【Understandable Buy Signal】 Chart pattern appearance is a sign for entry! Classic trend-following method using 20 EMA [Tomorani Saito]

This article is a reprint and revised edition of FX攻略.com's April 2019 issue. Please note that the market information described herein may differ from the current market conditions.

Tomorani Saito Profile

CEO of FX School Win-invest Japan Co., Ltd. Provides daily support to students and distributes advisory information services. He conducts numerous seminars at various financial institutions, including seminars at Himawari Securities, JFX no Hoshino’s Room, and Traders Securities, among others. He also writes daily market reports for Himawari Securities. His book is "FX Day Trading" published by Pancake Rolling (Pan Rolling).

Key Points of the Strategy

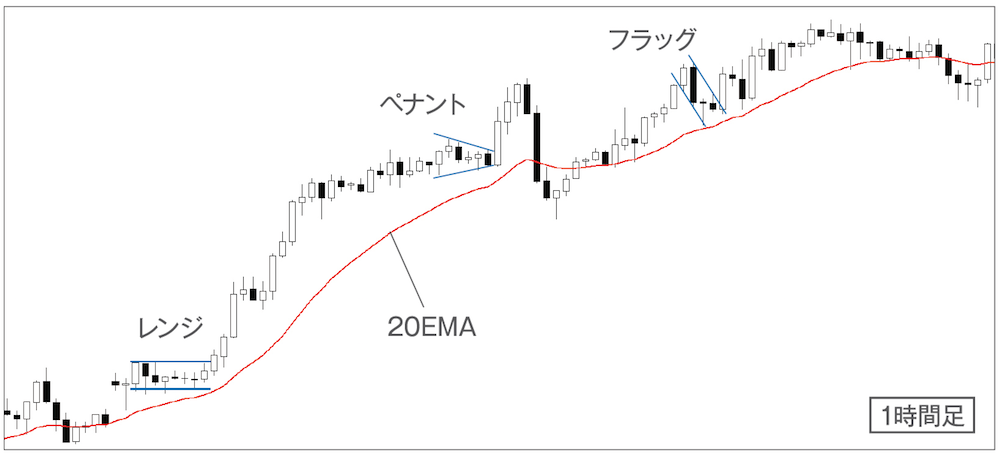

- Technical: Moving Average (20 EMA)

- Trading Timeframe: 1-hour chart

- Target currency pair: USD/JPY

- Benefits of this strategy: ride large trends, clear take-profit and stop-loss

New

- On the 1-hour chart, ensure price is above the 20 EMA and that the 20 EMA is sloping upward (indicating an uptrend)

- When a chart pattern appears, enter at 5 pips above the upper line plus 1 pip for the spread

Settlement

- Place a stop-loss order 5 pips below the most recent low

- Place a take-profit order at the same distance as the stop-loss

Note: The "Key Points of the Strategy" and the body text are explained assuming a long position in a rising market. In a falling market, the rules are the opposite for short positions.