Be careful of orders with narrow value ranges! Pitfalls of repeat-type orders [Relaxed Forex]

This article is a reprint and edit from FX Knowledge Base magazine January 2019 issue. Please note that the market information described in the text may differ from the current market.

Yuttari Currency Profile

Yuttari Kawa. Individual investor. A “Yuttari Trade” trader with extremely few trades. Studying every day with the aim of achieving great success in FX. Holds accounts with various FX companies and is familiar with a wide range of services within the industry.

Official blog:FX Yuttari Trade派

Official blog:FX Real Trade Dojo

From 2017 to 2018, the favorable development continued for repeat-type orders (a trading method exemplified by Tornado-like orders). In response, when market trends change significantly, there is a possibility that many people will incur large losses.

Therefore, we will examine the market since 2017 and consider future risk management.

Price movements of USD/JPY since 2017

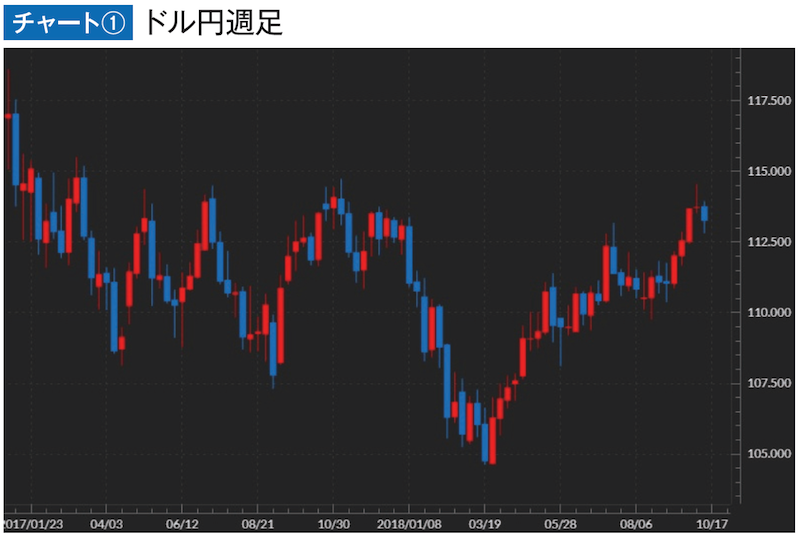

Chart 1 is a weekly chart of USD/JPY (quoted from DMM FX). The left half of the chart is 2017. It shows a range-bound period. It generally moved between about 108 and 114 yen, a very narrow range.

After that, in 2018 it trended toward stronger yen, but found a bottom just under 105 and then moved back toward yen depreciation. As of mid-October 2018 when this article was written, it is in the 112s.

In other words, in roughly two years, it moved only about 10 yen. This is a very small price movement. If we look at the past six years of USD/JPY price movements (difference between yearly high and low), they are approximately as follows.

2013: 19 yen

2014: 21 yen

2015: 10 yen

2016: 22 yen

2017: 11 yen

2018: 10 yen (through mid-October)

For a move of only about 10 yen over a period longer than a year and a half, this is quite unusual. Conversely, looking back at the past, there have been many times when it moved more than 20 yen in a single year. In other words, if you base your repeat-type orders on a 10-yen annual movement, you will be caught off guard when it moves a lot.

If you are selling yen and it strengthens significantly, there is no problem. It becomes a perfect trade where all orders end on the take-profit side. The warning signs are not a big yen appreciation when selling yen, and not a big yen depreciation when buying yen.

Blog traffic

The author’s blog tends to be focused on risk avoidance. In such cases, when the market is range-bound or moves toward yen depreciation, traffic tends to be very low. It is assumed that even if you aggressively attack without considering risk, you may still earn income. Conversely, when there is large yen appreciation on a monthly basis, traffic increases.

Chart 2 is USD/JPY on a monthly chart. In the middle of the chart, from the beginning of 2016 to around August, there is a period of more than 20 yen (over 2,000 sen) of yen appreciation. At that time, the author’s blog was thriving. However, when the yen depreciates and you increase your positions, and then it strengthens again, worrying “What should I do?” when the yen appreciates; even if you try to manage risk, it’s too late. Honestly, it might be better to cut losses and start over.