Foreign Exchange Online - Masakazu Sato's Practical Trading Techniques | Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [This Month's Theme | A year of upheaval at the start of the year for three years. What will 2019 b

Masakazu Sato Profile

Sato Masakazu. After a career in domestic banks, he joined BNP Paribas (formerly Paribas Bank) in Paris, France. He has served as Interbank Chief Dealer, Head of Money Market, Senior Manager, and other roles. Subsequently, he became the Senior Analyst at FX Online, which boasts the No.1 daily trading volume. He has over 20 years of experience in the world of foreign exchange. He appears on Radio NIKKEI programs “Comprehensive Stock Commentary! Stock Channel” and StockVoice’s “Market Wide - Foreign Exchange Information,” and regularly provides market information on Yahoo! Finance.

From the 2016 oil price crash, the 2017 Trump market rebound, to the 2018 rise in US long-term interest rates causing stock declines, the past three years’ early-year markets have been volatile. For 2019 as well, uncertainties such as the US-China trade war, rising US long-term rates, and oil weakness due to factors like scrutiny of crude prices have already cast shadows on the markets. Reflect on the volatile early-year markets of the past three years and prepare for FX trading in 2019.

*This article is a reprint/edit of an article from FX攻略.com February 2019 issue. Please note that the market information stated in the text may differ from the current market.

US-China Trade War, Rising US Long-Term Rates, and Oil Weakness: Numerous uncertainties at the start of 2019!

2019 is approaching. Positive factors for the USD/JPY pair include a still-strong US economy and the continued rise in US policy rates. Negative factors include the US-China trade war, and from 2019, negotiations may begin on the US-Japan Trade Agreement (TAG), suggesting Trump’s protectionist policies could also target Japan. Additionally, factors such as rising US long-term interest rates and comments by President Trump like “oil prices should be lower” leading to oil weakness are cited.

In particular, in the past three years, bad news in the financial markets has erupted from the very start of the year, and markets have continued to swing wildly even before the New Year mood has cooled. Therefore, this time we will review the past three New Year movements to lay groundwork for the 2019 new-year market.

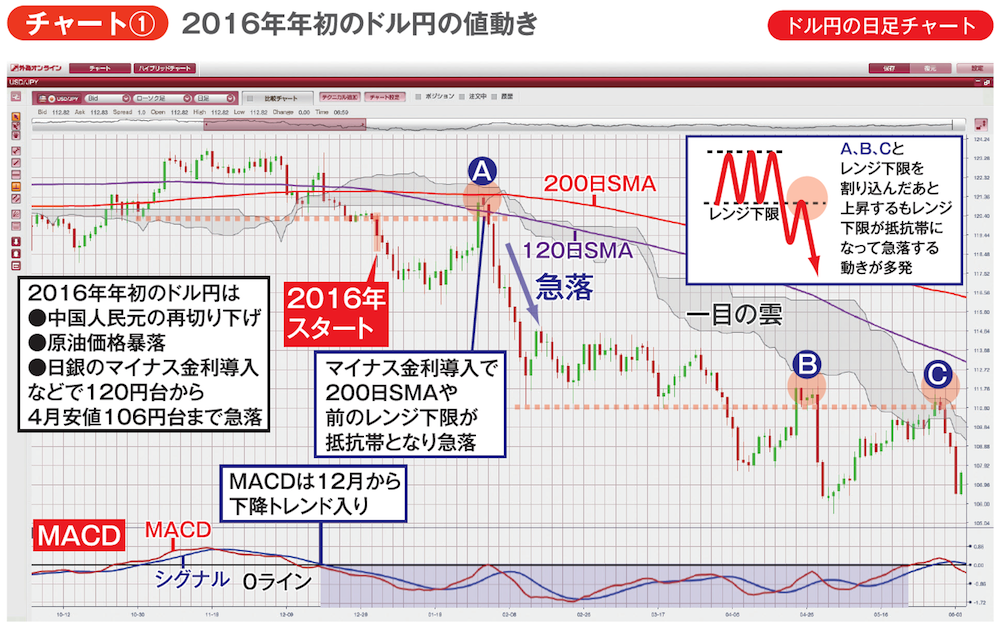

Chart ① is a daily USD/JPY chart around three years ago, at the beginning of 2016. In early 2016, following the yuan’s sudden devaluation in the summer of 2015, concerns about China’s economy slowing resurfaced. After the Fed began its first rate hike since quantitative easing in December 2015, dollar strength surged, and emerging-market slowdown concerns rose. Oil priced in dollars plummeted to the $26 per barrel range, and risk-off behavior accelerated in the FX market as well.

The coup de grâce was the Bank of Japan’s introduction of negative rates announced on January 29, 2016. The USD/JPY briefly recovered to around 121 early January, but from the day after BOJ’s negative rate announcement, the association of negative rates with “damaging bank profitability” led to a sharp fall to the 110s by February 11, more than 10 yen.

In recent years, when negative news about the global economy such as oil price declines appears, the stock market in the United States hits record highs first, and the FX market tends to follow with rapid risk-off movements.

In technical indicators, as shown in Chart ①, crosses with the MACD signal and breaking below the zero line (indicating a downtrend) appear to function effectively as early signs of sharp declines or crashes. Also, like point A where the BoJ announced negative rates, if the rate rebounds at the lower end of a previously defined range that acted as support, it becomes easier for a sharp drop to occur.

The same behavior is seen at points B and C on the chart. When aiming to sell during a rapid FX drop, consider the view that “once a previously broken support band becomes a resistance, it can function as a take-profit for a pullback sale.”