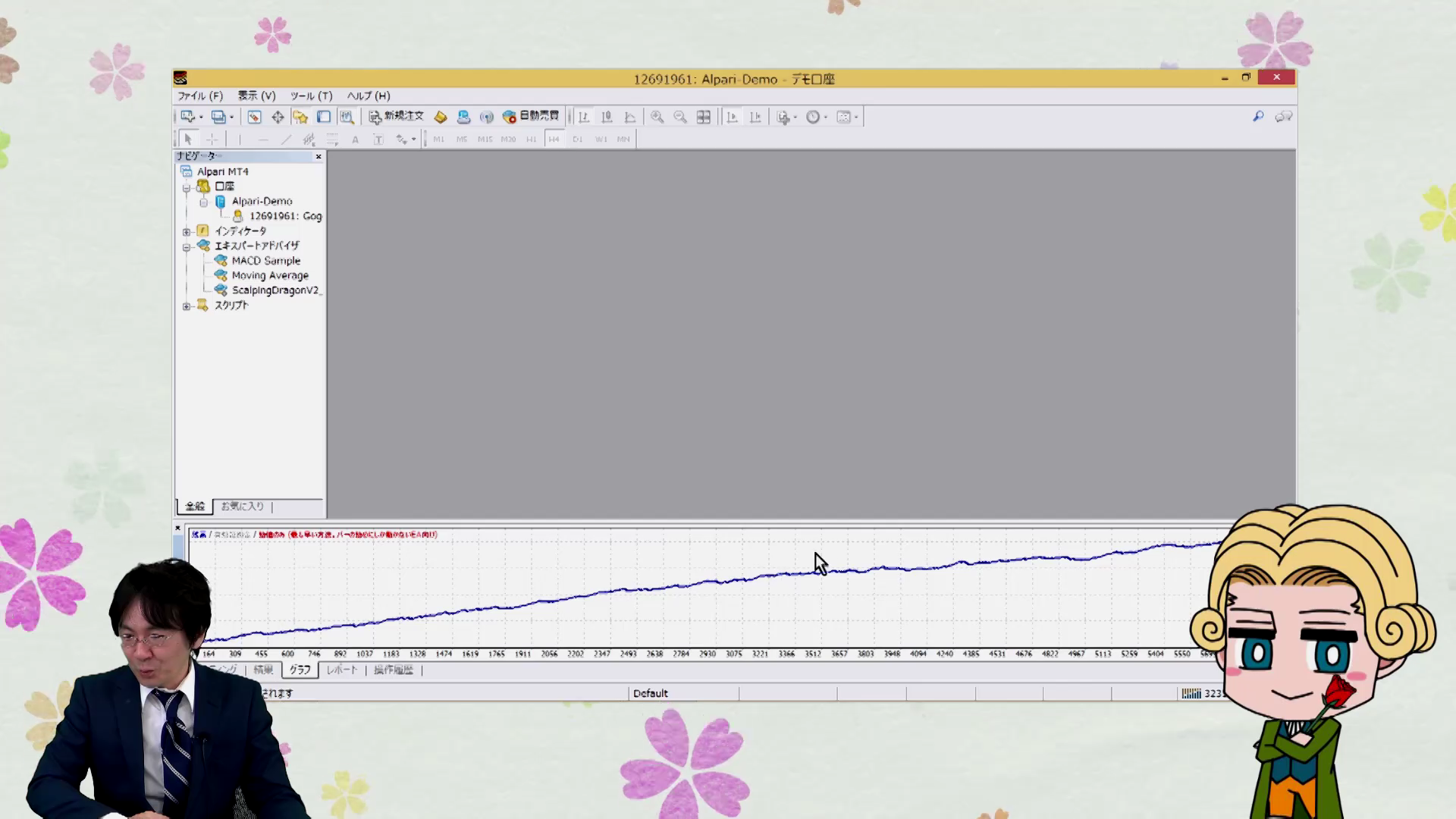

[Video] It's Too Late to Ask! How FX Nobles (FX Kizoku) Backtests EA from 1999 to Present - Explained

Once you get an EA, it’s an auto-trading rule of thumb to always run a backtest before operating with real funds. But the method for backtesting is surprisingly tricky.

So in this video, FX Noble kindly teaches the method of performing backtesting from scratch in detail. Moreover, you can conduct ultra-long-term tests from 1999 to the present, so if you’re serious about building a portfolio, this is definitely worth watching! (Interview: FX攻略.com Editorial Department Ebizawa)

What you can learn from this video

In this video, you will learn the following:

- Which account is best for backtesting?

- How to obtain historical data

- Backtesting settings

- How to interpret the results?

- How to save reports

- How to change parameters

- Try it yourself!

Video length: 11 minutes 43 seconds

FX Noble profile

Transitioned from discretionary trading to automated trading, and since 2017 has been an EA developer listed on GogoJungle. Among his flagship works, “Scalping Dragon,” the total number of EA sales exceeds 1,000. He shares information about automated trading on his blog and Twitter.

Official Blog:FX Noble’s EA Development Blog

Twitter:https://twitter.com/yenpetit

A note from the editor in charge, Ebizawa

Backtesting is very important, but the method is often tricky and confusing for many people, so please study with this video.

Also, when backtesting on ordinary MT4, data often only covers the most recent few years. This video shows how to use a certain MT4 to perform ultra-long-term backtests dating back to 1999.

How to view FX method videos

For readers who purchased the article, the FX method video is embedded at the bottom of this article. Click the play button to start the video.