Introduction to European Fundamentals | Episode 1: Features of the European Market [Miko Matsuzaki]

Miko Matsuzaki Profile

Miko Matsuzaki. She began her trader career at Sumitomo Bank Tokyo Branch. In 1988 she went to the UK, and in 1989 joined Barclays Bank London Head Office Dealing Room. She gave birth in 1991. In 1997 she transferred to Merrill Lynch Investment Bank in London’s City, and retired in 2000. Currently, in addition to FX trading, she delivers direct Europe-sourced information to Japanese individual investors via blogs, seminars, and YouTube. Her books include “Miko Matsuzaki’s London FX” and “London FX That Always Lets You Earn” (both published by Jimusho). Since 2018 she has operated “Fundamentals College.” She also started an online salon on FX at DMM titled “FX Style.”

Blog:http://londonfx.blog102.fc2.com/

Fundamentals College:https://fundamentals-college.com/

Online Salon:https://lounge.dmm.com/detail/1215/

*This article is a reprint and editing of an article from FX攻略.com August 2019 issue. Please note that the market information stated in the text differs from current market conditions.

A London Market Welcoming for Part-Timers

Recently I have been writing about European fundamentals, including the UK, as “London FX” Miko Matsuzaki. The foreign exchange market (FX) is said to be open 24 hours, but each region—Asia, Europe, and the United States—has its own characteristics, with different important economic indicators and key figures. Here, from my perspective as someone living in the UK, I would like to share European fundamentals with you all.

The FX market moves from the Tokyo session to the European continent, and one hour later the London session begins. In addition to actual buyers and sellers, institutional investors, speculative players represented by hedge funds, and M&A-related activities, the London market attracts a wide range of participants, making it the largest in trading volume. Until the end of the New York session, there are continuing events such as statements by central bank officials and government figures, and congressional testimonies that are not often seen in Asian markets.

The range of tradable currencies is wide; led by the euro and the pound, the London market’s appeal includes a broad spectrum of currencies from Nordic, Middle Eastern, African, Russian, and Eastern European regions where liquidity can be almost non-existent during Asian hours—the "department store" of currencies.

London's Trading Volume Ranks as the World's Largest

The Bank for International Settlements (BIS) conducts the triennial “Central Bank Survey on Foreign Exchange and Derivatives.”

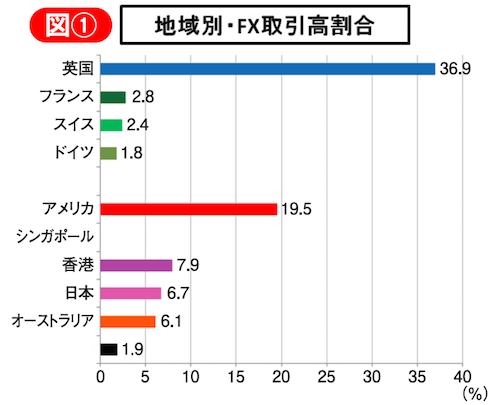

Among the FX trades exceeding $5 trillion daily, we examined how much each market accounts for. London is the birthplace of FX and currently accounts for about 40% of global trades (Figure 1). Next, we looked at currency share of trades, and as expected, the number one currency was the “Dollar.”

Figure 1 Source:BIS “Central Bank Survey on Foreign Exchange and Derivatives” (April 2016)