【No.5 Subaru Hachiya】The Real Image of a Full-time Trader—Facing oneself, acknowledging weaknesses, and reaching Parallel Channel Trading

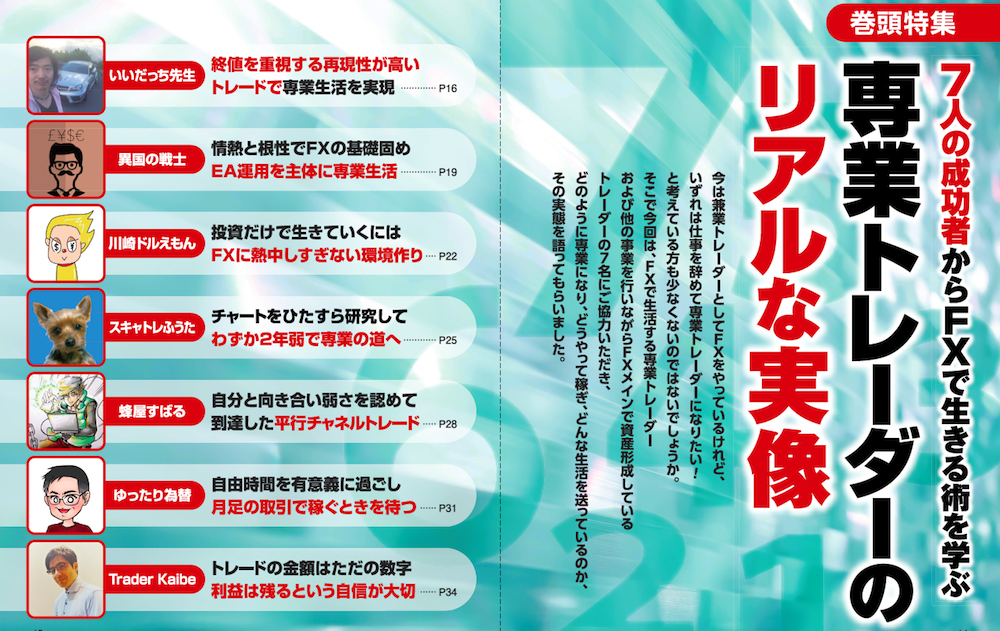

Learn FX Living Techniques from 7 Successful People

Many people who are currently working part-time as traders wonder if they can quit their jobs someday and become full-time traders. In this article, we asked seven traders who are living off FX as their main activity or who are forming wealth mainly through FX while running other businesses to share how they became full-time, how they earn, and what kind of lifestyle they lead.

*This article is a reprint and revision of an article from FX攻略.com, August 2019. Please note that the market information written here may differ from current market conditions.

Subaru Hachiya's Profile

Gaining popularity for simple yet practical chart analysis using only channel lines. Shares daily market views on Twitter, blogs, and YouTube.

Blog:https://www.gogojungle.co.jp/finance/navi/series/811/

Twitter:https://twitter.com/m45fx

YouTube:https://www.youtube.com/channel/UCSHFi0CsLjTA6R8rLMBJ0BQ/

Information to Refer to Is Generally One Type

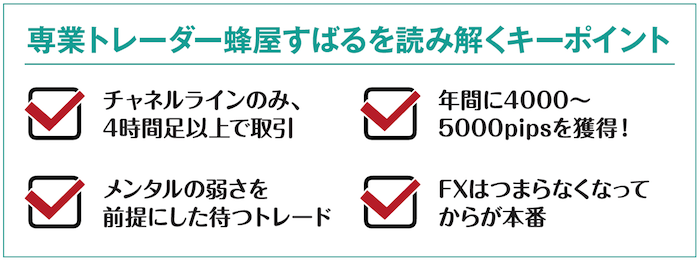

Subaru Hachiya, who has attracted attention with simple yet convincing chart analysis using only parallel channels, calls himself a “relaxed full-time trader.” He specializes in swing trading based on daily charts.

“I trade using daily charts, followed by 4-hour charts. What I display on the chart are only parallel channels and moving averages used as supplements.”

Since parallel channels are drawn on the chart, their shapes do not change with timeframes like moving averages do. Therefore, regardless of which timeframe you look at, you judge buy/sell using the same parallel channels.

“Basically, buy at the lower bound if the channel is rising, and sell at the upper bound if the channel is falling. This is because the aim is to enter at as favorable a point as possible. I do not take positions at other points; it’s important to enter a position by pulling it toward the functioning parallel channel as much as possible.”

By actually executing this simple idea of “entering at favorable points,” he has been earning about 4,000–5,000 pips in annual profit in recent years.

Regarding entries at the upper or lower bounds of the channel, entries occur at turning points from up to down or down to up, but it’s okay to not think of it as counter-trend trading. Trying to ride a point that has repeatedly reversed is interpreted as a trend-following approach, rather than counter-trend.