Era of Confusion; Gold Has Upside Potential [Ryuuji Sato]

Sato Ryuji Profile

Sato Ryuuji. Born in 1968. After graduating from a U.S. university in 1993, he joined a financial information vendor handling macroeconomic analysis, currency, commodities, and stock market analyst reports, and engaged in trading, at General Rex Co., Ltd. (now Oval Next Co., Ltd.). In addition to writing analyst reports and trading, he founded “H-Square Co., Ltd.” in 2010, writes analyst reports, and plans/publishes publications such as “FOREX NOTE Currency Notebook,” while serving as a radio program caster in investment matters. An individual trader. International Federation of Technical Analysts-certified technical analyst. Main caster for Radio Nikkei’s “The Money Doi Satto’s Market Forecast” (Mondays 15:00–).

Official site:Sato Ryuuji Blog

※This article is a reproduction and rewrite of an article from FX攻略.com January 2019 issue. Please note that the market information written in the main text may differ from the current market.

Bottoming Out Completed

The world has become quite suspicious. The U.S.-China struggle for dominance has begun, Brexit still has no conclusion, and far-right parties are rising sharply in Europe. In the Arab world, the traditionally pro-American Saudi Arabia and the United States have become tense over the murder of dissident journalist Khashoggi.

With the end of the U.S.-Soviet Cold War in 1989, the rise of globalism, and the multipolar system formed by the United States’ relative weakness after 2008, skewed income distribution has emerged, creating a gap society, and populism and dictatorial governance have taken hold in some areas.

Even so, when the world’s economy was strong, we managed to get by, but as the U.S. begins to tighten liquidity and the European Central Bank (ECB) is set to pivot toward an exit strategy next year, the hidden discontent and anger are starting to surface.

Apologies for the long preface, but this is to say: welcome to a era of confusion. This is evident in market movements. The gold price movements. Recently, the dollar has risen against many currencies. Yet gold has not reacted much to dollar strength. Also, in October, the Dow Jones rose by about 600 points at times, but the declines were limited, now trading around $1230–$1240. It fell to $1,160 on August 16 as a throw-out, but that became a near-term low, and by next year a return to the $1,300s is possible.

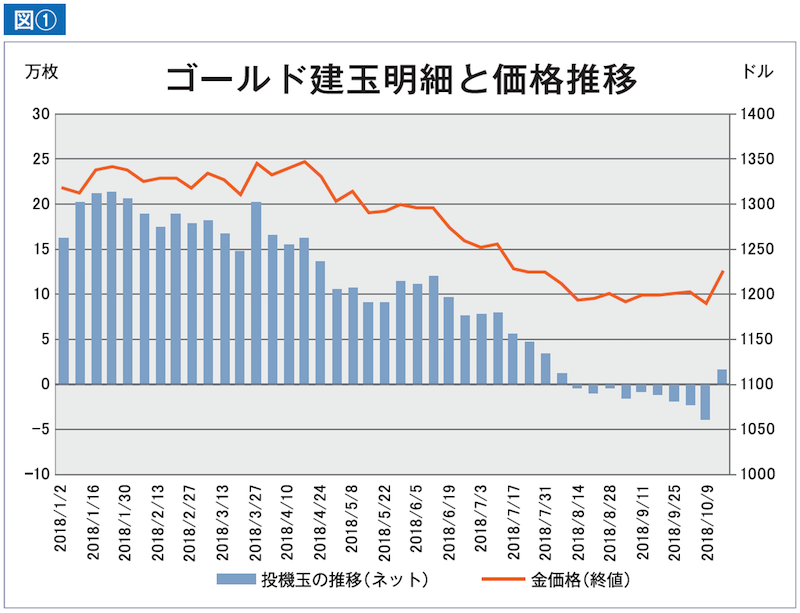

Looking at the CFTC position details (see Figure ①), at the beginning of the year speculative long positions swelled to net more than 210,000 contracts. Since then, supported by the Federal Reserve’s rate hike expectations and rising U.S. interest rates, long positions gradually shrank, turning into a net short position of 3,688 contracts as of August 14. The gold net position turned net short for the first time in 16 years. With rising interest rates, gold, which yields no interest, was sold. On October 9, net shorts expanded to 38,175 contracts. However, against the backdrop of tensions between the U.S. and Saudi Arabia, a rapid unwinding of positions occurred, turning into a net long position of 17,667 contracts as of October 16. When the net position reverses by 55,842 contracts, as gold’s commodity characteristics suggest, it tends to move in that direction for a while. The speculative funds are likely to increase their long positions in gold in the future.