The Path Ahead for Foreign Exchange Markets, Episode 105 [Tomotaro Tajima]

Tomotaro Tajima Profile

Economic analyst. CEO of Alphinance. Born in Tokyo in 1964. After graduating from Keio University, he switched careers following a stint at Mitsubishi UFJ Securities. He analyzes and researches a wide range from finance and overall economy to strategic corporate management, and ultimately individual asset formation and fund management. He has served as lecturer for lectures, seminars, and training hosted by private companies, financial institutions, newspapers, local governments, and various business associations, with about 150 lectures annually. He has written numerous serialized pieces and comments in print media, including Weekly Gendai’s “Rules of Net Trading,” and Examina’s “Money Maestro Training Course.” He has also written columns on many websites on stocks, foreign exchange, etc., earning high regard as a stock and FX strategist. He also writes the Home Economy section of the publishing company Jiyu Kokuminsha’s “Kiso Chishiki (Basics of Contemporary Terms). He has regular appearances on TV (TV Asahi “Yajiuma Plus,” BS Asahi “Sunday Online”) and radio (MBS “Mecha-chan’s Asa-ichi Radio.” He is currently a regular commentator on Nikkei CNBC’s “Market Wrap” and Daiwa’s Securities Information TV’s “Eco No Marche.” His main DVDs include “Very Easy to Understand: Tomotaro Tajima’s FX Introduction” and “Very Easy to Understand: Tomotaro Tajima’s FX Practical Technical Analysis.” His major books include “Asset Review Manual” (Pal Publishing), “FX Chart ‘Profit’ Equations” (Alchemix), and “Why Can FX Make You Asset Rich?” (Text), among many others. The latest publication is “How to Profit by Riding the Rising U.S. Economy” (Jiyu Kokuminsha).

*This article is a reprint/edit of an article from FX攻略.com January 2019 issue. Please note that the market information written in the main text may differ from current market conditions.

Potential for a slightly wider downside for Eurodollar in the future…

In the previous update, the author stated about Eurodollar: “It still cannot break above the 62-month moving average, and it does not fall below the monthly chart’s lower Cloud boundary of Ichimoku. Therefore, the trend remains hard to identify.”

In fact, September’s monthly candle was shaped as a slightly longer upper shadow, more like a small bullish candle or almost a Doji-like shape, but the monthly close stayed above the Cloud lower boundary. Since May this year through September, Eurodollar’s intra-month lows during each month dipped below the Cloud lower boundary, yet the monthly closes stubbornly held above that level.

However, the Eurodollar at the time of writing is well below the Cloud lower boundary, and it appears October’s close may finally break below that level.

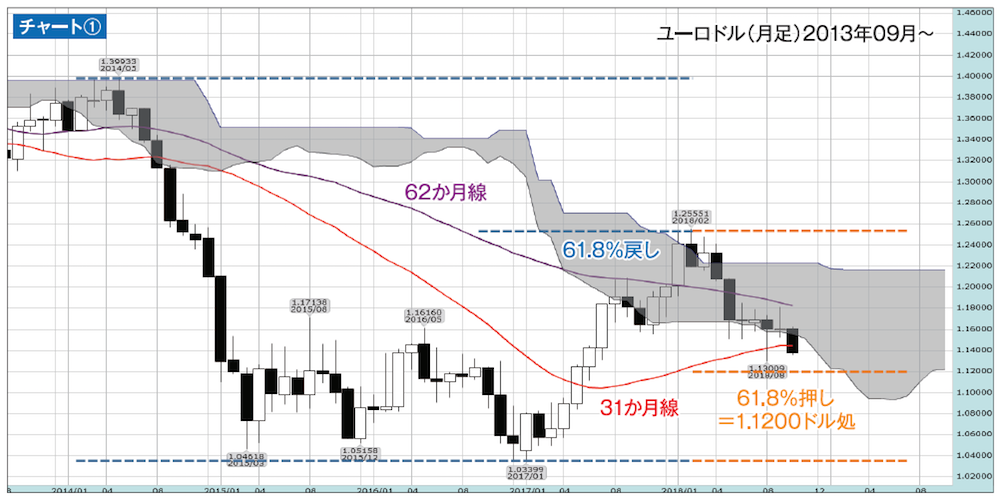

As shown in Chart ①, Eurodollar’s movements have since August 2017 been acutely aware of the Cloud’s lower and upper boundaries on a monthly basis. If it breaks away from such a critical juncture, it would not be surprising for downside potential to widen sharply from there.

Moreover, if Eurodollar’s October monthly close breaks below the 1.1500 level and the 31-month moving average (31-month line), the near-term market may tilt more bearish.

Recall that the 61.8% retracement of the decline from the May 2014 high to the January 2017 low was at the February 2017 high of 1.2555. And the 61.8% pullback of the rise from the January 2017 low to the February 2017 high is around 1.1200. Thus, those levels are likely targets for downside, but as noted before, depending on the outcome of the UK-EU Brexit talks, there is potential for an additional downside move.

Will the euro situation become more complex toward year-end?

Right now, the euro’s tendency to lean bearish is largely influenced by the unresolved fiscal issues in Italy and the ongoing Brexit negotiations in the UK.

As is known, the European Commission on October 23 rejected Italy’s budget and demanded a resubmission within three weeks. In response, the Italian government declared, “We will not surrender,” signaling it intends to continue its expansionary spending and will not comply with the Commission’s revisions.

The deadline for resubmission is November 13, and within three weeks thereafter the Commission is expected to give its view (as of the writing). Depending on circumstances, the Commission may initiate procedures for potential sanctions, making the situation increasingly precarious.

Neither side wants a breakdown, but if the Commission signals willingness to make some concessions to the Italian government, the euro could still face negative implications from concerns about “fiscal discipline within the region” being compromised. Ideally, the Italian government would drop its scattershot policy approach, but for a government formed by a typical populist party, that may not be a realistic option. It is also possible that Italy could opt for the EU exit path, and the situation is unlikely to resolve quickly.

On the other hand, regarding the UK’s Brexit negotiations, the focus remains whether a concrete path to agreement will be outlined by the time the EU summit on October 17 set the deadline of “Christmas for a smooth exit.”

Paradoxically, the signaling of a deadline means that clear direction may not be announced until the last minute. Of course, there remains a reasonable chance that a “no deal” Brexit could be avoided, in which case there might be a temporary rebound in the pound. The question is how Italy’s fiscal situation will look at that time.

Toward year-end, the euro may face increasingly complex circumstances. Depending on developments, there is also a possibility of substantial selling pressure, so caution is warranted.