Monthly yen-dollar chart strategy: How much profit can you make by trading aiming for swap points ~ [Relaxed Forex]

This article is a reprint and revised edition of FX攻略.com’s July 2019 issue. Please note that the market information written in the main text may differ from current market conditions.

Profile of Yuttari Forex-san

Yuttari Kase. Individual investor. A “slow and steady trade” advocate with very few trades. Studying every day with the aim of achieving great success in FX. Holds accounts with various FX companies and is familiar with a wide range of services within the industry.

Official blog:FX Slow-and-Steady Trade School

Official blog:FX Real Trade Dojo

Verifying Swap Points for USD/JPY

In several past articles, we examined whether it is possible to trade with a swap-point target on the following currency pairs.

- South African rand/Japanese yen (high-interest-rate pair)

- Polish zloty/Japanese yen (a currency pair that is neither a developed nor an emerging market)

This time we will test a representative major currency pair, USD/JPY. Will aiming for swap points in USD/JPY function effectively?

Swap points for USD/JPY differ by FX broker. Therefore, this time as well we use data from “Click 365.” Click 365 has publicly released exchange rates and swap points since its service began, free of charge. It is very convenient for backtesting, so please feel free to use it as well.

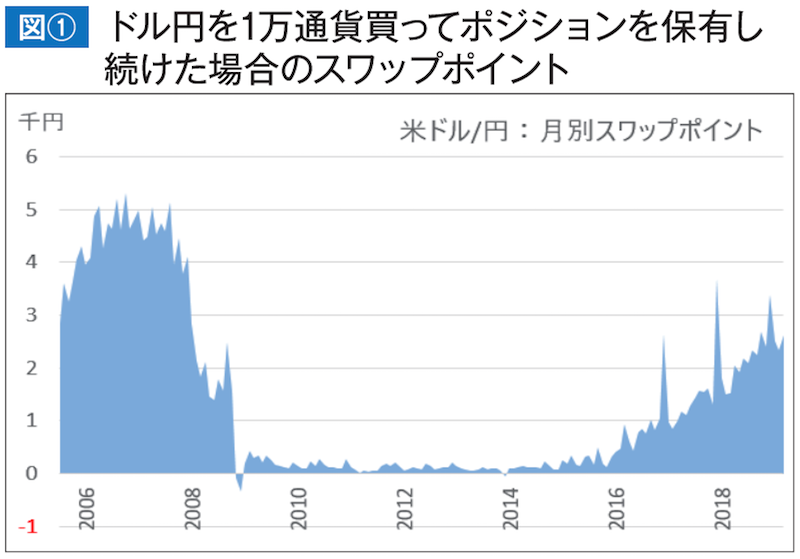

Now, Figure 1 shows the size of the monthly swap points when holding a position of 10,000 units of USD/JPY. Click 365 began offering services in July 2005, so the data starts from that point onward.

From the graph, the pattern is strikingly distinctive. The magnitude of swap points changes dramatically around the end of 2007 and thereafter. 2007 was the year of the subprime loan crisis. And in 2008, the Lehman Brothers collapse occurred. After a period of stagnation, from around 2016 the numbers gradually increased again.

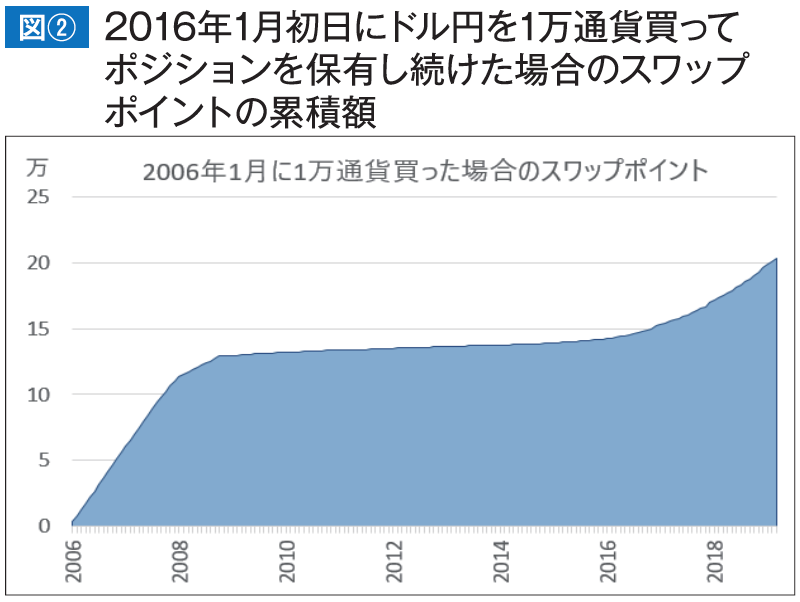

The cumulative swap points when buying 10,000 units on January 1, 2006 are shown in Figure 2. Initially the graph rises vigorously. Later it becomes almost flat, then rises again. Seen alone, this graph suggests there is little to lose by pursuing swap points on USD/JPY. However, there is also the impact of exchange-rate fluctuations on profits and losses. Therefore, please look at Chart 1, which shows the trend of exchange rates.

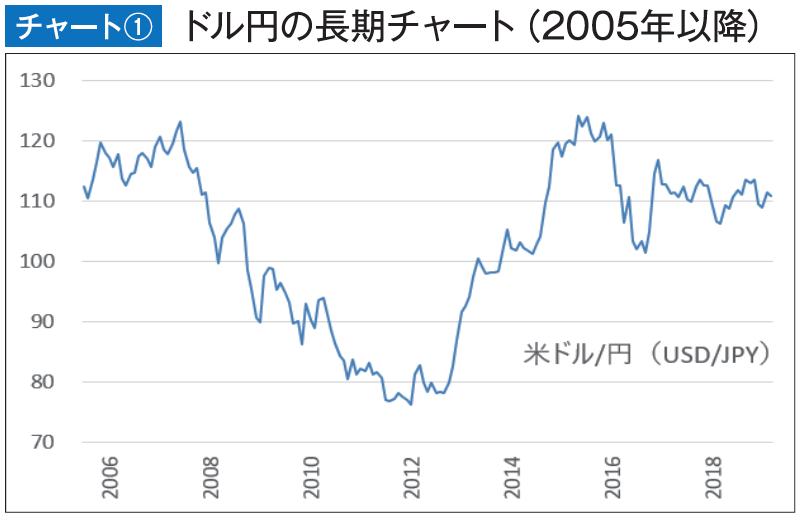

Around 2006, trading to buy USD/JPY and target swap points became popular, but from around 2007 the exchange rate began to appreciate yen-wise. During this yen-strengthening phase, a large number of positions taken to target swap points were likely to be stopped out. I was one of them. Consequently, this chart pattern is hard to forget.

Even though the yen appreciated, compared with the volatility of stocks and other assets, it was relatively mild. The reason is that the high in 2007 was in the low 120s and the low around 2012 was in the high 70s, meaning the exchange rate did not even halve. In other words, if leverage had been kept within twice, one could avoid forced liquidation while collecting swap points. In the ensuing yen depreciation period after 2012, it was possible to recover unrealized gains.