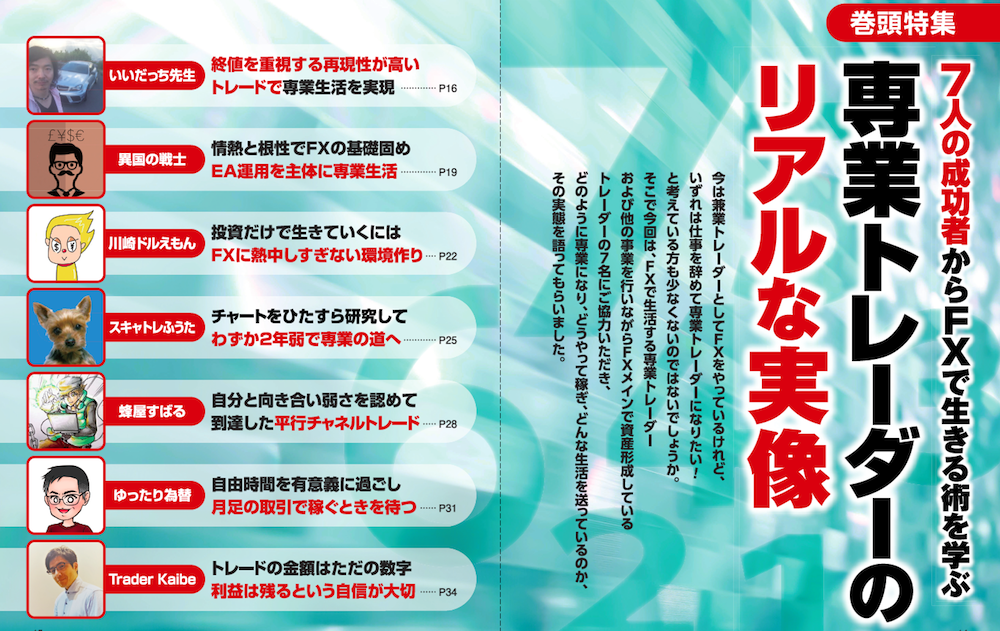

[No.6 Relaxed Currency Exchange] The Real Image of a Full-time Trader: Waiting for the Moment to Earn from Monthly Trades by Spending Your Free Time Meaningfully

Learn the art of living from seven successful people in FX

Some of you may be doing FX as a side job now, but you’re thinking about quitting your job someday to become a full-time trader. In this article, we asked seven traders who live off FX as their main income or who are building wealth primarily through FX while running other businesses, about how they became full-time, how they make money, and what kind of life they lead.

*This article is a reprint/edit of an article from FX攻略.com, August 2019 issue. Please note that the market information in the body of the article may differ from current market conditions.

Yuttari FX Profile

Individual investor. A “slow and relaxed trading” advocate with very few trades. Studies daily with the aim of achieving great success in FX. Holds accounts with various FX brokers and is familiar with a wide range of services in the industry.

Blog:https://yuttari-fx.com/

Twitter:https://twitter.com/yuttarifx

Long-term holding mainly through monthly trades

The “slow and relaxed trader” Yuttari FX focuses on a monthly trading strategy that targets swap points. Yuttari FX’s trading style is long-term, focusing on weekly and monthly timeframes. Many traders who hold positions for relatively long periods target emerging-market currency pairs for swap points, but Yuttari FX does not engage in ultra-long-term trading with emerging-market pairs. He trades only with developed-market currency pairs. Because there is a risk that emerging-market currencies can disappear from the market, he limits trading to amounts that stay within a playful range, and also selects currency pairs from a long-term trading perspective to stay risk-off.

When exchange rates fall to historically low levels, he gradually buys within the limits of his funds. He has pre-researched the relationship between statistics published by central banks and governments and exchange rates, so he trades when conditions meet, but he trades in various situations even if prices are not at their lows.

Settlements are not made all at once; he aims to take profit in the recent high ranges over the last ten years. He aims for a 100% win rate and does not cut losses. If buying USD/JPY, even if it drops to the 50-yen range or lower, he plans to hold, and runs various simulations in advance.

In monthly trading, the position-holding period often exceeds one year. Therefore, when holding for multiple years, he calculates so that swap points are always positive. The timing of trades can also continue for months to years, for example, trading opportunities for AUD/NZD have continued since 2014.

Additionally, he uses repeat-type orders: for example, in AUD/JPY, he places many buy orders between 55 yen and 84.80 yen. If the yen strengthens, he holds positions long-term, and when unrealized gains reach 10–30 yen, he closes them.

The funds obtained from profits and swap points are kept in the account or used for compounding. The advantage is that letting funds sit in the account reduces the risk of forced liquidation during major crashes, while compounding allows for larger daily profits. With this method, the usual annual rate is 5%–10%, but in a crash on the scale of Lehman Brothers, gains of up to 100% are possible.