The Future of Foreign Exchange Markets, Episode 106 [Tomotaro Tajima]

Tomotaro Tajima Profile

Economic analyst. Alfinaunts President and CEO. Born 1964 in Tokyo. After graduating from Keio University, he shifted careers following his time at the current Mitsubishi UFJ Securities. He analyzes and researches a wide range from finance and the overall economy to strategic corporate management, and even personal asset formation and fund management. He serves as a lecturer for lectures, seminars, and training organized by private companies, financial institutions, newspapers, local governments, and various business associations, with about 150 lectures annually. He has numerous writings in print media, including serialized columns and comments in Weekly Gendai “The Rules of Net Trading” and Examina “Money Maestro Training Course.” He has also written for numerous websites on stocks, foreign exchange, and other topics, earning high evaluations as a stock and FX strategist. He also writes for the Home Economics section of Shakai Fuminsha’s “Basic Knowledge of Contemporary Terms.” After regular appearances on TV (TV Asahi “Yajiuma Plus,” BS Asahi “Sunday Online”) and radio (MBS “Kei-chan’s Asa-ichi Radio”), he currently serves as a regular commentator on Nikkei CNBC “Market Wrap” and Daiwa Securities Information TV “Economy Marche.” His main DVDs include “Super Easy: Tomotaro Tajima’s FX Primer” and “Super Easy: Tomotaro Tajima’s FX Practical Technical Analysis.” His major books include “Wealth Review Manual” (Paru Publishing), “FX Chart: The Formula for Profit” (Alchemix), “Why Can FX Make You Asset Rich?” (Texts), among many others. His latest publication is “Make Money Riding the Rising U.S. Economy” (Shakai Fuminsha).

Note: This article is a reprint/edit of an article from FX攻略.com, February 2019 issue. Please note that the market information stated in the text differs from current market conditions.

There Is an Intrinsic Limit to the Euro-Dollar's Rebound!

In the previous update, the author wrote about the euro-dollar: “From the January low of last year (2017) to the February high this year, the rebound is at the 61.8% retracement level around 1.1200 dollars. First, that level around 1.1200 is likely a key lower bound.”

As expected, the euro-dollar briefly fell to around 1.1214 on November 12 and then paused its decline and rebounded. Considering that the situation surrounding the euro and the pound had not markedly improved at that time, it is correct to view that rebound as a technical bounce.

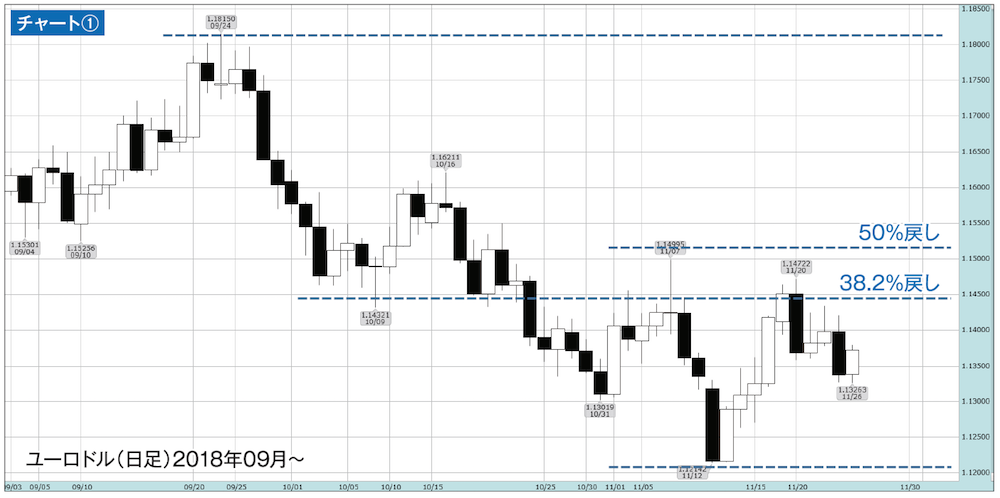

Moreover, the euro-dollar, which paused near 1.12 and rose briefly, tested around 1.145 on the 19th and 20th of the month, then turned down again. As shown in Chart 1, this area corresponds to the 38.2% retracement of the decline from the September 24 high to the November 12 low, and it was also a notable level during the three-step decline since late September. In other words, the euro-dollar again “rebounded technically and stalled.”

From this perspective, the next downside target is the psychological 1.1000 level. If that level is broken, the next target would be around 1.0862, the 76.4% retracement of the move from the January 2017 low to the February 2018 high.

Of course, after another rebound there is also a possibility of breaking above the recent high of 1.145. Still, the near-term rebound appears to have limits, possibly up to the psychological 1.1500 level, the 50% retracement from the September 24 high to the November 12 low around 1.1515, and the lower bound of the Ichimoku Cloud on the monthly chart around 1.1513.

Brexit and Italy's Budget Still Unresolved

On November 14, Prime Minister May forced through approval of the Brexit deal in a cabinet meeting. Immediately, voices of opposition rose from within the ruling party and cabinet, with some even seeking a vote of no confidence in the party leader. Clearly, it seemed unlikely to pass in Parliament in January as things stood.

Furthermore, on November 15, news of the resignation of former EU Brexit Minister Davide Davis surfaced, and the pound fell rapidly from around 1.3000 to the low 1.2700s. In essence, apart from May, no one wanted responsibility, and no one was eager to step forward as the successor prime minister. Recent polls reportedly show more Britons favor remaining in the EU than leaving the EU.

If so, a fresh referendum could be the solution, but it is not easy to implement. Other than a re-vote, the current reality suggests that a “no-deal Brexit” is the most plausible option. It is indeed a “quagmire.” As such, for the time being the pound’s downside may be hard to determine, which also translates into euro-dollar downside risk. Additionally, as for bearish factors on the euro, the Italy budget issue remains.

On November 13, the Italian government openly refused the EU’s requested budget revision. In response, the European Commission announced on November 21 its final decision, effectively stating that Italy will be subjected to the Excessive Deficit Procedure (EDP) sanctions.

As a result, depending on circumstances, the Financial Affairs Council of the EU could formally recommend entering EDP in early December, with the Council likely to decide on EDP in January. Actual sanctions would take time to implement, likely not before spring 2019, but this also means markets will be dealing with this issue for a long time. With the UK potentially facing a no-deal Brexit, the upside for the pound and euro is expected to remain heavy for the foreseeable future.

For the pound-dollar, the immediate focus is whether it can hold the 1.2700 level; a break below could leave open a path to around 1.2000. If that happens, euro-dollar could test the 1.0500 level or the January 2017 low around 1.0340, contributing to a stronger “dollar-dominant” trend.