Talk with the administrator of "How to Start with Gentle IPO Stocks" about the appeal of IPOs for FX traders to start too! Low-risk IPO investing to grow assets

Hikkiya Profile

This site, "How to Start Easy IPO Stocks," is run by the administrator who explains basic information about IPOs, information about companies planning to go public, and activities to win. He started IPOs in 2005, and as of March 2019 had 143 wins and profits of over 24 million yen. He has also published and supervised numerous books on stock investing, such as "First-Year Stock Student: New Profits and Losses Explained" and "From Zero! Manga Stock Introduction," among others.

Official site:https://www.ipokiso.com/index.html

※This article is a reprint and rewrites of FX攻略.com July 2019 issue. Please note that the market information in the main text may differ from the current market.

Low risk with high returns expected

Editorial team: Please start by introducing the site.

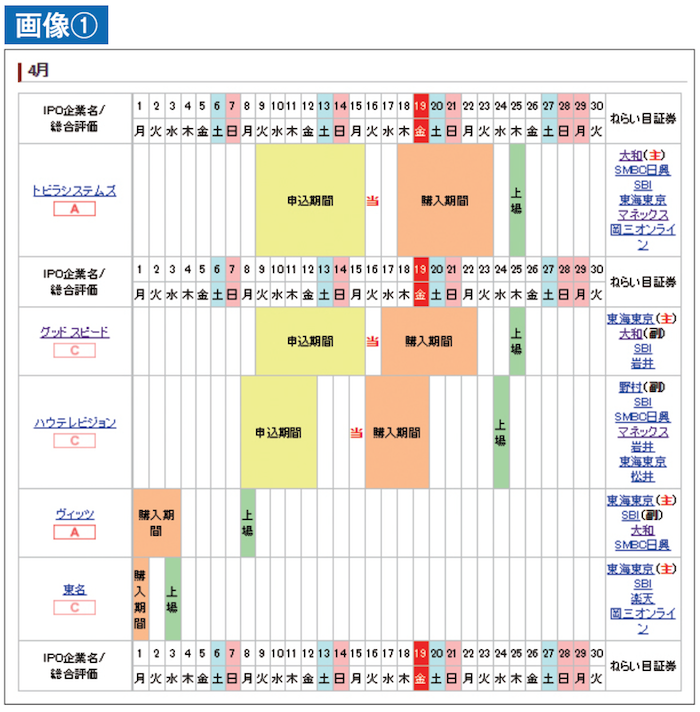

HikkiIn simple terms, this site comprehensively covers information and data related to initial public offerings (IPOs). The pages with the most access are the IPO Schedule (Image 1) and the IPO Company Information List (Image 2); next most accessed are individual company details. Overall, Google Analytics shows about 3 million visits per month.

Editorial team: 3 million visits is amazing. What is the gender and age composition?

HikkiMen make up 83.92%, women 16.08%. Age distribution: 18-24 years 4.13%, 25-34 years 26.73%, 35-44 years 33.56%, 45-54 years 17.69%, 55-64 years 10.59%, 65 years and over 7.30%. There are more men, and I think people in their 30s to 40s are the core audience.

Editorial team: It seems many people are looking to grow their assets in a stage when they have some financial leeway. Next, please tell us the魅力 of IPOs (appeal).

HikkiThe key point is that IPOs are easy to profit as long as you win the lottery. Last year, over 80% of the winning stocks were profitable when sold at the first price. Application for the lottery costs nothing, and even if you miss the lottery you only receive a notification saying you were selected as a miss. Even people who trade FX can take a subset of their surplus funds to participate in the lottery, and if you win, consider it a 'lucky' outcome. In terms of risk vs. return, risk is almost zero and returns are reasonable. However, applying takes some effort, so some investors skip it because it's a hassle, while others view it as a chance and take the challenge.

Easy to apply and high win rate are appealing

Editorial team: How much capital is needed for IPOs for beginners?

HikkiBasically, about 400,000 yen is enough to apply for almost all IPO stocks. With around 200,000 yen you can apply to about half of IPO stocks. If the public offering price is high, the returns increase proportionally, so it's better to try to raise funds and apply. Also, stocks priced at 100,000 yen or less have a very high win rate, making them good targets.

Editorial team: For IPOs with a public price of 100,000 yen or less, what is the win rate?

HikkiThe win rate is 97%.SiteThere are detailed data on the site, so please refer there if you want to know more.

Assessing risky stocks from data

Editorial team: Next, please tell us about past performance.

HikkiI have been applying for IPOs since 2005.

Editorial team: How many times have you applied in total?

HikkiI cannot say the exact total number of applications, but cumulatively I have won 143 times. By repeatedly selling IPO shares at the initial price, I have earned about 24.27 million yen in profits. In 2018 I won 11 times and earned 2.03 million yen; as of March 2019, I had won 3 times for a profit of 675,000 yen. Details are also introduced onSite.

Editorial team: It seems to be going smoothly, but were there any failures?

HikkiThere are about 2-3 failed stocks per year. Generally I don’t apply to stocks rated D on this site, but there have been occasional times when I thought 'this looks okay' for a D-rated stock and I applied and failed. Details of the evaluations areSiteon the site.

Editorial team: After all, low-rated stocks are more prone to failures. Since you have won 143 times, that would be roughly 10 wins per year, but you do not apply to all IPO stocks, correct?

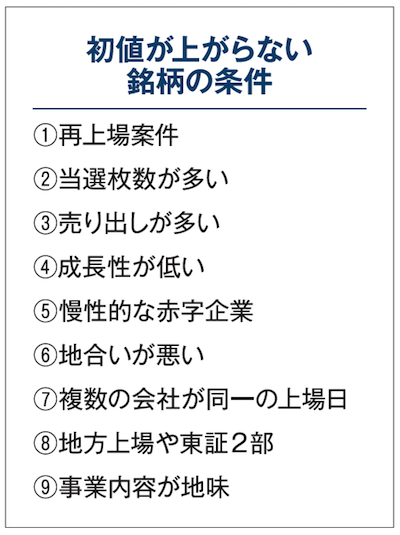

HikkiThere is data showing that the more criteria that match 'stocks whose initial price does not go up' (see upper image), the riskier it is. In particular, secondary offerings are very risky because they are unpopular with investors, so although there is a chance they rise somewhat, I choose not to apply due to the risk.

Editorial team: Which securities company do you apply through?

HikkiDifferent securities companies have different allocations for IPOs. Therefore, with larger capital I apply through the securities companies that are advantageous.