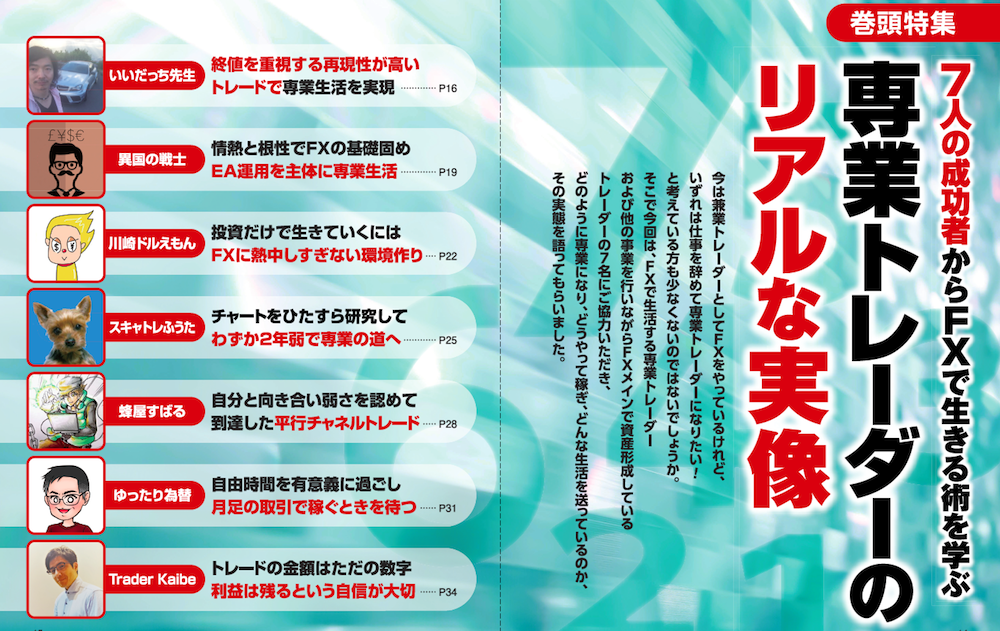

[No.1 Iida-tchi Sensei] The Real Image of a Full-time Trader: Achieving a Professional Lifestyle with Highly Reproducible Trades that Emphasize Closing Prices

Learn the Art of Living from 7 Successful People in FX

Nowadays I’m trading FX as a part-time trader, but I’m sure many of you are thinking, someday quitting your job to become a full-time trader. So, this time we asked seven full-time FX traders who live on FX or who are building wealth mainly through FX while running other businesses to share: how they became full-time, how they earn, and what kind of life they lead.

Note: This article is a reprint and revision of an article from FX攻略.com, August 2019. The market information described in the main text may differ from current market conditions, so please be aware.

Profile: Iidatchi-sensei

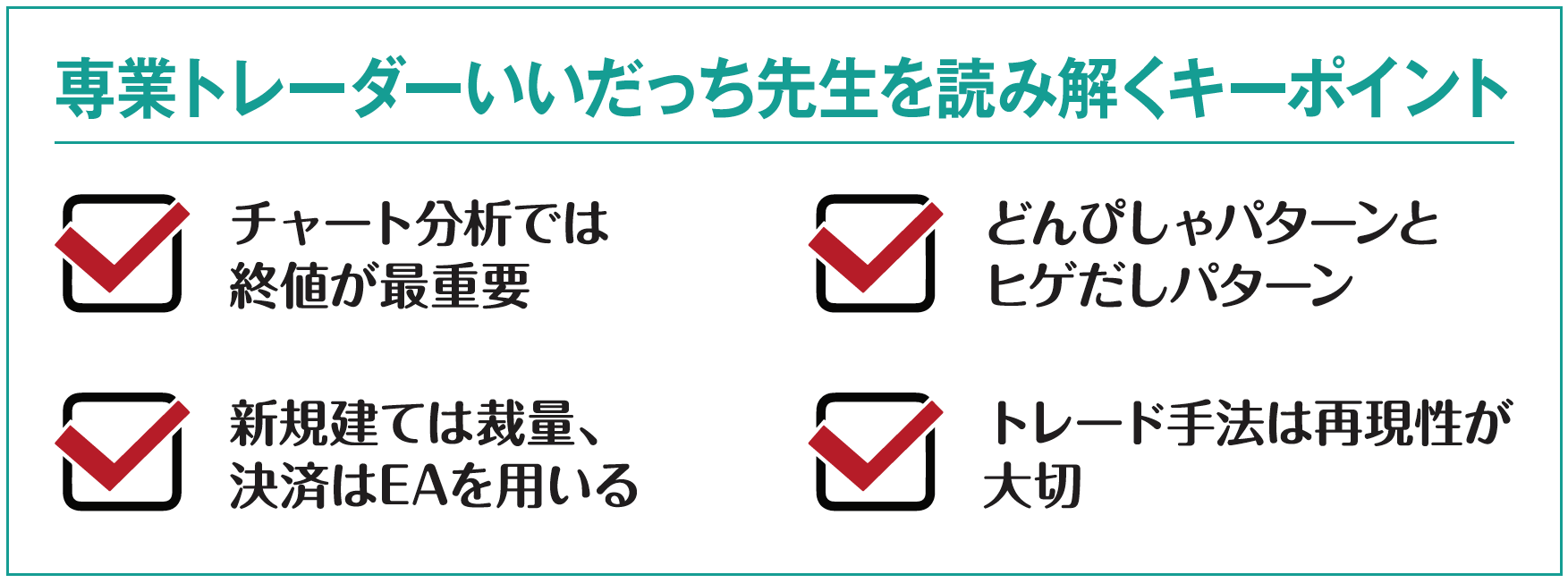

Former instructor at a cram school. Loves hot springs and holds a hot spring sommelier qualification. A professional FX trader who has trained many excellent traders using the “Close-Price Trading Method.” In his online study sessions, participants from all across the country—from the elderly to the young—learn together. His chart analysis method, which emphasizes the “close price,” is popular among part-time traders as a trading approach that doesn’t require constant focus on 24-hour markets.

Blog:http://iidatchi.blog.fc2.com/

Twitter:https://twitter.com/iidatchi

Line Charts Make the Close Easier to See

When you think of Iidatchi-sensei, the nickname that comes to mind is “Close-Price Trading.” Of the four price data points, the close price is overwhelmingly prioritized.

“Whether the candle is bullish or bearish is decided by the close price, and various technical indicators like moving averages and Bollinger Bands are calculated based on close prices. By focusing on the close price, you can trade more advantageously.”

This approach pairs well with line charts. Line charts display only the close price on the chart, not the open, high, or low. By doing so, extra information is not shown on the screen, making analysis simpler.

One of Iidatchi-sensei’s strong methods, the “Spot-On Pattern,” becomes less ambiguous when using this line chart. If the recent close price and the latest close price match, it tends to be a sign that an upward or downward move is about to begin—the Spot-On Pattern.

“Market participants all want to buy low and sell high. Therefore, the recent highs and lows become their benchmarks. If they line up perfectly, it is a sign that the market may reverse from there.”

This is especially true in range-bound markets, where a closing price on a horizontal line that matches can often mark the start of a reversal.