Nanaka Nonaka and aiming to become a seasoned trader! Learn FX with Nanamin

FX actress Nanami Nonaka is learning with FX specialist Yasushi Yamanaka to improve trading performance, studying with everyone what is necessary to profit in FX. This time, he will teach the basics of fundamental analysis in detail from scratch.

Click here for a list of serialized articles

【Table of Contents】Aim to be a fully-fledged trader with Nanamin at FX

Yamanaka Yasushi Profile

Yamanaka Yasushi. Joined American Bank in 1982, became Vice President in 1989, Proprietary Manager in 1993. Joined Nikko Securities in 1997, Deputy General Manager of the Foreign Exchange Fund Department at Nikko City Trust Bank in 1999. Founded Ascendant Co., Ltd. and served as Director in 2002.

Official Blog:Ascendant/Yamanaka Yasushi provides an FX information distribution site

Twitter:https://twitter.com/yasujiy

Nanami Nonaka Profile

Nanaka Nanami. Born March 17, 1997. From Fukuoka Prefecture. Works in films, stage, and commercials, and also has a regular program on Radiо NIKKEI, making her active as an FX actress. The blog updates daily trading activity.

Official Blog:FX Actress Arrives! Serious Real-time Trading Diary of New Actress Nanamin

Twitter:https://twitter.com/himnas03

※This article is a reprint/edit of an article from FX Challenge.com, June 2019 issue. Please note that the market information described in the text may differ from the current market.

What should we look at in fundamentals?

NonakaHello everyone. My name is Nanami Nonaka. From now on, I will learn various FX concepts from Mr. Yamanaka. I myself trade FX, so I’d like to study a lot. The first theme is “Fundamentals.” Please take care of us, Sensei.

YamanakaNice to meet you. This time we’re talking about fundamentals. Nanamin has been trading FX for about two years, so I’ll explain step by step what I actually look at in the market.

Various factors

YamanakaThis content covers fundamentals, flow, major markets and timeframes, interest rate markets, and peripheral markets—knowledge you should know when trading FX. And since financial markets involve many markets, we’ll focus on the interest rate market (image ①). So, what are fundamentals?

NonakaAre fundamentals broadly the economic indicators, statements by leaders like President Trump, and wars occurring somewhere summarized?

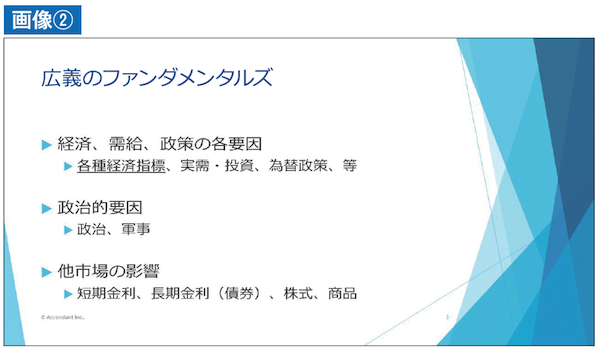

YamanakaYes. As Nanamin said, but fundamentally, what are fundamentals (image②). Broadly, there are the economy and the demand-supply (flow). Then there are policies and other factors. Among these, people worry most about various economic indicators. In particular, U.S. indicators are important.

Next is real demand, which means exports and imports. Then investment, like buying overseas companies. Also could include FX policy. In Japan it’s rarely used recently, but in other emerging countries interventions occur. Those are aligned with FX policy.

Other factors include political factors—this is politics. In the FX market and wider financial markets, military movements are a concern and can move the market. As for other markets, interest rate markets. Interest rate markets are broadly short-term and long-term rates; long-term rates relate to the bond market. There are also stock markets and commodity markets.

Even listing all these under the broad umbrella of fundamentals shows there is a lot involved. As with the concept of technical analysis and fundamental analysis, consider everything used in charts by technical analysis as part of fundamentals, and think of fundamentals as everything except the techniques used in technical analysis. So you can understand fundamentals as everything besides technicals.

The United States’ “Twin Deficits” that drew attention

YamanakaAs the first fundamental that moves the market, economic factors = various economic indicators are cited (image③). The indicators in focus change over time. What do you think is currently attracting attention?

NonakaU.S. employment statistics, perhaps?

YamanakaYes. Employment statistics were once highly watched, but recently they often don’t move the market much even when released. The reason is that unemployment in the U.S. has almost vanished. The Federal Reserve aimed for full employment, and we are now very close to it, so it’s less watched.

NonakaIndeed, the unemployment rate has remained in the 3% range for a while.

YamanakaYes. It remains low, a favorable situation with low and stable rates. Then what used to attract attention in the past was in the 80s and early 90s: the U.S. “Twin Deficits,” namely the fiscal deficit and the trade deficit. Particularly the fiscal deficit depended on the U.S. to do its part.

The trade deficit was notable when Japan’s trade surplus was prominent; every time a trade deficit was announced, especially when the U.S.-Japan deficit was large, the dollar would be sold and the yen bought. Now attention has turned to U.S.-China trade negotiations under President Trump, and since it is March, we are likely to see a final agreement within this month. After April, with the start of the U.S.-Japan trade talks, there may again be focus on the trade deficit. I will touch on other indicators that have historically drawn attention as well.