How the Trade Team of Ancient Earnings Works|Episode 6 Four Years of No Loss!! Long-Term Repetition Trading: How to Select Currency Pairs PART II Why Choose the Swiss Franc? [Okachan-man]

Okachanman Profile

Born in Fukuoka Prefecture in 1980. Hobbies include news searching and going out for drinks. Special skill is not sleeping. Began FX in 2011 and now leads a comfortable life as a full-time trader. Possesses strong intellectual curiosity and exceptional information gathering and analytical abilities. Recognized for these abilities by the “Trading Team Inishie,” becoming a core member of the team. Proficient in trades centered on swing trading based on fundamental analysis.

Inishie-ryu FX Blog:Fundamental Trade

※This article is a reprint/rewriting of an article from FX Tactics.com May 2019 issue. Please note that the market information stated in the text may differ from current market conditions.

Reading the Central Banks’ Motives

In the previous article, we found that there is an advantage to the buy strategy on the Swiss franc cross, but it is crucial whether the strategy aligns with the Swiss central bank’s intentions.

In conclusion, AUD/CHF, NZD/CHF, and CAD/CHF are unlikely to rise further in francs, so the downside is limited. This is ideal for repeater-type trading. Here, I will explain why. I would like to look back at the Swiss National Bank’s policy over the past 10 years.

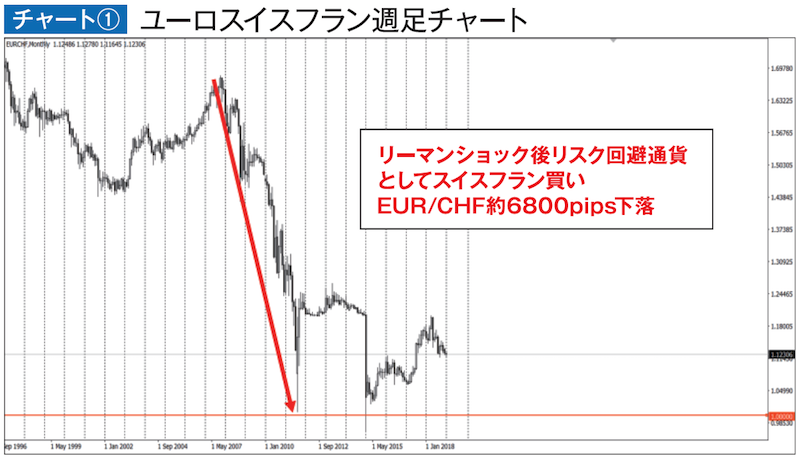

After the 2008 Lehman Shock, safe-haven currencies the yen and the Swiss franc were bought (Chart ①). If Japan experiences extreme yen strength, export companies suffer greatly. Switzerland would also be hit hard by an extreme CHF appreciation. Why is CHF strength so damaging to Switzerland? It lies in Switzerland’s geography.