Strategy to 1000x-activate a Crab Trader's YouTube stream|Episode 2 Why do many people lose in FX to begin with?

Kani Trader Profile

Kani Trader. Began YouTube Live on January 15, 2018. Streams all of his trades live for 12 hours from afternoon to late night. Under the themes “Make money, right before your eyes” and “Make money, right before your eyes, too,” he publicizes every limit order, stop order, and entry every day.

Twitter:https://twitter.com/keibakinma

*This article is a reprint/re-edit of an article from FX攻略.com January 2019 issue. Please note that the market information written in the main text may be different from current market conditions.

Hello everyone. I am KazuYoung, also known as Kani Trader. Today I would like to explore the question, “Why do so many people lose in FX in the first place?”

What is the win/loss ratio in FX?

How many people are actually winning in FX? On the internet you’ll see articles saying things like “the winners are only about 10%, most lose” or “individual investors end up losing.”

First, let’s look at the distribution of trading styles. When there was talk of an upcoming 10x leverage restriction, we looked at materials presented at an expert panel.

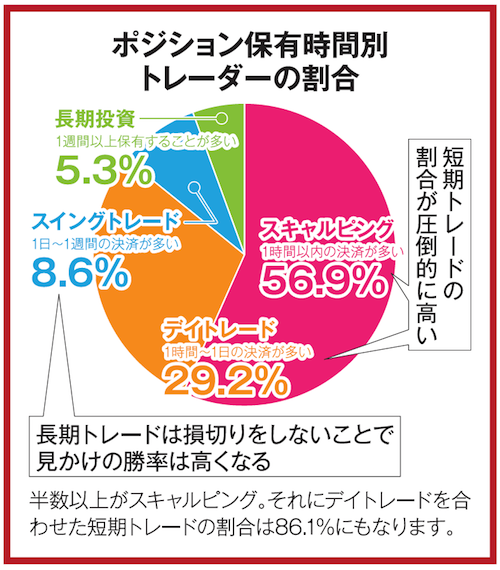

Looking at “Percentage of traders by position-holding time,” about 86% of FX traders engage in short-term trading.

And the annual proportion of people who win in FX was around 40–50% according to statistics. I think this is higher than many would imagine.

However, among the winners, many are long-term traders who hold positions for Swing or longer. The reason is simple: they tend not to cut losses. If you don’t cut losses, you can tolerate drawdown and still have several profitable closes per year, resulting in overall profit.

Therefore, the current majority of short-term traders, the winners, are likely around 20–30%. However, this 20–30% earns far more than the long-term traders, and the remaining 70–80% tend to suffer large losses or exit the market.