Foreign Exchange Online - Masakazu Sato's Practical Trading Techniques | Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [This Month's Theme | Verifying Major Currencies by the Slope of the 200-Day Moving Average. 2018 W

Looking back calmly at the 2018 foreign exchange market, the biggest key factor was the “U.S. long-term interest rate” even more than President Trump. It is striking to observe the movements of the three major currencies—yen, dollar, and euro—as the 200-day moving average remains flat. It looks like there was big volatility, but in fact, the market was range-bound. Let’s summarize the factors behind 2018's forex fluctuations and use them to inform our 2019 market outlook.

※This article is a reprint and edit of an article from FX攻略.com, January 2019 edition. Please note that the market information written herein may differ from the current market.

Profile of Masakazu Sato

Sato Masakazu. After working at a domestic bank, he joined PariBa Bank (now BNP Paribas) in France. He has served as an interbank chief dealer, head of the funds division, senior manager, and other positions. Subsequently, he became the senior analyst at Online FX, which boasted the highest annual trading volume. He has been involved in the currency markets for over 20 years. He appears on Radio NIKKEI’s “Stock Comprehensive Live Commentary! Stock Channel↑”, Stock Voice’s “Market Wide: Foreign Exchange Information,” and regularly provides market information on Yahoo! Finance.

The Market Impact of Rising U.S. Long-Term Interest Rates on the Dollar/Yen

The 2018 forex market also entered a gradually holiday-leaning quiet period from the Thanksgiving on November 23 to Christmas in December.

At the time of writing this manuscript, the results of the U.S. midterm elections held on November 6 had not been announced. If the Republican Party led by President Trump had won, further stimulus measures would likely be announced, protectionist policies would face a material saturation point, and the dollar would probably appreciate. Conversely, if the Democratic Party had won, the Trump administration might become lame-duck, potentially weakening the dollar.

To forecast the future, we need to organize the past. So, this time we will review the 2018 Forex movements and recap exactly what factors moved the exchange rates.

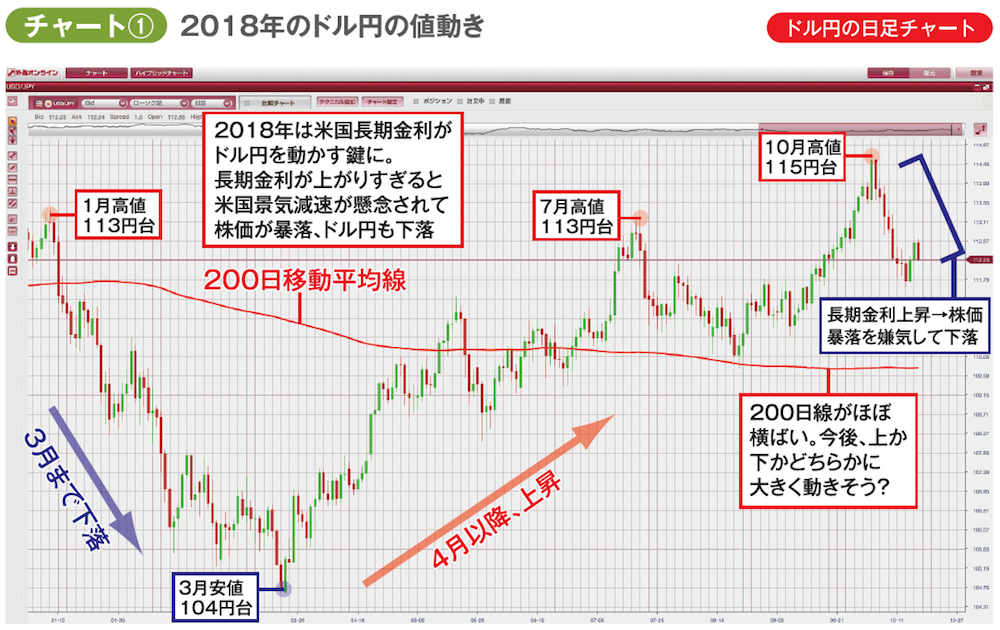

Chart ① is the daily chart of USD/JPY from January 2018. From February onward, the USD/JPY fell sharply from the 113 yen level to the 104 yen level due to rising U.S. long-term rates, a plunge in stock prices, and Trump’s protectionist measures. However, since April, strong corporate earnings and a robust U.S. economy acted as supportive factors, and the three increases in the Federal Reserve’s policy rate within the year were well received, shifting into a rising trend. In mid-October, it reached a year-to-date high in the 115 yen range.

However, immediately afterward, U.S. long-term rates surged to the 3.26% vicinity, causing the previously well-bought stocks to reverse. As the major U.S. stock indices, which had been near their highs, were dumped significantly, risk-off behavior intensified, and the safe-haven yen strengthened, pushing the dollar down.

Looking back at 2018, what drove USD/JPY was the U.S. long-term rate itself—more than President Trump. The rise in U.S. long-term rates attracted dollar-buying from Japanese institutional investors craving yield, driving the dollar higher and the yen lower. Yet if long-term rates rise too much, the surging U.S. economy faces risks of a slowdown due to higher rates, and stock prices at their peak could crash. This would trigger risk-off in the forex market, pushing the yen higher, which was a major factor in moving the 2018 dollar-yen market.

How stocks and currencies react to the “double-edged sword” of U.S. long-term rates will undoubtedly be a focal point of price movements again in 2019.