Active forex traders discuss with the talked-about person: Trader’s interview — Guest Tametame Part 1 [Traders Securities Minna no FX Iguchi Yoshio]

TamaTama-san Profile

He dropped out of a famous university and has zero real-world experience. An unusual background: from pachinko pro to FX trader. He started FX in 2009, was driven to below 1 million yen assets, but he recovered splendidly and by 2012 earned 20 million yen, and by 2016 over 100 million yen in profits.

Iguchi Yoshio-san Profile

Iguchi, Yoshio. Trader’s Securities Market Division, Dealing Section. Certified Technical Analyst. Since 1998, he has worked in financial institutions, mainly involved in cover dealing in the commodities markets focusing on precious metals and oil products. From 2009, he has been at Minna no FX, focusing on dealing in USD/JPY and major European currencies. He is proficient in forex analysis from a fundamental perspective and is also well-regarded for short-term predictions using technicals. Recently, he has appeared in Minna no FX’s free online seminars, where his easy-to-understand lectures have been well received. Additionally, on Twitter, professional dealers share real-time opinions on the market, so be sure to check it out.

Twitter:https://twitter.com/yoshi_igu

※This article is a reprint and rewrite of an article from FX Koukaido.com, June 2019 issue. Please note that the market information written in the text may differ from the current market.

Earn Billions with Only Candlesticks!

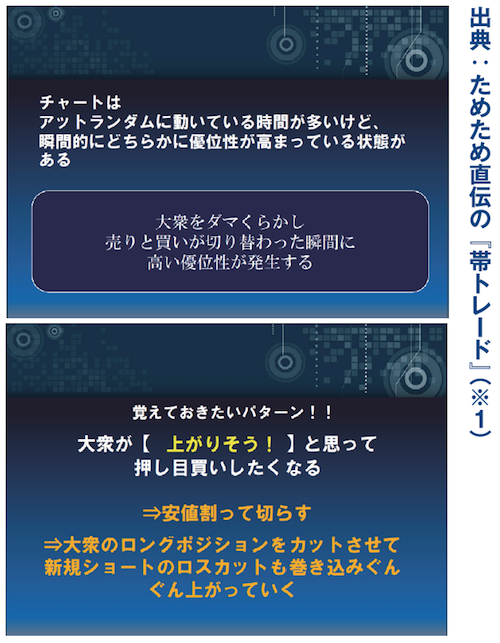

Iguchi: TamaTama-san is a billion-trader whose online seminars on Minna no FX fill up immediately. I think everyone is curious about what kind of trades he makes. So I’d like to ask: previously you said you “aim at where the crowd is deceived.” Specifically, what do you mean by that?

TamaTamaI target moves after individual investors get their stops hit. They move big after being squeezed out, so I try to ride that. For example, individual investors who keep longing are shaken out, and after that, a stronger rise comes. I capture that rise.

Iguchi: In textbooks, trend following is taught where highs and lows are rising. That’s a different approach.

TamaTamaWhen highs and lows are rising, you never know when you’ll be faked out, and where to lean on your back. Therefore, I rarely do trend following in such cases. I follow the trend after there’s a move that shakes out the crowd.

Iguchi: That’s when the crowd is fooled. Then, what indicators do you use?

TamaTamaI use nothing, just candlesticks. Do you use anything?

Iguchi: I also only look at candlesticks. On daily charts I check moving averages, but only selectively, focusing on areas that seem functional. After all, for the shorter timeframes where you enter, indicators become a hindrance, so I stopped looking at them. Is there a reason TamaTama stopped using indicators?

TamaTamaThere was a time I used indicators, but I realized indicators’ signals aren’t what moves the market. Since then, I’ve focused only on candlesticks.

Iguchi: Many traders trade only with candlesticks. So, how long do you hold positions?

TamaTamaIf things go smoothly, about 5 minutes. Sometimes I hold longer.

Iguchi: When scalping, how do you view fundamentals?