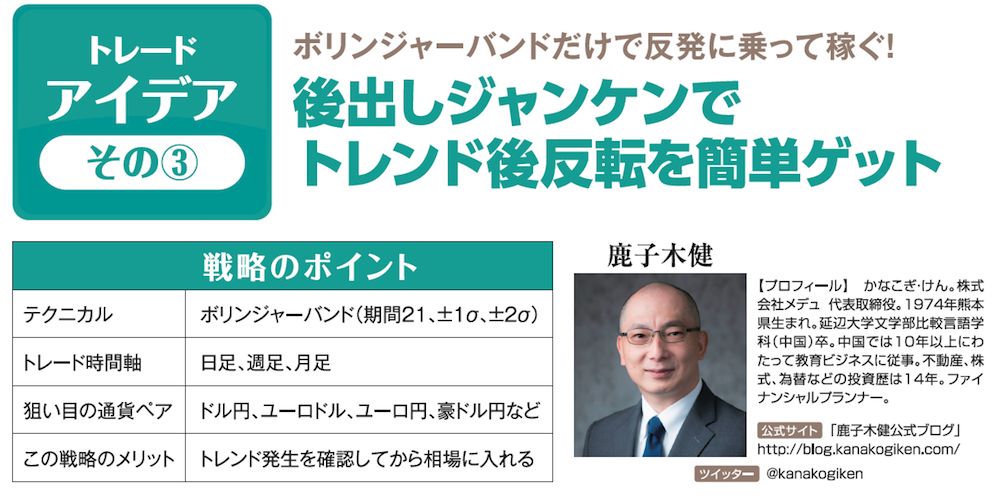

【Everyone Can Understand Buy Signal】Make money by riding rebounds with only Bollinger Bands! Easily catch post-trend reversals with late-stage same-signaling [Ken Kanekoki]

※This article is a reprint and edit of FX攻略.com May 2019 issue. Please note that the market information described herein differs from current market conditions.

Ken Kanako Profile

Kanakogi Ken. President & CEO of Medu Co., Ltd. Born in Kumamoto Prefecture in 1974. Graduated from the Department of Comparative Linguistics, Faculty of Literature, Yanbian University (China). Has been involved in the education business in China for more than 10 years. Investment experience in real estate, stocks, and foreign exchange is 14 years. Financial planner.

Official site:Ken Kanakogi Official Blog

Twitter:https://twitter.com/kanakogiken

Key Points of the Strategy

- Technical: Bollinger Bands (period 21, ±1σ, ±2σ)

- Trading timeframes: daily chart, weekly chart, monthly chart

- Target currency pairs: USD/JPY, EUR/USD, EUR/JPY, AUD/JPY, etc.

- Advantage of this strategy: enter the market after confirming the trend

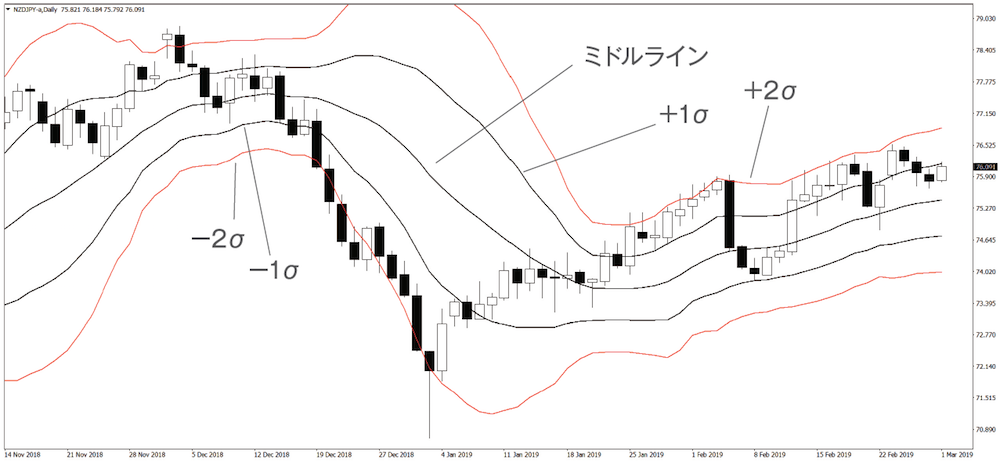

Using Bollingers to Judge from Trend Reversal to Exit

New

- Between -1σ and -2σ, the candlesticks have walked the band for 9 or more bars

- Buy if the close price breaks above -1σ

Exit

- Take partial profit at the middle line. The remainder aims for +1σ to +2σ

- Cut losses at -2σ or at the most recent low

※The “Key Points of the Strategy” and body text assume a long position in an uptrend. For a downtrend, the rules are the opposite for shorting.