Foreign Exchange Online - Masakazu Sato's Practical Trading Techniques | Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [This Month's Theme | 2019 Market Outlook and Main Scenarios for Major Currencies]

Sato Masakazu Profile

Sato Masakazu. After working at a domestic bank, joined French Banque Paribas (now BNP Paribas Bank). Served as Interbank Chief Dealer, Head of Funding, Senior Manager, and others. Later became Senior Analyst at FX Online, which boasts the No.1 annual trading volume. Has been involved in the world of currency trading for over 20 years. Appears on Radio NIKKEI "Live Commentary on Stocks! Stock Channel↑", Stock Voice "Market Wide - Foreign Exchange Information," and regularly provides market information on Yahoo! Finance.

Nearly a month has passed, but the 2019 forex market is expected to be unstable due to the US-China trade war and concerns about global economic slowdown. That said, the US economy is still performing strongly. The pace of rate hikes is likely to slow, but given the absolute interest rate differentials, the main trend for this year is highly likely to be a dollar-firming environment. Let’s look ahead at the major currency pairs for 2019.

*This article is a reprint/edit of FX攻略.com’s March 2019 issue. Please note that the market information written in the body may differ from the current market.

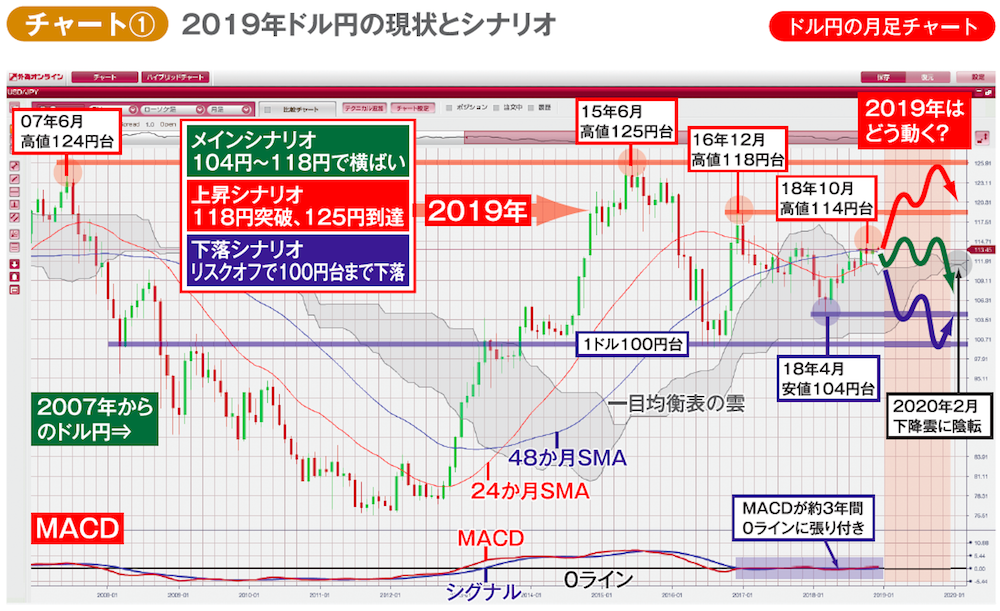

USD/JPY likely to stay in a 104–118 yen range. Is 100 yen a solid floor?!

Since this is the first issue of the year, let’s forecast the forex market for 2019. We will use long-term monthly and weekly charts. I will also consider which direction—up, sideways, or down—will be the main scenario.

The trend in 2019 is “US dollar strength.” When looking only at USD/JPY, price action tends to stay within a narrow range, and risk-off moves can push the yen higher, making dollar strength less obvious. However, when you view monthly and weekly charts of EUR/USD, GBP/USD, AUD/USD, NZD/USD, etc., on FX Online’s browser charts, each pair is either near the lower bound of a range or has broken below it, and since the latter half of 2018, the dollar has been rising distinctly.

President Trump has been in the spotlight, but the key theme for 2019 is whether “US dollar first” will persist rather than “America First.” Incidentally, it is notable that President Trump, who advocates America First, strongly dislikes a strong dollar, which is a crucial point of this theme.

In 2018, the driver of US dollar strength was none other than the US economy’s robust growth aided by Trump’s tax cuts. To prevent overheating, the Federal Reserve (Fed) continued raising rates, widening the interest rate differential with other currencies, which propelled the dollar higher. The biggest risk factor is the impact of US-China trade war spreading to the US economy as well. If Powell and the Fed signal halting rate hikes under Trump pressure, the end of the widening interest rate differential would become a factor pushing the dollar lower.

Of course, if halting rate hikes signals a revival of a “normal economy” and leads to higher stock prices, that could also support dollar strength. Conversely, if the US economy slows enough to force the Fed to pause, a rapid yen appreciation could occur.

Rate hikes and rising US long-term interest rates have both positive and negative implications for USD/JPY; in a sense, it’s a double-edged sword. Which way it will move depends on the market flow, so rather than overanalyzing theory, look at the charts and adopt a straightforward trend-following approach to price action.

Chart ① shows the long-term monthly chart of USD/JPY from 2007 with two moving averages (24 months and 48 months), the Ichimoku cloud, and MACD.

As of December 2018, USD/JPY rose from the April low in the 104 yen range to the early October high in the 114 yen range, rising above the Ichimoku cloud. It sits around the rising 4-year moving average. On a larger view, the main scenario for 2019 is likely a range-bound market within a very tight band bounded by the 118 yen high at the peak of the Trump rally in late 2016 and the 104 yen low thereafter.

Since April 2018, a gentle uptrend has continued, and in 2019 there is a scenario where USD/JPY could break through the 118 yen high of the Trump rally. If the Fed continues to hike and the US-Japan rate gap widens from the current 2% to the high 3% range, 120 yen could be reachable, but it is unlikely to rise to the 125 yen peak seen in June 2015 during the Abenomics era.

On the downside, the target area includes the 100 yen zone where Ichimoku clouds and previous lows converge. Considering the interest rate gap, unless the US economy falters sharply in 2019, the 1 USD = 100 JPY barrier appears to be a solid floor.