Continued consolidation natural rubber [Ryuuji Sato]

Ryuuji Satoh Profile

Satoh Ryuuji. Born in 1968. After graduating from a U.S. university in 1993, he joined a marketing company, then joined Genesis Corporation (later Oval Next Co., Ltd.), a information vendor covering finance and investment in general. He has written analyst reports on macroeconomic analysis, exchange rates, commodities, and stock markets, and has been involved in trading. Since 2010, he founded “H-Square Co., Ltd.”, writing analyst reports and planning and publishing works such as FOREX NOTE Currency Handbook, while also serving as a radio program caster in investment-related programs. He is an individual trader. International Federation of Technical Analysts certified technical analyst. Main newscaster on Radio Nikkei “The Money Do-sato’s Market Forecast” (Mondays 15:00–).

Official site:Ryuuji Satoh Blog

※This article is a reproduction and re-editing of FX攻略.com August 2019 issue. Please note that the market information written in the main text may differ from current market conditions.

The current market is in consolidation

In the April 2019 issue, we reported that natural rubber prices hit a two-year low and then sharply rebounded due to supply-side factors. In this issue, as US–China trade frictions intensify, we would like to forecast the future of the natural rubber market, which is in a tug-of-war between supply and demand factors.

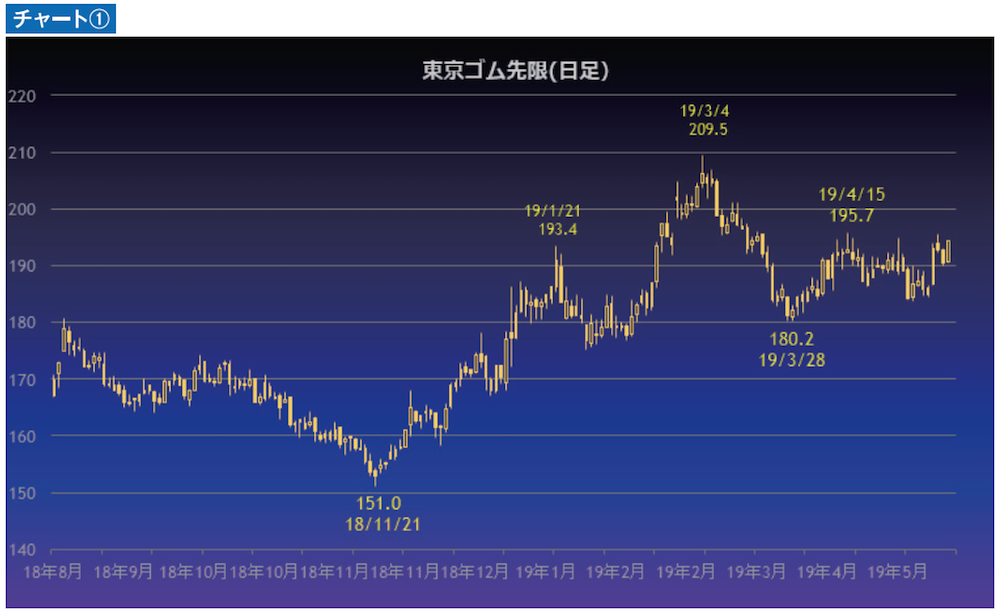

First, let's briefly review the major trend of rubber prices since the latter half of last year, by looking at the Tokyo rubber front-month chart (quote value per kilogram) (Chart ①). It is immediately evident that from November last year to March this year there was a rise of about 60 yen. The high of 209.5 yen reached on March 4 is the current year-to-date high. The background for this rise includes that in December last year the three major natural rubber producing countries of Thailand, Indonesia, and Malaysia grew frustrated with rubber prices below production costs, held a meeting to counter market conditions, and agreed to reduce exports in March this year.

However, after agreeing to export reductions, the market moved to a “buy on rumors, sell on news” scenario. With buying materials exhausted, on March 28 it fell to 180.2 yen. Since then, it has traded in a range around 185–195 yen.

Possibility of future supply reductions

Currently, price movements lack direction, but looking at the fundamentals, it is a battle between supply and demand factors. From a supply perspective, this year production is expected to decrease due to abnormal weather. In rubber production, tapping—the process of extracting latex from rubber trees—requires sufficient moisture in the trees. Therefore, the rainy season becomes extremely important.

However, due to the El Niño phenomenon, the rainy season in the world’s largest natural rubber producer, Thailand, started late. Traditionally, around April 13–15, during a festival known as Songkran (Water Festival), marks the transition from dry season to rainy season, but this year the rainy season began only on May 20, about a month later than usual. As a result, Thailand’s rubber production this year may decrease by about 5–10%.