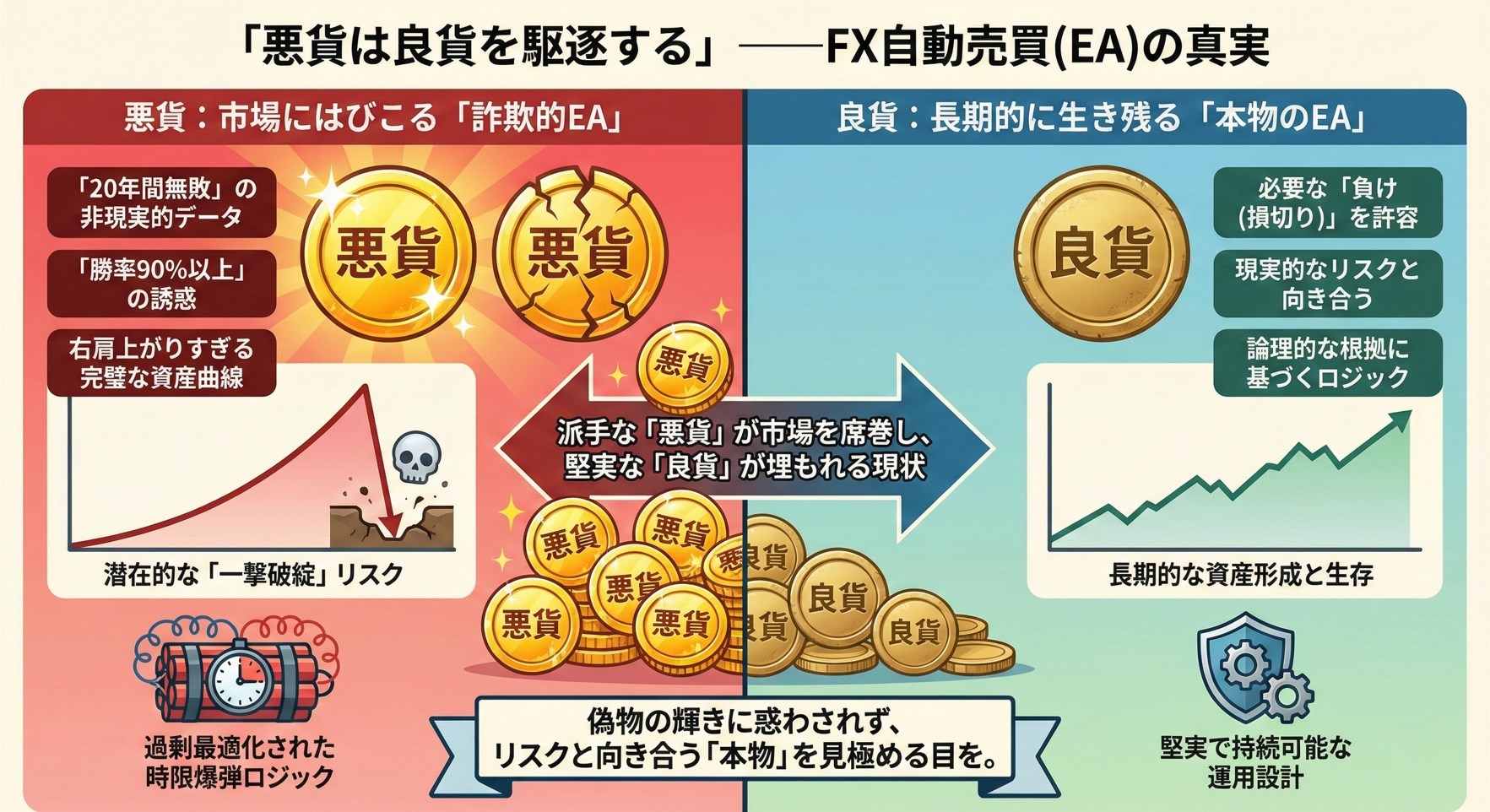

"Bad money drives out good money" (Thomas Gresham)

A passage from 16th-century economist Thomas Graunt? Actually Thomas Graysham? The famous "Gresham's Law." Wait, correct historical figure is Thomas Gresham. The line reads: "Gresham's Law," proposed by 16th-century economist Thomas Gresham.

It refers to the phenomenon that when bad money (the lower-quality currency) circulates, the higher-quality money (good money) is hoarded, and only bad money remains in circulation.

In fact, right now, even in today's modern FX automated trading (EA) industry,

I can't help but feel that the exact same thing is happening.

The Identity of the “Bad Money” in the FX Industry

By “bad money” I mean fraudulent EAs that lack substance. They parade seductive promises to inflate investors' expectations.

・ Unrealistic backtests claiming “20 years of no losses”

・ Astonishing figures like “90% win rate”

・ An up-right, almost flawless equity curve

At first glance these EAs appear perfect.

But behind them lies a terrifying trap.

Their true nature is forcing past market data to fit a model

— overfitting.

Even if they seem to have no losses, they secretly carry

a potentially catastrophic drawdown that could wipe out the entire account in a single blow.

With just one unexpected event, not only profits but your entire capital can vanish.

That time-bomb-like logic is precisely the “bad money” in this industry.

On the other hand, there are EAs built with honest logic that can be called “good money.”

I take pride in developing and offering such EAs.

Real EAs (good money) are by no means invincible.

Since markets have no absolutes, temporary drawdowns and stop-outs will occur.

But these are merely the “necessary expenses” to survive long-term and remain profitable.

・ Question excessively perfect backtests

・ Confirm that risks are disclosed and losses are not hidden

・ Ensure the reasons for winning are logical and well-founded

Do you tremble at the fear of sudden ruin while dreaming of an undefeated 20 years?

Or do you face realistic risks and aim for grounded, practical operation?

Wise investors should already know which path to choose.

Until next time.

【Free】 Spread Monitoring Indicator “Spread Monitor”

【Promotion】 Selling a single-position EA (Seven-Colored USDJPY). Forward performance: 3 years.

Real operation is also 공개. Please refer.

× ![]()