Ask Max Iwamoto about the essence of moving averages that even beginners can understand | Episode 2: Please tell me about the Granville's Rule

In the previous issue, we explained the construction of moving averages, how to adopt their parameters, and the basics of single-line analysis such as the Golden Cross and Dead Cross. This time, we will explain “Gravell's Law” proposed by Mr. Grandville, and from a more practical perspective, let Max Iwamoto-san teach you how to find easy-to-understand buy and sell points even for beginners.

Note: This article is a republication/edit of FX Koukaido.com’s June 2019 issue. Please be aware that the market information stated herein may differ from the current market.

Max Iwamoto Profile

Iwamoto Keisuke. As the nickname “Technical Analyst with a middle-school diploma,” he is rarely seen in the analyst industry with no formal education. Even in today’s strongly credential-driven society, he fights daily in the FX market where such backgrounds do not matter. With the belief that now is the time when anyone can start FX easily, he serves as a serial writer and seminar lecturer to help people steadily acquire winning techniques.

Understanding eight trading signals is important

Last time we explained the single-line analysis of the moving average, which is perhaps the most popular form of technical analysis. Next, we will explain “Gravell's Law.” In FX seminars, many instructors start by talking about Gravell's Law when they mention moving averages, but I believe it is more correct to first thoroughly understand the original concept and single-line analysis before learning Gravell's Law, so I am presenting it in this order.

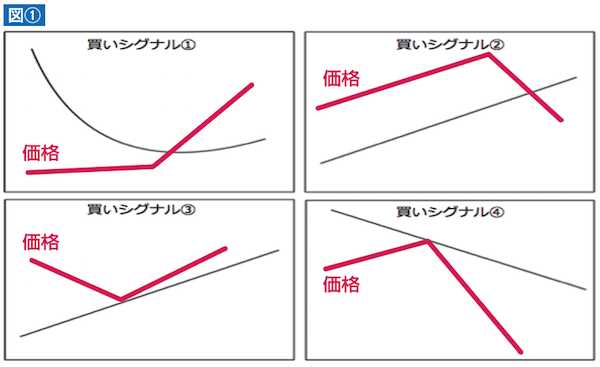

Gravell's Law refers to the eight trading signals (Figures 1 and 2) recommended in the book published by Gravell in 1962. There are four buy signals and four sell signals, making a total of eight trading signals, which I will explain in order. Although entry points may look similar yet occur in different market contexts, they all share that they are signals capturing the characteristics of moving averages.

These are Gravell's eight trading signals. In buy signals, the moving average tends to slope upward, and in sell signals, it tends to slope downward. Signals ④ for buying and ⑧ for selling are special, but keep in mind the rule that when the price breaks down below the moving average, or breaks out too far above it, the price tends to return to the moving average.