【No.3 Kawasaki Doruemon】The Real Image of a Full-Time Trader: Creating an Environment that Prevents Over-Exposure to FX While Living Purely from Investing

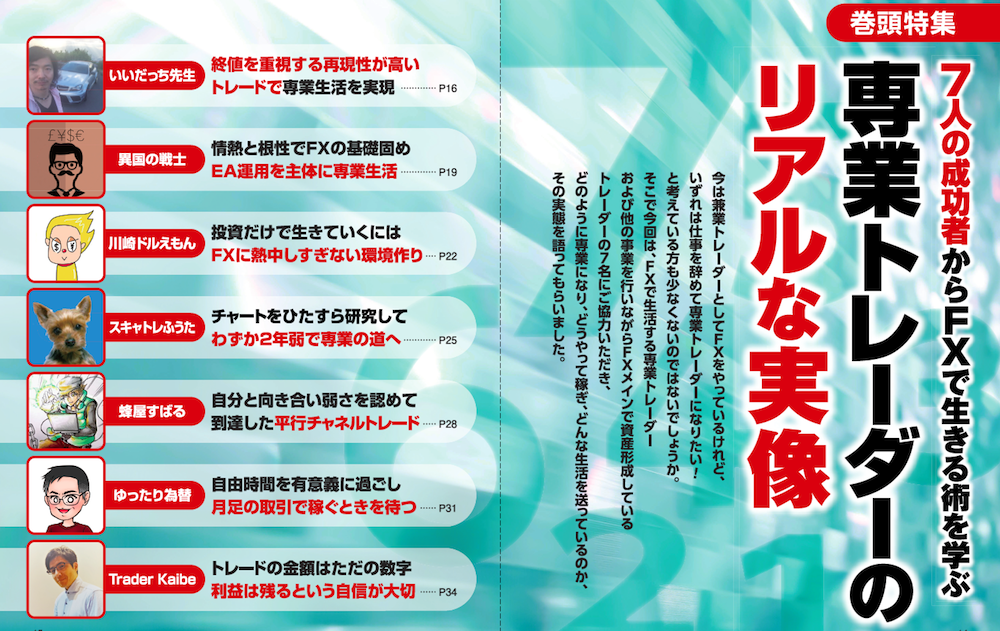

Learn the Art of Living from 7 Successful People in FX

Nowadays I’m working as a part-time trader in FX, but isn’t there likely someone who thinks, “I want to quit my job someday and become a full-time trader!”? In this article, we collaborated with seven traders who either live off FX as their main income or who, while running other businesses, focus on FX to build assets. They share how they became full-time, how they earn, and what kind of life they lead.

*This article is a reprint and revised edition of FX攻略.com, August 2019 issue. Please note that the market information written here differs from the current market.

Profile of Kawasaki Doruemon

Having felt the limits of discretionary trading, he sought a system-trading method that is as mentally light as possible and can be earned easily. After various simulations, he completed “Guruguru Train.”

Blog:http://kawasakidoruemon.com/

Twitter:https://twitter.com/kawasakidoruemo

A Repeat-type Strategy That Doesn’t Depend on the Account

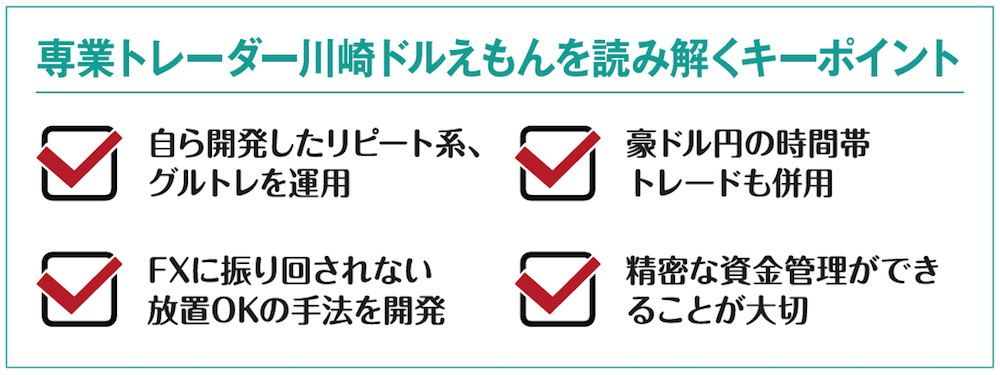

When it comes to Kawasaki Doruemon, he is famous for the repeat-type strategy he developed, “Guruguru Train,” abbreviated as “Guryore.”

The Gurutore mechanism is quite intricate, so try running it in a demo account to form your own interpretation (summary shown in the upper left corner).

What sets Gurutore apart from other repeat-type strategies is that it can be used with any FX company’s account. Since it is not a tool provided by a specific broker, you can execute trades by placing orders manually without being tied to a particular broker. Doruemon also trades using this manual style. There are Gurutore EAs available for MT4 as well. If you use one, you can easily set many Gurutore orders on an MT4 account, and it is convenient because you can re-adjust or delete orders in response to market moves.

Another difference is that reading market direction and the exit strategy of the trade are important.

“I decide whether Gurutore should be long or short by looking at the daily Bollinger Bands and slow Stochastic. Particularly, when the Stochastic drops below 20% once and then rises again, I start Gurutore long, and when it exceeds 80%, I close the position.”

In this way, Doruemon determines the entry and exit points of Gurutore, but this part can be customized to fit each person. You can look at longer time frames for trends, or use other technical indicators as the basis. However, it is important to decide exit conditions before starting.

Also, Gurutore does not have strict currency-pair restrictions. Doruemon tends to focus on AUDJPY, but please choose the currency pairs you operate based on your own confident chart analysis and trend judgments. By the way, Doruemon targets an annual return of 20% with Gurutore.