A potential to target an annual yield of 100% with GOLD is coming into view even with low-risk neglect.

【Operational Comparison】Fixed 100,000 yen lot vs 1,000,000 yen 1% risk compound interest

〜Even with the same logic, the way it grows and the way it protects differ〜

This time, while testing the in-development EA “Cassiopeia,” one interesting finding emerged.

It isthat even with the same logic, simply changing the operation method can make it look like a completely different thing.

Cassiopeia is more of a

“not driven by win rate” type,

a logic that aims to extend profits when a trend appears and be less prone to drawdowns during stagnation.

That is why,

the strengths being utilized clearly differ depending on the trading style.

⸻

■ Tried the USD/JPY logic on GOLD and it turned out surprisingly good

Originally Cassiopeia isa logic that was being optimized for USD/JPY.

However, I suddenly

thought,

“Would this work on GOLD as well?”

“Maybe it would fit better with recent price movements?”and, I ran a backtest on GOLD with about one year of data.

Then, more than I imagined

it began to behave in a way that seems to fit the current market.

⸻

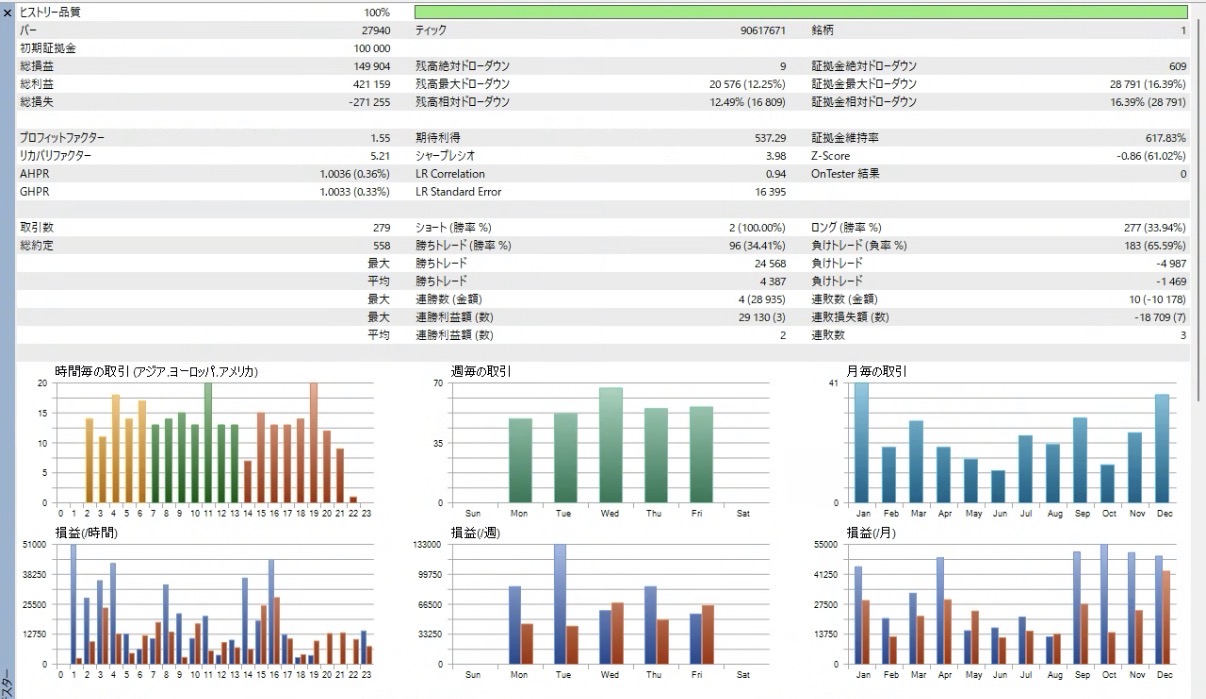

①Fixed 100,000 yen × 0.01 lot (solidly "watching for patterns" approach)

First, the simplest fixed-lot operation.

This is in a sensean operation to discern the personality of the logic.

The good thing about fixed lots is that

the lot size does not change even when the market is volatile,

so the reasons for winning or losing remain visible without fluctuation.

The curve is easy to understand,

profits grow when a trend appears,

and during stagnation, gains and losses tend to settle around zero to a small profit.

In other words, this is more about validating that you can act when moves occur rather than aggressively increasing exposure.

It is quite excellent as an operation that confirms “not forcing increases, but taking what moves occur.”

—

②1,000,000 yen × 1% risk compound interest (“make the operation viable” operation)