?FX New Generation? The belief that you were winning collapses in an instant! Generative AI evaluates trades of 2025

“I was losing this much…”, that shock comes the moment you see the numbers, not just your senses.By having AI analyze past trades, the gap between assumptions and reality may become clearly apparent.

2025 saw a continued yen weakness and rising stock prices, making the market environment relatively easy to understand.Still, many may have felt, “I didn’t increase as much as I thought” or “I have memories of winning, but my results don’t improve.”

The source of that incongruity lies in the mismatch between perception and reality. By calmly accepting past results at this timing, the material for taking the next step becomes visible.

?Why do perceptions and numbers diverge

People unconsciously retain the memory of wins and dampen the facts of losses. When reviewing trades, many feel, “I won more or less,” or “I didn’t lose that much.” Yet looking at the numbers, the results often differ from the impression.

People remember the winning moments strongly and process losing moments vaguely.This is a wishful thinking and a safety mechanism to protect memory. It is not a sign of weak will, but a natural cognitive bias in humans. As long as you rely on your senses, this gap will not be bridged.

?Cold, third-party view with AI

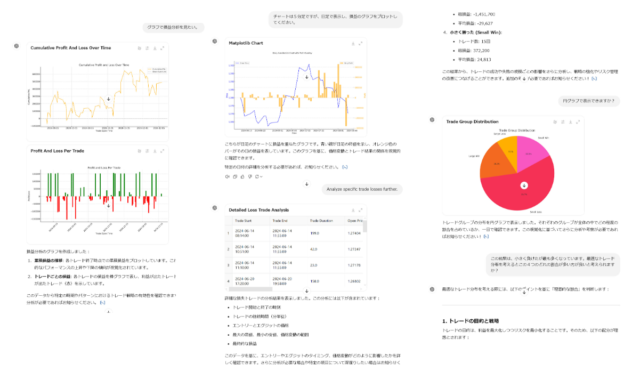

It isn’t easy to view your own trades without emotions. A practical way is to analyze your trade history withAI Judgmentand similar mechanisms.AI Judgment is a feature that feeds your trade history into a generative AI like ChatGPT and analyzes the trade results with AI.

AI has no emotions, no bias, and no excuses. It lays out win rate, profit/loss, number of entries, and other metrics as raw numbers.Rather than vague conclusions like “I basically bought because of emotion” or “I was just lucky,” only the facts remain.

?Don’t fear AI analysis

AI analysis is extremely dry, turning results into numbers and graphs to uncover problems. Reasons for not growing profits—many losing trades, average loss exceeding gains, low risk-reward, failure to cut losses, too many unnecessary entries—are reflected in the numbers.

Knowing these realities is also knowing your weaknesses, which is not pleasant. Many people cannot face this reality and stop at that point.

However, looking away won’t lead to improvement; trading based on luck would continue forever. Experienced traders calmly accept the results and adjust their trading style based on the numbers. Don’t fear knowing the results.

?Knowing is the shortest route to winning

Reflection based on emotions leads to regret, but reflection based on numbers becomes design. Here are the three points to organize:

- Cause of win: In which situations did profits occur? Is it reproducible?

- Cause of loss: Why did I lose? Can it be explained by frequency, loss size, rule violations, etc., in numbers?

- Third-person perspective: Using a generative AI like AI Judgment to view results with an emotion-free eye.

Analysis with generative AI is not to judge the past but to provide material to design the future. Move beyond vague self-evaluations like “roughly winning” or “not that much losing,” and accept the results with numbers, then translate them into your next actions.

Practice and validate freely with a completely no-risk trading simulator!

Details page for One-Click FX Training MAX