"Before reducing the loss, fix how you break."

Many methods

think first about how to win.

But the cause of collapse is always

the failure to decide how to lose.

Even a small reversal

and you wait to see how it goes.

Wait a little longer.

It might return.

That ambiguity

turns small losses into a large collapse.

So decide in advance.

If two back-to-back reversal candles appear,

consider the end price as the "broken position."

If you break through there with the close, it's over.

No exceptions.

When where you lose is fixed,

people can finally focus on winning.

You don't have to try to win through clever stop-losses.

If it breaks, it's over—that's all.

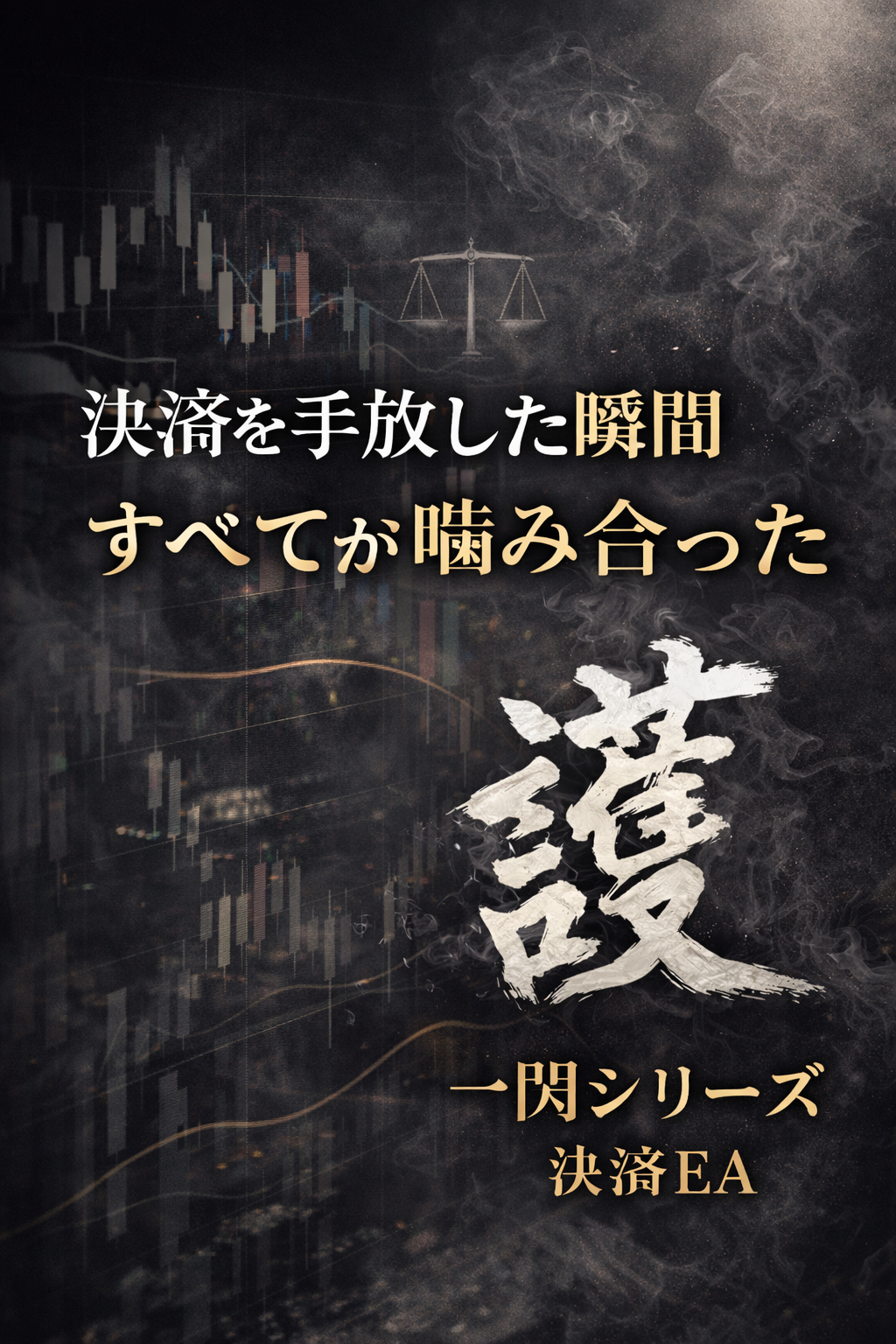

When the way you lose becomes consistent,

trading stops being emotional and becomes structural.

× ![]()