Forex Online・Masakazu Sato's Practical Trading Techniques|Technical and Fundamental Analysis Predicting the Future of the 3 Major Currencies [This Month's Theme|Now is the Time to Pay Attention as Recession Concerns Loom! 2019 Fundamentals]

Profile of Masakazu Sato

Sato Masakazu. After working at a domestic bank, he joined the French Paris Banque (now BNP Paribas Bank). He has served as Interbank Chief Dealer, Head of the Funding Department, Senior Manager, and other roles. Later, he became the Senior Analyst at the Foreign Exchange Online, which boasts the No.1 trading volume annually. He has been involved in the world of foreign exchange for over 20 years. He also appears on Radio NIKKEI's "Stock Live Commentary! Stock Channel Up," Stock Voice's "Market Wide - Foreign Exchange Information," and regularly distributes market information on Yahoo! Finance.

The US-China trade war is also negatively affecting the once-booming US economy. With the economy at a turning point, 2019 is expected to see even more focus on the fundamentals. In this issue, we introduce the major US economic indicators and explain which indicators are hot right now. The keyword is “numbers that are bad rather than good.” It is important to watch out for negative surprises that signal an economic downturn.

*This article is a reprint and revised edition of an article from FX攻略.com's June 2019 issue. Please note that the market information described in the main text may differ from current market conditions.

Outlook and possible responses for US long-term interest rates, which have a strong influence on USD/JPY

Due to the US-China trade war, concerns about an economic slowdown are spreading. In the latter half of 2019, it can be said to be a year of fundamentals where attention will be on economic indicators and statements by central bank presidents of various countries.

The direct factors that move exchange rates are investors’ buying and selling actions. When buyers and sellers enter or exit positions, take profits, or cut losses, price movements occur. The supply-demand balance among buyers and sellers is inferred through technical analysis, which uses past price movements to forecast the future. However, many reasons why investors act come from changes in fundamentals. It is worthwhile to know what major economic factors are having a significant impact on the forex market in 2019.

For example, during the boom before the Lehman Brothers collapse, consumer price indices and retail sales, which signal inflation and could lead to central bank rate hikes, were the focus of investors. After the Lehman collapse, employment statistics that show the progress of economic recovery became the “star” indicators. Major economic factors that directly affect investor behavior change with the era and economic conditions.

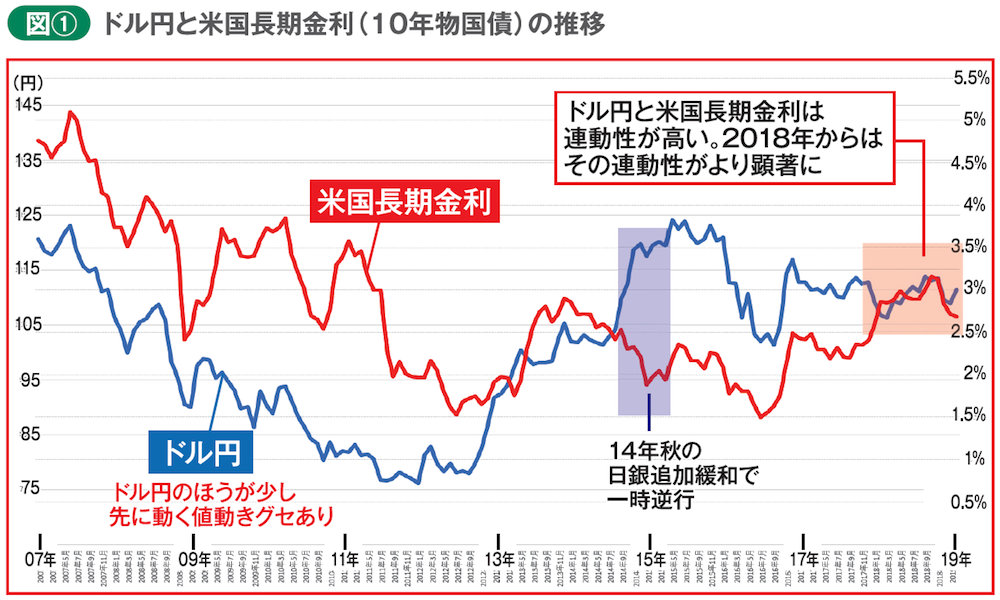

And currently, the fundamental factor with the greatest influence on USD/JPY is the US long-term interest rate. Figure 1 shows the trend of USD/JPY since 2007 alongside the yield on the 10-year U.S. Treasury, a representative long-term rate. Long-term rates have always had a major impact on exchange rates, so their coupling is clear. There was a period around August 2014 to April 2015 when they briefly moved in opposite directions, due to Japan’s fiscal stimulus in October 2014 lowering long-term rates in Japan more than in the United States. The US long-term rate is currently fluctuating around 2.6%, but the market consensus of “no rate hikes within the year” is suppressing any rise in rates.

Among investors, there is a solid view that “unless there is a large external shock, the United States will not enter a recession. The strong U.S. labor market is starting to push wages higher, and steady consumer demand supports corporate pricing power.” If U.S. long-term rates recover again into the 3% range, USD/JPY could target the 115 level. The U.S. budget deficit is widening, and from a supply-demand perspective, rate rises are becoming more likely. However, if U.S. long-term rates rise too rapidly, higher rates could cool corporate earnings and the economy, leading to a sharp stock sell-off and a rapid move to stronger yen and weaker dollar. In January 2018, U.S. long-term rates rose above 3%, and in October reached the 3.2% range, spurring a stock crash. The USD/JPY, which had been around 114- level at its peak, fell as well.

Since the start of 2019, indicators showing the U.S. economy’s weakness have stood out, such as December retail sales down 1.2% month-on-month in February and February employment data showing only 20,000 new jobs in March—the slowest gain in 1 year and 5 months. With the unclear path of the US-China trade war, U.S. long-term rates have declined to around the 2.6% level, which has restrained further upside in USD/JPY.

Considering the continued tendency for U.S. long-term rates to decline, USD/JPY is more likely to move downward. Still, rate declines are not limited to the U.S.; many major economies, including Japan, Germany, France, the U.K., and Canada, are also seeing rate reductions, suggesting a global slowdown. Although U.S. long-term rates have fallen, they are still in the 2.6% zone, maintaining the status of a high-interest-rate currency comparatively. If USD/JPY shows low volatility and limited price movement, holding dollars can be advantageous, and the “yen carry” could support the decline in USD/JPY.