Euro/Yen Monthly Strategy ~ How much profit can be earned by trading aiming for swap points ~ [Relaxed Forex]

Note: This article is a reprint and revision of FX Koujou.com’s August 2019 issue. Please be aware that the market information described herein may differ from current market conditions.

Profile of Yuttari Forex

Yuttari Forex. Individual investor. A “slow and steady trade” advocate with extremely few trades. Studying every day with the goal of achieving great success in FX. Holds accounts with various FX companies and is familiar with a wide range of services within the industry.

Official Blog:FX Slow and Steady Trade

Official Blog:FX Real Trade Dojo

Examining Swap Points for EUR/JPY

Until now, we have used USD/JPY and ZAR/JPY to verify whether long-term swap-point targeting is effective. In all cases, the results suggested effectiveness, but there is a problem with this verification: “the currency pairs were chosen by looking back from the present and selecting ones that have proven successful.”

In actual trading, you don’t know how future price movements will unfold. Therefore, let’s also consider EUR/JPY, which, when viewed from the current moment back into the past, would show that swap-point targeting could be difficult.

This time again we will use the published data from the “Click 365” (Cricle 365). We assume buying 10,000 units of EUR/JPY on Cricle 365 and holding it throughout.

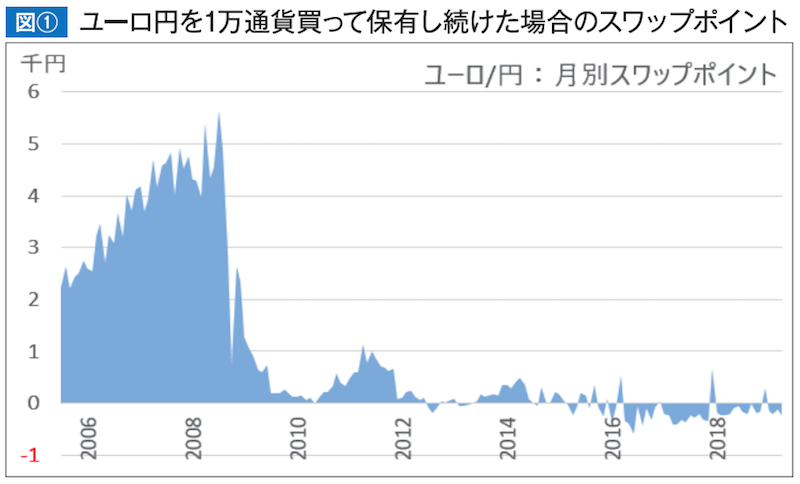

Figure 1 shows the evolution of EUR/JPY swap points. Until 2008, swap points appear to have grown larger and larger. While USD/JPY turned to a stronger yen in 2007, the EUR/JPY trend remained yen depreciation. Moreover, swap points continued to increase month by month. It’s reasonable to speculate that some people switched from USD/JPY to EUR/JPY.

However, in 2008 the recession hit the eurozone as well, and the swap points drastically diminished. Even so, from 2010 to 2011 there is a small sign of revival. Some people may have continued long EUR/JPY buys hoping this would continue. Yet contrary to that hope, from 2014 onward monthly swap points spent more time in negative territory, and since 2016 the negative trend has been the norm.