What will happen? The United States' hardline trade policy, deceleration of growth in China and Europe, and the turmoil of Brexit in the UK [Jiro Ota]

Jiro Ota Profile

Ohta Jiro. FX Strategist. Began FX trading in 1979 at The First National Bank of Boston Tokyo Branch. Later worked in corporate forex dealing at Manufacturers Hanover Trust Bank, BHF Bank, National Westminster Bank, and ING Bank, then moved to retail FX, worked in sales at GFT Tokyo, then gained experience as a Market Strategist. Currently active as an individual investor.

*This article is a reprint and re-edit of an article from FX攻略.com, June 2019 issue. Please note that the market information stated in the text may differ from the current market.

Persistent U.S. Trade Deficit

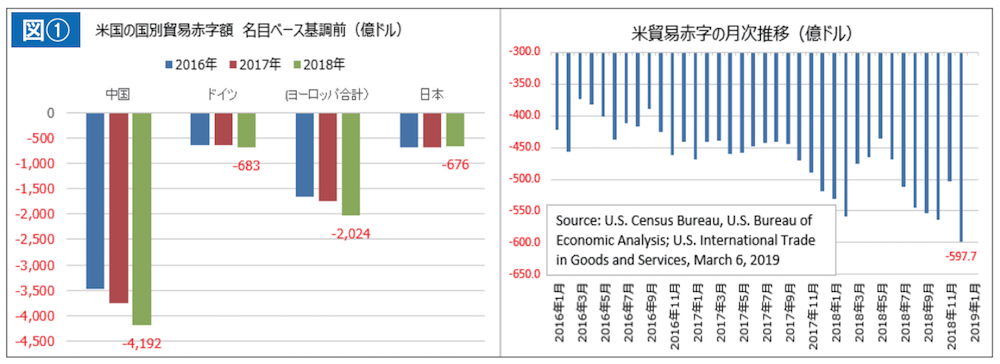

According to the 2018 trade statistics (customs basis) released by the U.S. Department of Commerce on March 6, the trade deficit, calculated as the difference between exports and imports of goods, reached about $878.7 billion (approximately 98.24 trillion yen), up 10.4% year over year despite the implementation of significant U.S. tariffs, and set a new all-time high beyond 2006’s approximately $828 billion.

In the latest 12 months of U.S. trade statistics, looking by country for the U.S. trade deficit in 2018, the deficit with China is the largest and appears to be widening. Deficits with Germany and Japan follow with modest increases or decreases, but deficits across Europe as a whole show a widening trend (see Figure 1).