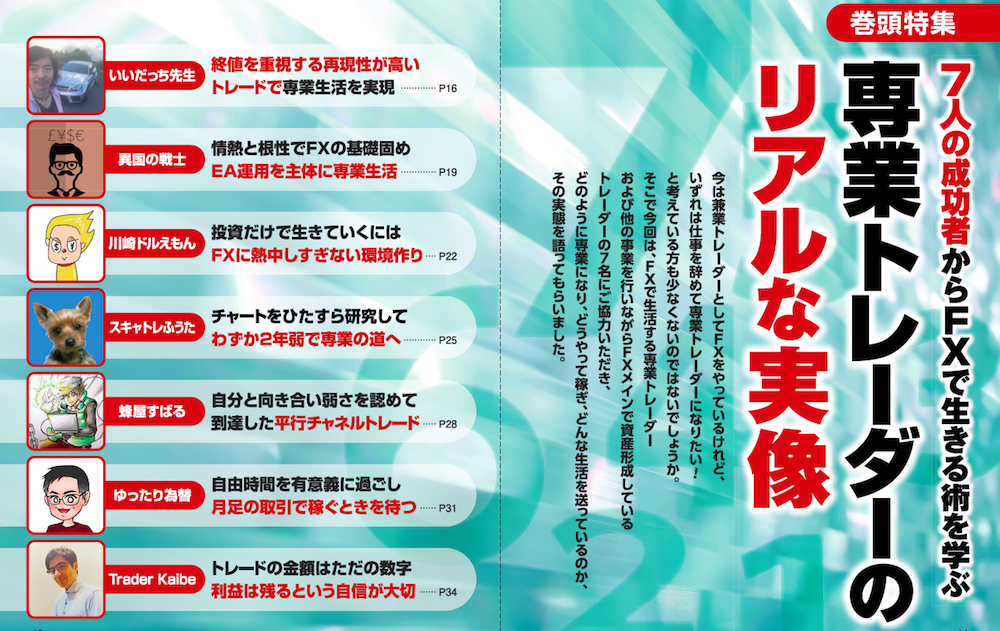

【No.4 Scantrreo-Fuuta】The Real Image of a Full-Time Trader - Diligently studying charts and reaching the path to full-time in just a little over 2 years

Learn the Craft to Live on FX from 7 Successful People

Some people are currently doing FX as a side job but are hoping to quit their regular job someday and become a full-time trader. In this article, we asked seven full-time traders who live off FX or who are building assets mainly through FX while running other businesses, about how they became full-time, how they earn, and what kind of lifestyle they lead.

*This article is a reprint and editorial revision of FX攻略.com August 2019 issue. Please note that the market information described in the text may differ from the current market.

Fuuta the Scalp-Trader Profile

He rode the stock day-trading boom to become a full-time trader, but retired after a severe loss during the Subprime Mortgage crisis. Later he discovered FX, trading on a side basis for about two years and becoming full-time in his third year.

Blog:http://fxfighter-fuuta.link/

Twitter:https://twitter.com/fuuta_fx_trader

Becoming a Full-Time Trader Triggered by Corporate Restructuring

Fuuta, who had entered his sixth year of FX, made the transition to a full-time trader in September 2016. He decided to become a full-time trader when he retired from his company due to corporate circumstances.

“About a year before I left the company, I started earning from trading, and I was confident I could be independent with FX, so I became a full-time trader as soon as I left that company.”

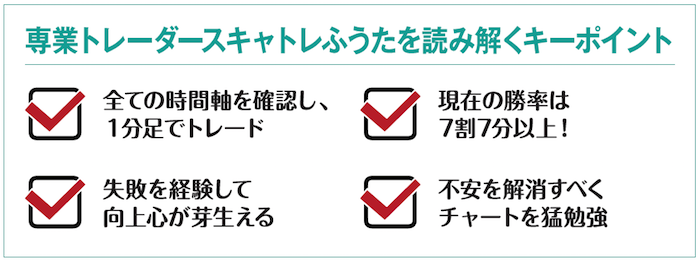

Fuuta had previously spent several years as a full-time stock investor, so it didn’t take him long to get used to FX. He acquired the skills needed for full-time trading in about a year and a half, but he says he never stopped studying FX on a daily basis.

“At first I read as many books as I could from bookstores. I didn’t really intend to imitate others’ trades; during my salaried days I would study charts during any spare moment, analyzing how markets moved by time of day and market, and how the Bollinger Bands and moving averages interacted, and I studied with single-minded focus.”

Even though he was so diligent, Fuuta experienced many failures during his time as a part-time trader, and he says those experiences helped him raise his trading skills.

“During work hours I couldn’t set aside time for trading, so I traded during breaks and while commuting, seizing any gaps. I wanted to trade so badly that I would hurry to enter even when it wasn’t my intended entry point, thinking I could average down if it moved against me… and, as you’d expect, it mostly moved against me and I ended up taking losses, then I would finally analyze the charts after returning home and realize I could have won if I had entered properly.”

He calls it the “Posi-Posi disease” when you over-trade even where you don’t need to enter, and during his part-time days that was exactly how he behaved. After repeatedly experiencing failed trades, he realized that to grow money one must take it more seriously.