10 Steps to Make a Crab Trader-style FX a Pillar of Income — Step 2: Decide on the Timeframe That Fits Your Life

Kani Trader Profile

Kani Trader. Started YouTube Live on January 15, 2018. Streams all 12 hours of trading—from midday to late night—in real time. The themes are “Make money, in front of you” and “Make money, you in front of it too,” with all orders, stop orders, and entries disclosed every day.

Twitter:https://twitter.com/keibakinma

*This article is a reprint/rewriting of an article from FX攻略.com May 2019 issue. The market information written in the main text may differ from current market conditions, so please note.

Choose a time frame that makes trading easy

This month, we will explain how to fix the time frame you trade on. In short, you should decide the main time frame you monitor early on.

Charts in software like MT4 can display various periods from 1 minute to monthly charts, but you should fix which time frame you will trade on before you start FX seriously. More precisely, you should study trading methods that can be used with the chosen time frame.

For example, if you’re employed and cannot analyze trades or charts during the day, trading with 5-minute charts during that time won’t work. Conversely, a salaryman who can occasionally look at charts can implement methods using hourly or 4-hour charts. Once you determine your main trading time frame, you’ll understand the idiosyncrasies and characteristics unique to that time frame.

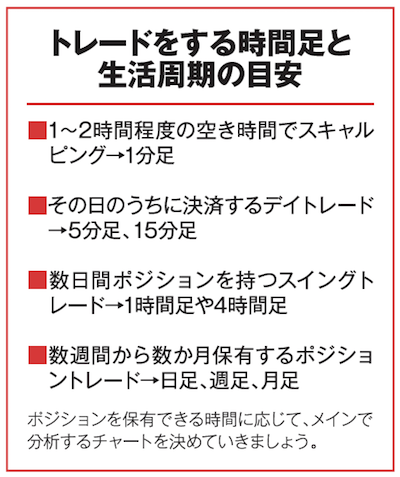

This kind of classification of trading styles by the time you trade is commonly referred to as scalping, day trading, swing trading, and position trading.