For the first time in 16 years, palladium overtakes gold [Ryuji Sato]

Ryuuji Sato Profile

Sato Ryuuji. Born in 1968. After graduating from a U.S. university in 1993, he joined a marketing company, then joined GeneX Inc. (later Oval Next Co., Ltd.), a information vendor for finance and investment. He has written analyst reports on macroeconomic analysis, foreign exchange, commodities, and stock markets, and has been involved in trading. Since 2010 he has founded H-Square Co., Ltd., writing analyst reports and planning/publishing works such as “FOREX NOTE Forex Notebook,” while also serving as a radio program caster in the investment field. Individual trader. International Federation of Technical Analysts – Certified Technical Analyst. Main caster on Radio Nikkei’s “The Money DoiSat’s Market Forecast” (Mondays 15:00–).

Official site:Sato Ryuuji Blog

*This article is a reprint and revised edition of FX攻略.com March 2019 issue. Please note that the market information written in the main text may differ from the current market.

Supply shortage is severe

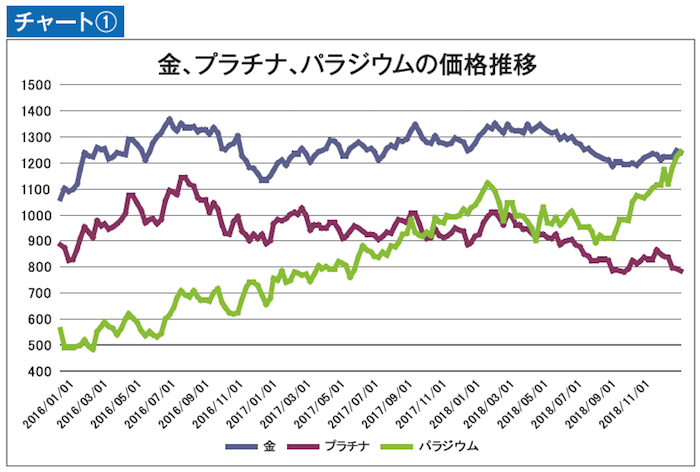

In the January 2018 issue, we reported that palladium had surpassed platinum, and we stated that palladium would continue to have a premium over platinum. However, palladium’s subsequent rise far surpassed expectations, and on December 5, 2018, it even surpassed the gold price for the first time in 16 years (see Chart ①). Now, let’s forecast palladium’s ongoing rise, current status, and future prospects.

It has been more than a year since we wrote about palladium in this page. For many readers, palladium may not evoke much recognition. Moreover, since investing experience with palladium is still relatively rare in Japan, here is a brief explanation of palladium first.

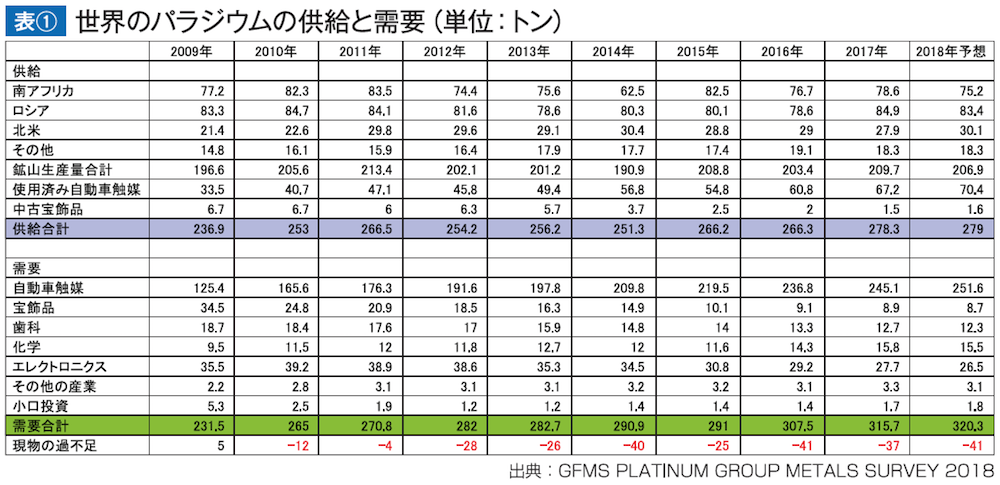

Palladium, like gold, silver, and platinum, is considered a precious metal, and its main use is in catalytic converters for gasoline-powered cars (diesel vehicles mainly use platinum). According to data from the research firm GFMS (Gold Fields Mineral Services) (see Table ①), global demand in 2017 was 315.7 tons, of which automotive catalytic converters accounted for 245.1 tons, about 77% of total demand. Other uses include electronic materials, dental materials, and jewelry materials.

On the supply side, the main producers in 2017 were South Africa and Russia, accounting for about 78% of mine production, and including North American mine production, over 90% of total production. When you add recycled used automotive catalytic converters, that becomes palladium’s total supply. Total supply in 2017 was 278.3 tons. Subtracting total demand of 315.7 tons from total supply of 278.3 tons yields a deficit of 37.4 tons, i.e., a 37.4-ton supply shortfall.

Palladium’s supply shortage has continued since 2010, and a supply shortfall of about 413,000 tons is expected in 2018. GFMS also predicts that approximately 320,000 tons of supply shortfalls will occur annually through 2020.