Understanding Max Iwamoto's "Pivot" Part 2 [Max Iwamoto]

Max Iwamoto Profile

Keisuke Iwamoto. "A Technical Analyst with no formal education" as the nickname suggests, he is a rare no-education analyst in the industry. Even in an era where academic credentials remain highly valued, he continues to strive daily against the FX market, which is indifferent to such things. With the belief that now, when anyone can start FX easily, one should acquire the skills to keep winning consistently, he serves as a columnist and seminar lecturer.

*This article is a reprint and revision of FX Strategy.com January 2019 issue. Please note that the market information written here may differ from current market conditions.

Two Buying/Selling Rules Recommended by the Inventor

Trading around pivots is generally based on the fact that price has reached each line. In typical technical indicators, trend-type indicators are used for trend-following trades and oscillator-type indicators for contrarian trades, but pivots have no such rules. It is a versatile indicator that has both trend-following and contrarian faces. Possibly due to this versatility, its applications are diverse, but here we introduce the buying/selling rules recommended by the inventor, J. W. Wilder.

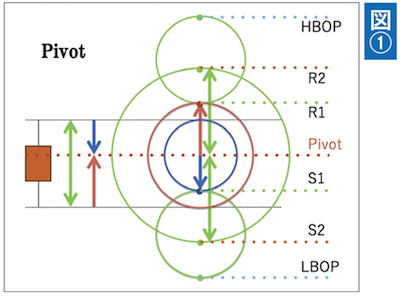

This rule has two modes: “Reaction Mode” and “Trend Mode.” Reaction Mode is a contrarian method that buys in a downtrend and sells in an uptrend. Trend Mode, on the other hand, is a method used when the market suddenly shows movement in one direction, simply following that trend. This buying/selling approach is characterized by using reverse trades at most points, regardless of buy or sell. The basis for catching the timing of trades is the levels R1 and S1, which are calculated by rotating the price range from the previous day’s high/low by 180 degrees to the current day’s pivot, and HBOP and LBOP, which add the daily price range to those levels (Figure 1).