Natural rubber returns to its lowest price range in 2 years [Ryuji Sato]

Profile of Ryuuji Sato

Sato Ryuuji. Born in 1968. After graduating from a US university in 1993, he joined Genesis Co., Ltd. (later Oval Next Co., Ltd.), a financial and investment information vendor, after working at a marketing company. He writes analyst reports on macroeconomic analysis, foreign exchange, commodities, and stock markets, and engages in trading. Since 2010, he founded H-Square Co., Ltd., writing analyst reports and planning/publishing works such as “FOREX NOTE Foreign Exchange Notebook,” while also serving as a radio program caster in investment-related topics. He is an individual trader. International Federation of Technical Analysts certified technical analyst. Main caster on Radio Nikkei’s “The Money Doisat’s Market Forecast” (Mondays 15:00–).

Official site:Ryuuji Sato Blog

※This article is a reprint and edit from FX攻略.com February 2019 issue. Please note that the market information described in the text differs from current market conditions.

Recording a low since September 2016

In November, news spread that the Asia-Pacific Economic Cooperation (APEC) summit, held in Papua New Guinea, closed without a joint statement for the first time in 25 years due to US–China tensions, which has cast a heavy shadow on commodity prices. In October 2018, in the issue titled “Gold price searching for a bottom,” we examined the decline in natural rubber prices; this time, we will look at the subsequent trend in the natural rubber market.

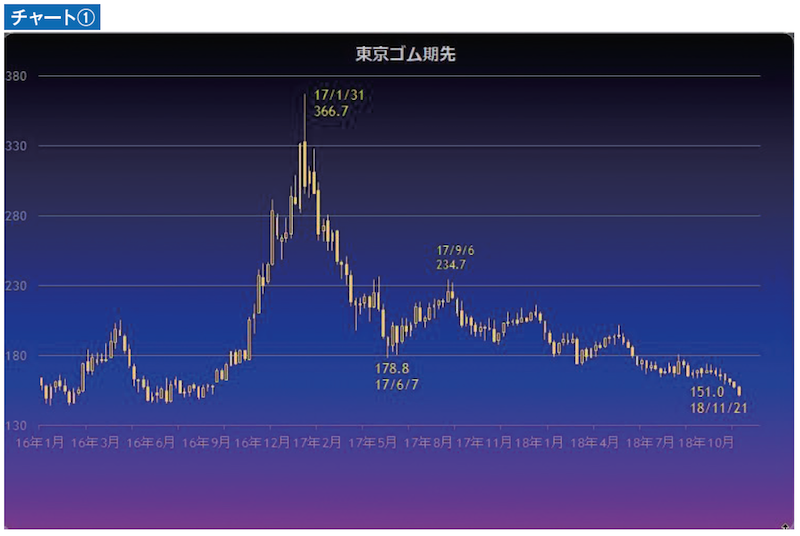

First, let’s briefly review the major flow of rubber prices using the Tokyo Rubber Futures weekly chart (tick value per kilogram) (refer to Chart ①). The first noticeable thing is the sharp rise from November 2016 to January 2017. Contributing factors include bad weather in producing regions, increased public works in China—the largest consumer of natural rubber—and the major factor being the Trump rally triggered by Mr. Trump’s victory in the US presidential election, which led to stock and commodity price increases. The opening price in November 2016 was 183.0 yen, but by January 31 of the following year it rose to 366.7 yen. In just three months, the price more than doubled.

However, once the Trump rally ended, market enthusiasm cooled rapidly, and a sharp decline began. By June 7 of the same year, it fell to 178.8 yen, erasing the gains from the Trump rally. After that, there were rebound moments up to 202.1 yen, but with repeated oscillations, the level gradually declined, and by November 2018 it fell to 151.0 yen, marking the lowest since September 2016.

Impact of US–China trade friction

Looking at rubber prices from this year, they held around the 160-yen range from summer to early autumn, but collapsed in mid-October. The background includes the intensification of US–China trade friction, which has been a major theme this year, and expectations of a slowdown in China’s economy.

The conflict between the two countries involves the world’s number one and number two automobile markets, and given the broad scope of the automotive industry, it affects many material industries. Also, both countries are the world’s top two consumers of natural rubber, with about 40% of global natural rubber demand coming from China. If the economies of these two countries slow, it will be a major pressure factor on the natural rubber market.