Will the rise in crude oil prices continue? [Ryuji Sato]

Profile of Ryuuji Sato

Sato Ryuuji. Born in 1968. After graduating from a U.S. university in 1993, he joined Genex Corporation (later Oval Next Co., Ltd.) after working at a marketing company, as an information vendor covering finance and investments. He has written analyst reports and been involved in trading on macroeconomic analysis, currency, commodities, and stock markets. Since 2010, he founded “H-Square Co., Ltd.”, writing analyst reports and planning/publishing works such as “FOREX NOTE Currency Handbook,” while also serving as a radio host for investment-related programs. Independent trader. Certified Technical Analyst by the International Federation of Technical Analysts. Main announcer on Radio Nikkei’s “The Money Doisato’s Market Forecast” (Mondays at 3:00 PM).

Official site:Ryuuji Sato Blog

※This article is a reprint/re-edition of an article from FX攻略.com July 2019 issue. Please note that the market information written in the main text may differ from the current market.

Rising Price of Crude Oil

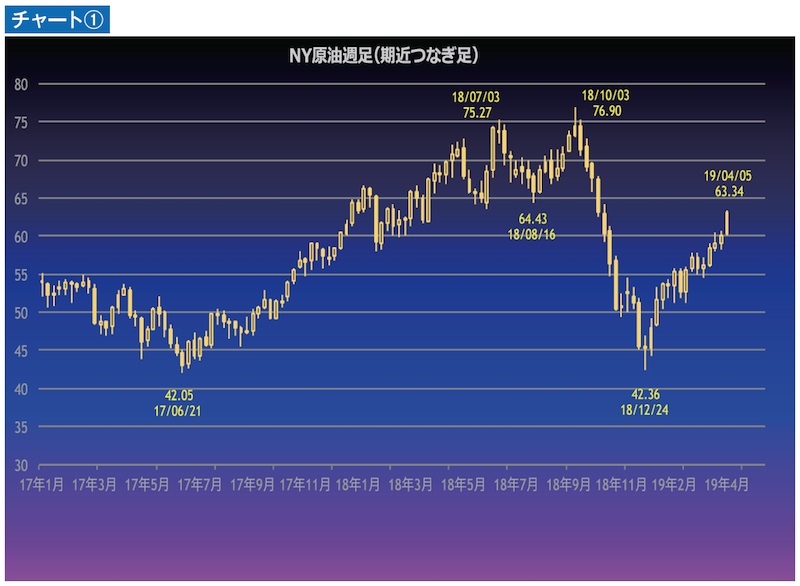

The crude oil market is testing higher levels. The WTI near-month futures, a representative indicator of crude prices, fell to $42.36 on December 24 last year due to global economic slowdown and intensifying U.S.-China trade tensions, but has since gradually risen, breaking through the $60 level that had capped gains by early April, and rising to $63.34 on the 5th (Chart ①).

President Trump has repeatedly pressed OPEC to increase production in an attempt to lower oil prices, but the effect has not been significant.

Street Contango Expanding

A notable movement in this crude oil rally is the widening contango in the futures market (near-month high, far-month low). In futures markets, typically, as delivery approaches, storage costs rise, pushing prices higher—this is called contango. However, when supply and demand are tight, there may not be enough near-term cargoes, leading market participants to secure as many cargoes as possible, which can cause near-month prices to be higher than far-month prices, a phenomenon called backwardation (or negative contango).

From Table ①, as of April 5, the NY crude oil futures curve shows near-month contracts in contango (rising from near month), but ICE Brent and Tokyo crude are all in backwardation. This pattern is also observed in other markets, such as Oman crude futures. This contango/backwardation relationship suggests that, if supply and demand remain tight and prices continue to rise, the market expects the tight conditions to persist and the uptrend to continue.