Dr. Iidatachi’s “Yūyū” End-of-Day Trade | Episode 4 Perfect Pattern ④ Market Crowd Psychology (Part 2) [Dr. Iidatachi]

A lecturer from Gen Shingaku Juku. He loves hot springs and holds a qualification as a hot spring sommelier, a professional FX trader. He trains many excellent traders using a method called “Close Price Trading Method,” and in his online study sessions people from all over the country—from the elderly to the younger generation—participate and learn. The chart analysis method that emphasizes the “close price” is popular among part-time traders as a trading approach that does not require constant focus on 24-hour markets.

Blog:A Grand Comeback from 100,000 Yen! FX Trader II-da-chi BLOG

※This article is a reprint/edit of an article from FX攻略.com February 2019 issue. Please note that the market information in the text may differ from current market conditions.

Why does the Head & Shoulders pattern occur?

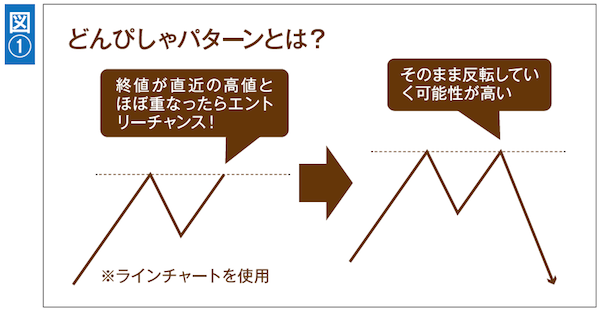

Hello, this is II-da-chi sensei. Last time I wrote about “mass psychology of the market.” The market psychology is very simple: everyone wants to avoid losses and to gain. In other words, they want to sell high and buy low. That is why recent highs and lows become conscious and reversals tend to occur there. The slam-dunk pattern (Figure 1) is based on this psychology as well.

Even though a chart pattern is a chart pattern, it’s hard to invest your precious money in trading unless there is a rationale or reason behind why that pattern forms. The patterns that II-da-chi sensei recommends have clear grounds or reasons for their occurrence. This is why many people trust him and why students of his trading study group become traders who don’t lose money.

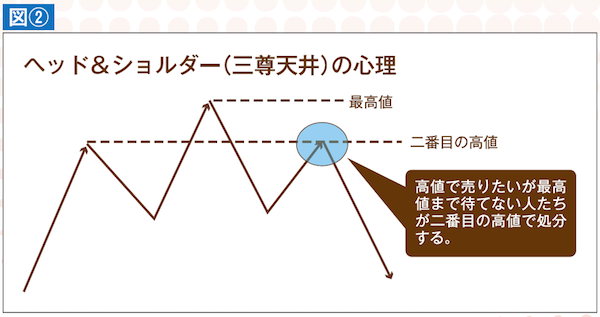

You all have probably heard terms like Head & Shoulders, double top, or inverse head and shoulders. These are representative reversal and bottoming chart patterns. They are well-known patterns often shown in FX教材 books, but when you only show examples, you rarely find books explaining why such shapes occur. Perhaps this article is the first public disclosure of the reasoning? It doesn’t seem an exaggeration to say so.

In fact, the reason head & shoulders occurs also stems from the aforementioned mass psychology of “not wanting to lose, wanting to gain,” i.e., “wanting to sell high, buy low.” If one could always sell at the immediate high or buy at the immediate low, that would be ideal, but in the world of markets, things rarely go that conveniently. People who want to liquidate quickly or cannot wait for the nearest highest or lowest prices end up saying, “Just dispose of it at the second-highest or second-lowest price,” and let go. That corresponds to the shoulder part of the second-highest or second-lowest price. And that is how the Head & Shoulders forms (Figure ②).